Bitcoin Miners Dodge Forced Sales as BTC Holds Firm 7.4% Above Critical Difficulty Floor

Bitcoin miners are breathing easier—for now. Despite recent market turbulence, BTC’s price remains 7.4% above its last difficulty-adjusted bottom, sparing miners from mass liquidation scenarios. No fire sales, no panic—just the quiet hum of ASICs grinding away.

The Miner Resilience Playbook

Forced selling? Not today. Miners are holding the line, thanks to a combo of efficient operations and strategic hodling. The network’s difficulty adjustment—Bitcoin’s built-in shock absorber—keeps the game alive even when margins get razor-thin.

Wall Street’s Missing the Memo

Meanwhile, traditional finance still can’t decide if Bitcoin’s a ‘risk asset’ or digital gold. Spoiler: It’s both—and miners are playing the long game while hedge funds flip ETFs like short-order cooks. Stay cynical, stay stacked.

Bitcoin Miner Health Signals Neutral-to-Positive Market Backdrop

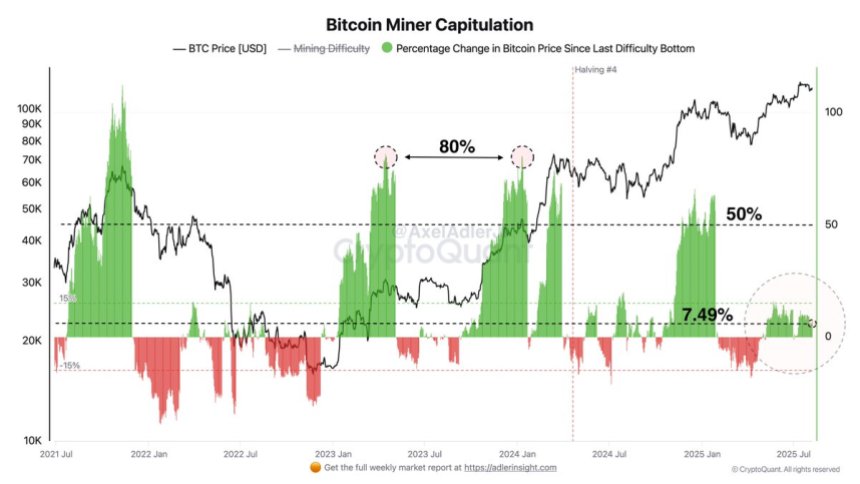

Top analyst Axel Adler shared fresh data suggesting that Bitcoin’s miner health remains in a neutral-to-positive state. According to Adler, the price is currently above the last difficulty bottom level, meaning there is no capitulation among miners. This reduces pressure from forced sales by weaker mining operations, a dynamic that often adds selling pressure during market downturns.

The current +7.4% reading on the “% BTC price change since last difficulty bottom” indicator points to moderate momentum. While this is a constructive signal, Adler noted that it is far from the euphoric conditions seen in past market peaks, when readings surged between +50% and +80%.

Looking ahead, Adler outlined several key factors to monitor:

Next difficulty adjustment during falling prices: This WOULD be a warning sign, indicating potential stress for weaker miners.

Hashprice/revenue per TH/s: Tracking miner profitability can confirm or refute whether the sector is under pressure.

Miner reserves: An increase in selling during weak price action would be an early signal of mounting stress.

The bottom line, according to Adler, is that the miner factor is not currently dragging the market down, but it is also not a strong bullish driver. Instead, it serves as a steady, supportive backdrop — as long as Bitcoin does not break sharply above the last difficulty bottom level with double-digit percentage gains or, conversely, drop below it. In this environment, BTC’s price action will depend more on demand-side catalysts and macroeconomic developments than miner-driven pressures.

BTC Price Analysis: Testing Key Resistance Level

Bitcoin’s 4-hour chart shows the price attempting to sustain gains after reclaiming the $115,724 support zone. Following a strong bounce from recent lows, BTC pushed above the 50-day (blue), 100-day (green), and 200-day (red) moving averages, signaling a short-term shift in momentum.

Currently, BTC is consolidating around $116,585, with immediate resistance at $116,600–$116,700, aligned with the 100-day SMA. A breakout above this area could open the path toward the $118,000–$118,500 region, with the next major resistance at $122,077, the previous range high.

On the downside, $115,724 remains a crucial support level. A failure to hold this could trigger a pullback toward $114,000, with stronger support NEAR the $112,500 zone. Volume has been relatively modest on this rebound, suggesting that bulls need stronger participation to maintain upside momentum.

The recent move above multiple SMAs is a positive short-term sign, but BTC is still trading within the broader range established in July. Until the price decisively breaks above $118K, the market remains in a consolidation phase, vulnerable to reversals if buying pressure fades. Maintaining support above $115.7K will be key for bulls aiming to test higher resistance levels in the coming sessions.

Featured image from Dall-E, chart from TradingView