Smart DCA Strategy Surges as Bitcoin Dips Below $117,700 Fair Value—Time to Buy?

Crypto veterans aren’t panicking—they’re pivoting. With Bitcoin trading under its on-chain fair value of $117,700, savvy investors are doubling down on ‘Smart DCA’ tactics to accumulate at a discount.

The Discount Window Is Open

Forget FOMO. The real action is in systematic buying while Wall Street snoozes on-chain signals. ‘Fair value’ isn’t just theoretical—it’s a flashing neon ‘sale’ sign for long-term holders.

DCA Gets an Upgrade

Basic dollar-cost averaging is so 2021. The new playbook? Algorithmic triggers, liquidity zone targeting, and—because this is crypto—a dash of contrarian spite against paper-handed traders.

As one whale put it: ‘Traders lick windows. We build vaults.’ Meanwhile, traditional finance is still trying to short ETFs. Good luck with that.

Bitcoin Currently In Accumulation Phase, Analyst Says

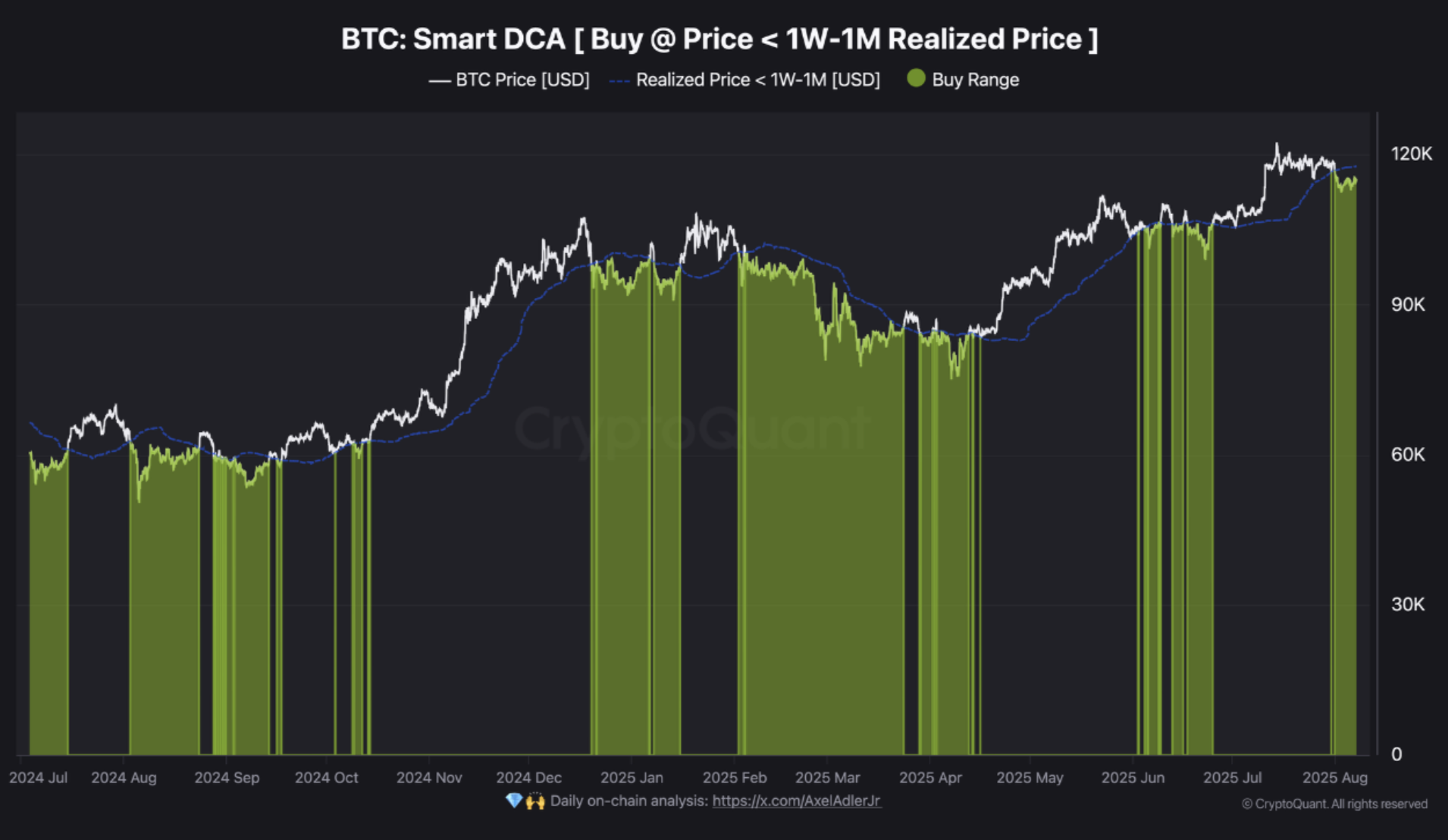

According to a CryptoQuant Quicktake post by contributor BorisVest, a strategy called Smart Dollar-Cost Averaging (DCA) may help bitcoin investors accumulate the asset more strategically and improve long-term performance.

In his analysis, BorisVest noted that investors often struggle to time their entries into BTC. Many tend to buy during local tops due to fear of missing out (FOMO) and avoid entering the market during bottoms out of fear of further declines.

Smart DCA offers a way to bypass these emotion-driven decisions. The strategy recommends accumulating BTC when its market price falls below the 1-week to 1-month realized price – a period during which short-term holders are often in loss, resulting in heightened sell-off. BorisVest explained:

At these levels, short-term holders are usually underwater, leading to increased sell pressure. Smart DCA activates hourly purchases during such periods, helping to bring the BTC and USD cost basis closer together.

Currently, the 1-week to 1-month realized price stands at approximately $117,700. As long as BTC trades below this level, Smart DCA continues to flash an accumulation signal. Once BTC climbs above this threshold, the strategy advises gradually selling previously accumulated coins.

With Bitcoin now trading NEAR $116,000, the analyst suggests that the asset is still in an accumulation phase – though it’s approaching the realized threshold. According to data from CoinGecko, BTC remains about 5.2% below its ATH of $122,838, recorded on July 14.

Is BTC Unlikely To Hit A New ATH?

Despite holding steady around $115,000, some analysts warn that Bitcoin’s realized price is slowly beginning to show signs of fragility. A drop below the $105,000 mark could lead to increased downside momentum, potentially triggering a larger sell-off.

Notably, Binance’s net taker volume has slipped back into negative territory, raising concerns about a near-term correction. Additionally, rising Bitcoin ETF outflows have shown signs of weakness, adding another LAYER of uncertainty.

Still, not all indicators are bearish. Some on-chain metrics suggest BTC may simply be entering a cooling-off period after a brief overheated phase. At press time, BTC trades at $116,316, up 2.1% in the past 24 hours.