Bitget Wallet Teams Up with Immersve to Roll Out Zero-Fee Crypto Card in USD – Spend Digital Assets Like Cash!

Crypto just got its plastic revolution. Bitget Wallet—one of the fastest-growing multi-chain platforms—is slashing fees and friction with its new USD-powered crypto card, built alongside Web3 payment heavyweight Immersve.

No Fees, No Kidding

Forget nickel-and-diming by traditional finance. The card bypasses transaction fees entirely—spend stablecoins or converted crypto anywhere Visa’s accepted, with real-time blockchain settlements. Because apparently banks think 3% for the privilege of moving your own money is ‘innovation.’

Bullish on Real-World Utility

This isn’t another vaporware partnership. Immersve’s tech already processes millions in crypto payments globally. Now Bitget’s 20M+ users get instant access to a debit card that actually works—without jumping through centralized exchange hoops.

The bottom line? Crypto’s stepping on Visa/Mastercard’s turf. And this time, the underdog isn’t asking permission.

Bitget Wallet, a renowned non-custodial cryptocurrency wallet, has recently partnered with Immersve, a popular platform for Web3 payment infrastructure. The collaboration aims to release a USD-based Mastercard card for zero-fee crypto payments across Latin America and Brazil.

As Bitget Wallet announced in its official press release, the card will let users spend cryptocurrency directly from wallets at more than 150M merchants supporting Mastercard across the globe. Thus, those looking for protection from native currency volatility can leverage the card for seamless $USDC top-ups and rapid crypto-to-fiat conversion.

Bitget Crypto Card Offers Zero-Fee Digital Payments in Latin America and Brazil

The collaboration between Bitget Wallet and Immersve unveils a Mastercard-based zero-fee crypto card that is backed by USD. Hence, this move enables the wallet to officially enter the growing digital payment world of Latin America and Brazil.

Additionally, the latest Bitget Wallet Card enables consumers to perform direct expenditure of USD from crypto wallets at more than 150M merchants that are compatible with Mastercard. At the moment, the card can be accessed via the official app of the Bitget Wallet for the rapid digital issuance via Mastercard.

Bitget Wallet Expands Stablecoin Card Across LATAM

While facilitating stablecoin holders with a hedge against inflation, the card serves as a noteworthy alternative to conventional bank cards with its compatibility with Google Pay and Apple Pay without any fees. Apart from that, a 10% annual yield even on unused stablecoin balances is another standout feature of the project.

According to Bitget Wallet, after launching the crypto card in Brazil, the platform intends to strategically expand into Guatemala, Peru, Chile, Colombia, Mexico, and Argentina. With this initiative, Bitget Wallet is driving its wider PayFi strategy while also supporting QR Scan-to-Pay, in-app buyouts, and integrated yield products. All these things help it become a fully self-custodial entity for the management, earning, and spending of digital assets.

Interview Session

While covering the strategic collaboration, we contacted the Bitget Wallet team to inquire about their perspective and more related information. Jamie Elkaleh, the Chief Marketing Officer (CMO) at Bitget Wallet, responded and discussed multiple aspects of the collaboration. He spoke about the vision behind this initiative, how it is to facilitate the users around the globe, and related aspects.

Q. How does Bitget Wallet Card, Bitget Wallet’s newly launched USD-based crypto card in collaboration with Immersve, facilitate its users?

The Bitget Wallet Card enables users to store, earn, and spend USDC directly from their self-custodial wallet. Users can fund the card with USDC on the Base blockchain and spend in USD at over 150 million Mastercard-accepted merchants globally, including through Apple Pay and Google Pay.

There are zero fees on USD transactions and top-ups. What makes the experience seamless is the backend infrastructure provided by Immersve, the licensed Mastercard issuer that handles the real-time crypto-to-fiat conversion during each transaction, abstracting the complexity from users and ensuring smooth, point-of-sale experiences.

At the same time, users can earn up to 10% annual yield on USDC balances in Bitget Wallet while maintaining liquidity, turning a typical spending card into a hybrid tool for both payments and onchain savings. The entire experience is built natively within Bitget Wallet’s self-custodial ecosystem, so users never relinquish control over their assets.

Q. What factors brought your attention to launching the Bitget Wallet Card in Brazil? And in which other countries can users leverage the services of crypto card for real-world payments?

Brazil has emerged as one of the most active crypto economies globally, particularly in its use of stablecoins for hedging inflation, sending remittances, and making digital payments. Currency volatility and high banking fees make Brazil a prime market for dollar-denominated alternatives.

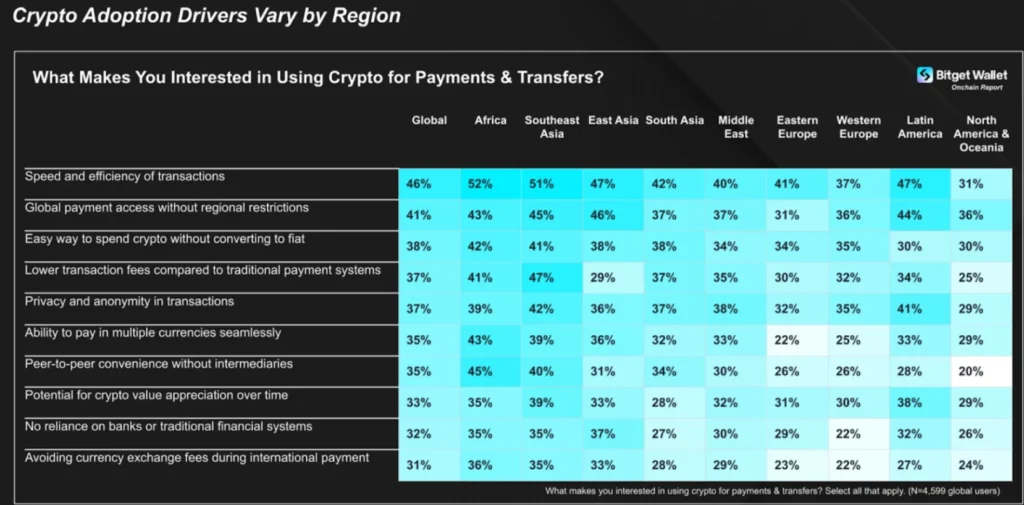

Our research also reports that in Latin America, 44% of surveyed wallet users prefer crypto payment for its global access, showing a growing user demand for bank-free, globally usable payment options which aligns closely with the card’s USD-based, self-custodial model.

Beyond Brazil, the Bitget Wallet Card is already live in the UK and 30 European Economic Area (EEA) countries, where it has seen encouraging early adoption. Latin America is the next major focus, with planned expansion to Argentina, Mexico, Colombia, Chile, Peru, and Guatemala in the coming months. Asia-Pacific rollouts are planned for later this year, with a long-term goal of making the card available in every region where stablecoin utility meets real economics.

Q. How does the integration with Immersve and Mastercard Digital First technology enable a seamless user experience for crypto-to-fiat payments?

The integration with Immersve and Mastercard Digital First bridges the worlds of crypto and traditional finance without exposing users to friction. Immersve acts as the licensed issuer, handling backend services like card issuance, real-time transaction processing, compliance (KYC/AML), and fiat settlement. Meanwhile, Mastercard’s Digital First infrastructure enables instant digital issuance, so users can apply and activate their card in minutes without paperwork or delays — and immediately add it to Apple Pay or Google Pay.

This architecture eliminates the need for users to manually convert crypto to fiat or interact with centralized exchanges. Instead, when a user initiates a payment, the system automatically deducts USDC from the wallet, converts it to fiat via Immersve’s infrastructure, and settles the transaction through Mastercard’s network. The entire process is designed to be invisible to the user, delivering a Web2-like user experience underpinned by Web3 technology.

Q. What distinguishes the exclusive crypto card from the conventional bank cards catering to international payments, travel, and online shopping?

The Bitget Wallet Card offers a distinct alternative to traditional bank cards, delivering low-cost access, yield generation, and instant usability, all while keeping assets fully self-custodied.

First, it eliminates unnecessary fees. Users pay no transaction fees when spending in USD, making it a cost-effective option for international payments, travel, and online shopping. The card is issued instantly through the Bitget Wallet app with no bank account or slow application process.

Second, it turns stored value into earning potential. Users can hold USDC directly in their self-custodial wallet and earn up to 10% yield on idle balances, effectively combining saving and spending in one place. This reflects behavior seen in Bitget Wallet’s recent research, where 38% of wallet users cited long-term value growth as a reason to pay with crypto.

Third, settlement is real-time. Crypto is converted to fiat at the moment of transaction, enabling fast, borderless payments without off-ramping or delays. 47% of users surveyed identified transaction speed as a top driver for crypto payments, and this card meets that need across 150 million Mastercard-supported merchants.