🚀 Ethereum Daily Transactions Hit Record Highs — Is ETH Primed for a Parabolic Breakout?

Ethereum's network activity just went supersonic. Daily transactions are spiking—but is this the start of a sustained rally or another 'number go up' illusion for crypto bagholders?

The gas gauge is running hot

Chain activity hasn't just increased—it's gone vertical. Blocks are filling up faster than a VC's seed round slide deck.

Smart money or dumb liquidity?

While retail traders pile in, institutional players are quietly building positions. Classic Wall Street playbook: pump the narrative, dump on the hype.

One thing's clear—when Ethereum's network coughs, the entire altcoin market catches pneumonia. Buckle up.

Is Ethereum Positioning For Market Leadership?

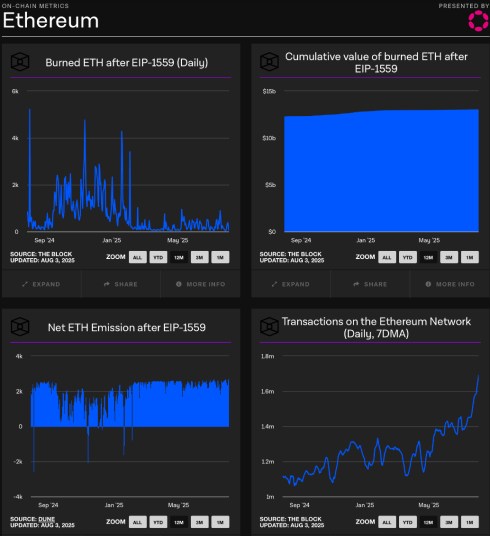

Ethereum on-chain activity is quietly but decisively gaining momentum. According to Cas Abbe’s post on X, ETH’s daily transactions have now climbed to their highest levels in more than a year, which is a sign that network usage is not just holding steady, but also accelerating.

Data shared by the expert shows that the number of daily transactions stands at about 1.7 million. This surge in activity suggests that ETH’s fundamentals are strengthening, even if price action hasn’t fully reflected it yet.

Presently, more users are engaging with the ETH network, as both active addresses and new addresses trend sharply upward. This is more than short-term trading noise; it’s a sign of real adoption and sustained network usage.

While daily transactions have spiked, the EIP-1559 upgrade has continued to act as a quiet and powerful force in Ethereum’s economics by permanently removing ETH from circulation over time, leading to a tightening supply. Despite recent market volatility, Cas Abbe highlighted that the net ETH emissions remain NEAR neutral, which means that the ETH supply dynamics are becoming increasingly tight.

This combination of rising network usage and limited net supply is a powerful market signal. It shows that ETH momentum isn’t being driven by short-term hype, but by genuine, sustained demand for block space and the service built on its network, and long-term fundamentals.

Could Strategic Accumulation Mark The Start Of A New Bull Phase?

Ethereum continues to experience notable growth in several key areas. Recent reports revealed that ETH’s strategic reserve has exploded in size over the past few months, signaling a dramatic shift in market positioning.

An analyst known as crypto Patel stated on X that back in April, the ETH strategic reserve stood at around $200 million. Meanwhile, today, the reserve has surged to an astonishing $10 billion, which reflects a 50% increase in just four months.

The sharp growth in the ETH strategic reserve is more than just a big number; it’s a clear signal of strong accumulation and DEEP long-term confidence in the ETH network’s future. It also suggests staking growth and large-scale capital repositioning ahead of ETH’s next potential catalysts.