ECB Doubles Down: Cash Isn’t Dead—But Its Digital Twin Is Coming in Hot

The European Central Bank just dropped a truth bomb: physical cash isn't vanishing—but it's getting a high-tech makeover.

Digital Euro or Bust

While banknotes cling to existence like a boomer refusing Venmo, the ECB's digital euro prototype is already in beta. This isn't your grandma's CBDC—it's programmable money with expiration dates and spending limits baked into the code.

Banks Sweat While Tech Bros Cheer

Traditional lenders face disintermediation as the digital euro could let citizens hold accounts directly with the ECB. Meanwhile, crypto exchanges are salivating over arbitrage opportunities when the two systems inevitably collide.

The Punchline

Europe's financial future? A schizophrenic mix of paper bills collecting dust and digital tokens tracking your every purchase—because nothing says 'privacy' like a central bank monitoring your morning coffee habit.

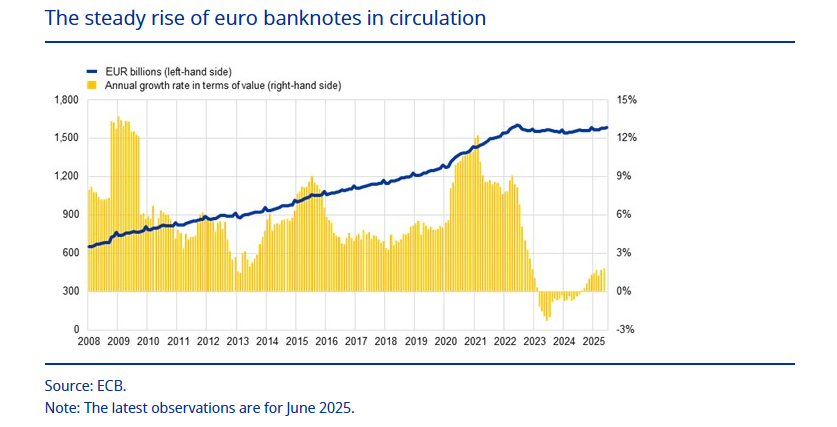

ECB’s Cash And Digital Push

According to a blog post by Cipollone, the digital euro will sit alongside physical money, not replace it. He wrote that cash and digital euros, both with full legal tender status, will give consumers more choice.

Reports have disclosed that on April 8, Cipollone said a digital euro WOULD curb the rise of foreign-pegged stablecoins in Europe. He added that failing to launch it would leave risks on the table and forgo key opportunities.

Cash is indispensable as a way to pay and to store value, says Executive Board member Piero Cipollone.

We are modernising banknotes, ensuring they remain accessible and widely accepted.

A digital euro will complement this by bringing the benefits of cash to digital payments.

— European Central Bank (@ecb) August 4, 2025

Private Coins Are Growing Fast

Crypto payments are on the rise. Stablecoins now handle many everyday buys and cross-border deals. Data shows that these digital coins often tie to the US dollar and escape strict banking rules.

That worries regulators who fear a shift away from the euro. By building its own digital currency, the ECB plans to keep control firmly in its hands.

A working paper published on March 13 found that Europeans aren’t exactly lining up for a digital euro. When people were asked to split 10,000 euros (about $10,800) among different assets, only a small slice went to the digital version.

Cash still dominated. Based on reports, that survey showed nearly all respondents kept most of their mix in coins, bills or traditional bank deposits.

Some analysts say the world needs a stablecoin rulebook, pointing out that strong global coordination is vital to check the power of dollar-pegged coins.

Other financial experts agree, highlighting the significance of options like regulated euro-pegged stablecoins, distributed ledger applications and the digital euro itself.

By stressing that cash is here to stay, the ECB sends a clear message: innovation must not come at the cost of stability.

The plan is to roll out the digital euro in a way that works for all Europeans—whether they live in a city with fast internet or a town where ATMs are lifelines.

Featured image from Meta, chart from TradingView