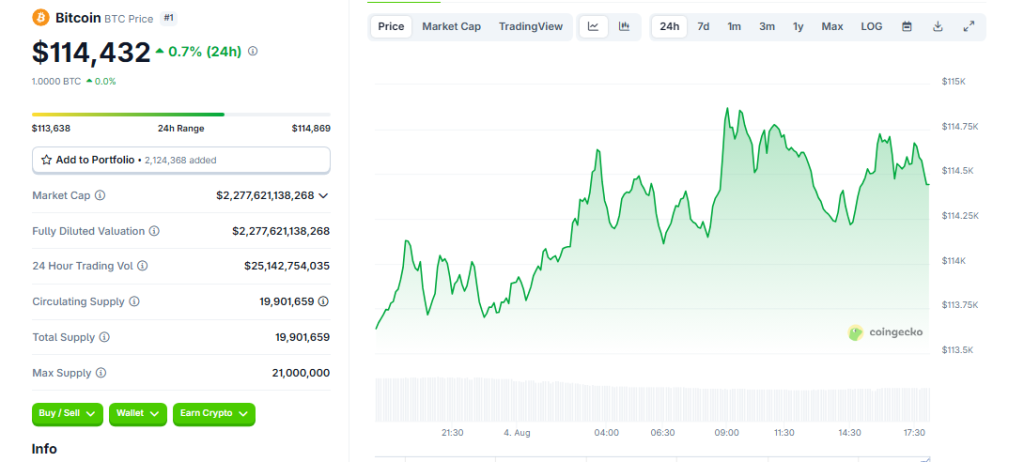

Bitcoin Holds Strong at $114K – But Is This Rally Running Out of Steam?

Bitcoin's bull run faces a critical test as it clings to $114K support. Traders are watching for fresh catalysts—without them, this party might end before the Wall Street suits even show up.

Key Levels to Watch

The $114K floor is holding... for now. But the market's getting twitchy. No new buyers? Prepare for a classic crypto fakeout.

Where's the Rocket Fuel?

Institutional inflows? ETF approvals? Even Elon's tweets can't save us this time. This market needs real adoption—not just greater fools.

Finance Jab Included

Meanwhile, traditional investors still think 'blockchain' is a new type of yoga mat. Their loss.

Labor Data Fuels Fed Speculation

Recent economic data in the US isn’t helping much. Reports showed that job growth came in weaker than expected, with the unemployment rate rising to 4.2%.

Average hourly wages only went up by 0.3%, pointing to a cooling labor market. These numbers are adding weight to the idea that the Federal Reserve might soon hit pause on interest rate hikes—or even lower them.

That possibility matters a lot for assets like Bitcoin, which tend to do better when borrowing is cheaper and liquidity is high. A shift in central bank policy could push more institutional investors back into the market.

But for now, the mood is cautious. While some investors are quietly adding to their positions, many are waiting to see what the central bank does next.

ETF Inflows Show Mixed Signals

Bitcoin ETFs in the US saw strong demand in June and July. Based on figures from MarketWatch, total inflows into spot Bitcoin ETFs crossed the $50 billion mark by mid-July. That’s a big milestone. It shows that Bitcoin is no longer just a niche interest—it’s part of how big institutions think about their portfolios.

Meanwhile, global tension continues to push some investors toward Bitcoin. Rising unrest in the Middle East, the ongoing war between Russia and Ukraine, and China’s tightening grip on trade and key supplies are all reasons why people are looking for assets that sit outside government control. Bitcoin, while not as trusted as Gold just yet, is increasingly seen as a backup plan.

Bitcoin’s Support Still Holds Above $100KDespite the shaky short-term action, bitcoin still looks stronger under the hood. On-chain data shows that more holders are staying in for the long haul. At the same time, there’s less borrowing for risky trades. These trends suggest the market is shifting away from hype and moving toward value-based buying.

As long as Bitcoin stays above $100,000, analysts believe the larger trend is still intact. Pullbacks, like the one this month, could just be part of a bigger pattern. If the Fed makes a dovish MOVE later this year, a fresh wave of capital could come in by the fourth quarter.

Featured image from Meta, chart from TradingView