Dormant Bitcoin Whale Awakens: Dumps $80K BTC as Bulls Hold Firm in 2025 Market

A sleeping giant stirs—then blinks. One of Bitcoin's long-dormant whales just unloaded $80,000 worth of BTC... and the market barely flinched.

Why? Because the bulls are still driving this rocket ship. While the whale's move might've made headlines (and some paper-handed traders sweat), Bitcoin's fundamentals remain bulletproof. Institutional adoption? Check. Lightning Network growth? Check. Maxis still screaming 'number go up'? Double-check.

Here's the kicker: that $80K sale is couch cushion money in today's crypto economy—barely a rounding error when BlackRock's BTC ETF does that volume before breakfast. But hey, whales gotta whale.

So while the 'dormant whale' narrative makes for sexy clickbait, the real story? Bitcoin's resilience. Again. The king isn't just surviving—it's thriving while traditional finance plays catch-up with stone tablets and abacuses.

Bitcoin Dips To $115,000, Bulls Quickly Bought The Dip

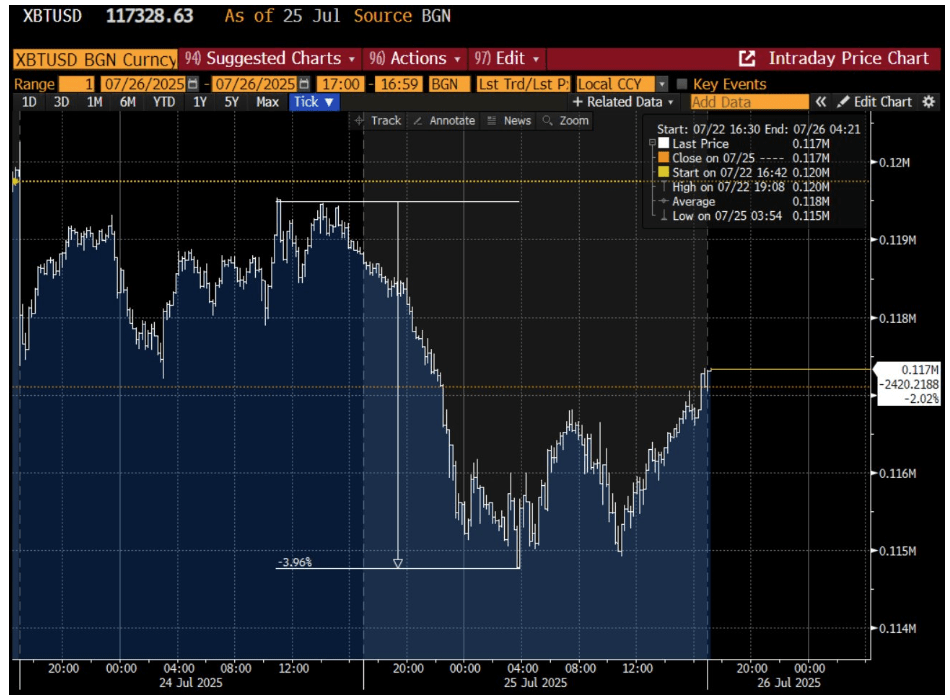

News of the $9 billion Bitcoin sale initially caused price volatility. Bitcoin’s price had recently been trading around $119,000, so the sudden influx of sell orders caused a short-lived pullback. On July 25, as reports of Galaxy’s whale sale spread, BTC/USD swiftly fell to around $114,000 to $115,000.

The sheer size of 80,000 BTC (over 0.4% of total supply) hitting the market had the potential to trigger panic. Indeed, there were signs of profit-taking and higher exchange inflows in the days surrounding the sale. This, in turn, led to a 3.5% drop, which is one of Bitcoin’s steepest intraday dips in weeks, temporarily breaking below the $115,000 support level.

However, it soon became clear that Bitcoin’s bulls were more than prepared to absorb the shock. The price decline bottomed out in mere hours. By the end of that same day, Bitcoin had rebounded above $117,000, and it was trading back in the mid-$117,000.

This rapid recovery demonstrated remarkable liquidity and depth in the Bitcoin market. “80,000 BTC, over $9 billion, was sold into open market order books, and Bitcoin barely moved,” observed crypto analyst Joe Consorti, showing how quickly buyers stepped in to counter the selling pressure.

Image From X: Joe Consorti

Back in earlier years, a sell order of this magnitude could have triggered a double-digit percentage price crash. By contrast, the ecosystem in 2025 handled it with surprising ease. “The entire sale has been fully absorbed by the market,” noted Bitcoin analyst Jason Williams.

What’s Next For Bitcoin Price?

With the whale’s 80,000 BTC sale now largely in the rearview mirror, the next step is looking ahead to where Bitcoin might go from here. The fact that the market digested a $9 billion sell-off with only minor turbulence has many observers feeling even more bullish about Bitcoin’s trajectory. “We’re going so much higher,” Jason Williams noted.

It’s a sentiment shared by several crypto analysts on X, who see the quick recovery as evidence of strong upward momentum. The consensus among bulls is that new all-time highs could be on the horizon in the coming months. Bitcoin already notched a record around $123,000 on July 14, but analysts are still calling for new highs above $130,000, $150,000, or even higher.

At the time of writing, Bitcoin is trading at $118,063, up by 0.5% in the past 24 hours.

Featured image from Unsplash, chart from TradingView