Whales Move $4B in Bitcoin to Exchanges – Open Interest Explodes (Here’s Why It Matters)

Bitcoin's derivatives market just got a $4 billion adrenaline shot—and whales are loading the syringe.

Open interest surges as crypto's big players shift stacks to exchanges. Is this a leveraged long setup... or the calm before a liquidation storm?

Behind the numbers: Whale-watching chain analysts spotted nine-figure BTC transfers hitting major trading platforms this week. The timing? Suspiciously aligned with the open interest spike.

Market mechanics 101: When heavyweights park coins on exchanges, it typically signals one of two plays—either preparing to sell, or collateralizing for leveraged longs. Given the 15% price rebound since last month's dip, smart money's betting on option two.

The cynical take: Wall Street's 'risk-on' narrative conveniently ignores that 80% of BTC futures contracts get liquidated within 30 days. But hey—what's a few billion in vaporized leverage between degenerates?

Bottom line: This much firepower moving onto exchanges rarely happens without volatility following. Whether that means breaking $70k or retesting $60k depends which whale faction blinks first.

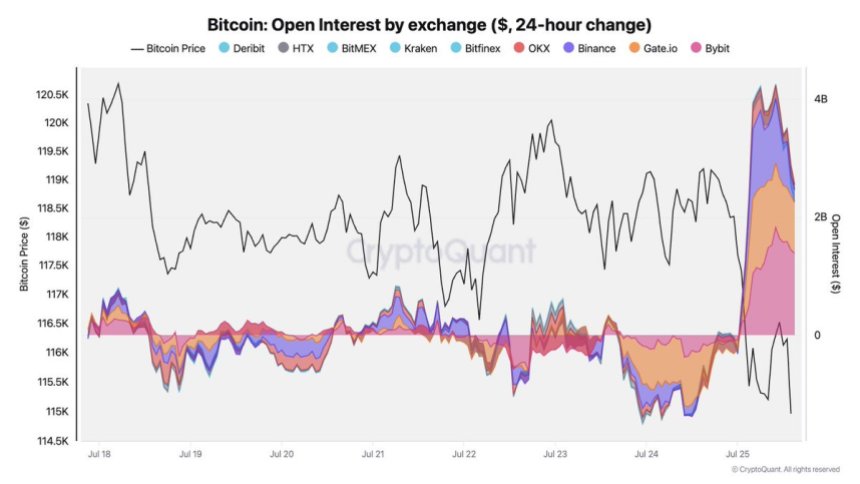

Rising Open Interest Signals Growing Volatility

According to Julio Moreno, CryptoQuant’s head of research, over the last 24 hours, open interest surged by approximately $4 billion, indicating that Leveraged positions—particularly shorts—have entered the market in large numbers. This spike coincided with significant Bitcoin transfers to major exchanges like Binance and Bybit, which received a substantial portion of today’s large-volume transactions.

These developments suggest increased speculative activity as traders anticipate further price movement. The inflow of coins to exchanges, combined with rising open interest, typically signals upcoming volatility. Short sellers appear to be betting on continued downside, but with bitcoin already recovering from its recent $115,000 dip, this could lead to a short squeeze if momentum shifts back in favor of the bulls.

This market shift comes as ethereum and altcoins show notable strength. Since May, Ethereum has consistently outperformed Bitcoin, aided by institutional accumulation and clearer regulatory signals in the US. As ETH leads the altcoin rally, investors are watching closely to see whether capital rotation from BTC into altcoins continues.

Bitcoin Holds Key Support After Minor Pullback

The daily Bitcoin chart shows that BTC remains in a bullish structure despite recent volatility. After briefly consolidating near the $122,000 resistance zone and reaching an all-time high just above that level, the price retraced toward the $115,700–$117,000 support band. This zone, marked by the horizontal yellow range, also aligns closely with the 50-day simple moving average (SMA), currently at $117,593.23, reinforcing its role as a strong technical support.

The overall uptrend that started in early May remains intact, with higher highs and higher lows clearly visible on the chart. Notably, BTC continues to trade well above the 100-day (green) and 200-day (red) SMAs, which sit at $112,547.95 and $109,436.38, respectively. These levels serve as deeper support zones if selling pressure intensifies.

Volume has increased slightly on red candles, indicating some sell pressure, but there is no sign of panic. As long as BTC holds above the $115,700 level, bulls maintain the advantage. A breakout above $122,000 WOULD signal trend continuation and could open the path to new highs.

Featured image from Dall-E, chart from TradingView