Australian Investment Giant Bets Big on Bitcoin – Reveals Stunning Treasury Purchase

Move over gold—this Aussie fund manager just went all-in on crypto.

In a bold pivot, the investment heavyweight added Bitcoin to its treasury reserves. No timid 'dip-your-toe-in' approach here—they snapped up a staggering amount of BTC while traditional finance analysts were still debating 'digital tulips.'

The play? A hedge against fiat's slow-motion collapse—and maybe a middle finger to the 'we’ll regulate it later' crowd.

One thing's clear: When institutions buy at these levels, they’re not here for the tech. They’re here for the exit liquidity.

DigitalX Buys 74.7 BTC

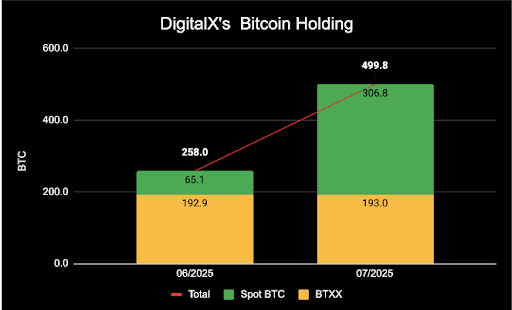

In a recent X social media post on July 23, DigitalX confirmed the addition of 74.7 BTC to its treasury. The acquisition, completed at an average price of $117,293 per BTC, reflects the company’s ongoing commitment to its Bitcoin-led strategy. This latest purchase has raised the crypto fund manager’s total bitcoin holdings to 499.8 BTC, valued at approximately $91.3 million.

Notably, the company also announced and expanded on the details of this large-scale Bitcoin purchase in an official statement on Investorhub. Of its total 499.8 BTC holdings, 306.8 BTC are held directly by DigitalX, while the remaining 193 coins are held indirectly through 881,000 units in its ASX-listed Bitcoin ETF, BTXX.

The recent addition of 74.7 Bitcoin follows an earlier acquisition of 57.5 BTC disclosed by the company on July 18, 2025. These back-to-back purchases demonstrate a continued reallocation of DigitalX’s digital asset treasury toward Bitcoin. The firm’s total treasury, excluding cash, now exceeds $104.4 million.

As part of its long-term crypto strategy, DigitalX’s targeted portfolio adjustment reinforces its role as a leading institutional-grade Bitcoin investment vehicle on the Australian Securities Exchange. The crypto fund manager highlights its latest acquisition as a key step in its ongoing effort to establish Bitcoin as its core treasury reserve asset.

Shareholder Focus Sharpens As Bitcoin Treasury Value Rises

According to its official statement, DigitalX’s strategy goes beyond simply growing its BTC reserve. It also aims to enhance shareholder value through consistent and transparent reporting. The crypto fund manager now tracks its Bitcoin holdings per share in Satoshis (Sats), the smallest unit of BTC.

As of the latest update, DigitalX’s BTC per share stands at 33.88 Sats, marking a 58% increase in its Bitcoin treasury value since June 30, 2025. This figure reflects the impact of recent acquisitions and provides a somewhat measurable benchmark for investors assessing exposure to the company’s considerable portfolio.

By prioritizing Bitcoin accumulation and optimizing its treasury structure, DigitalX continues to position itself as a prominent crypto-centric firm—one that views shareholder value as directly tied to the strength and growth of its BTC holdings. The company is also doubling down on its long-term vision of leveraging the flagship cryptocurrency as a strategic financial foundation.

Leigh Travers, former CEO and present Non-Executive Chairman of DigitalX, reaffirmed the company’s commitment to its digital asset goals, stating that it aims to steadily grow its BTC portfolio throughout the year and well into the future.