Crypto Analyst Exposes Shocking Truth Behind XRP’s Brutal Price Crash

XRP just got wrecked—here's why.

Market watchers were left scrambling yesterday as the embattled token nosedived without warning. Turns out, this wasn't your typical crypto volatility.

The smoking gun? A perfect storm of whale dumps and regulatory PTSD. Whales unloaded bags while retail investors panicked over fresh SEC rumors—classic 'sell the news' behavior, even when there isn't any news.

Meanwhile, Bitcoin maximalists are (predictably) using this as 'proof' that altcoins are doomed. Never mind that the entire market dipped—but why let facts ruin a good narrative?

Silver lining? The dip puts XRP at levels not seen since the last time someone said 'Ripple will moon any day now.'

Why Did XRP Crash Yesterday?

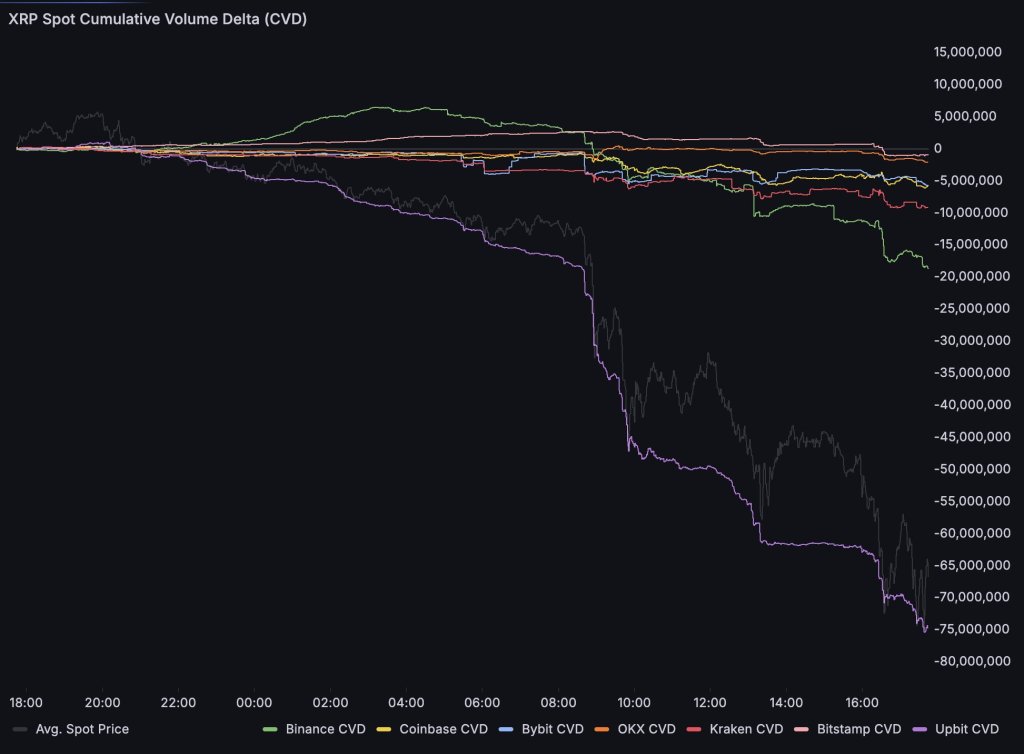

The spot CVD chart shared by Dom isolates net market buying and selling across major venues. While Binance, Coinbase, Bybit, OKX, Kraken and Bitstamp CVD lines remained comparatively flat to modestly negative, the Upbit CVD (purple line) plunged in a near‑one‑way trajectory to roughly –75 million XRP during the period, mirroring the intraday decline in the average spot price plotted alongside it. The analyst stated: “The pump AND dump was brought to you by Upbit… The orderbooks have been pretty empty, thus the quick MOVE down today.”

Concurrent order book heatmaps for Binance, Coinbase, Binance USDⓈ‑M perpetuals and Kraken show a sharp breakdown from recent highs above $3.5 toward the mid‑$3.1 area during the session. Visible liquidity pockets were thin above price, with bids clustering just below, consistent with Dom’s observation that depleted depth amplified the impact of the concentrated Upbit flow.

He added that “We have reached some bids around $3, which I am monitoring now,” emphasizing that “I think we want that area hold to keep shorter term bull structure in tact.”

The same source underscored that the Korean venue had also dominated the preceding upside phase. On 11 July, Dom attributed the earlier surge to localized demand: “XRP pump brought to you mainly by the Koreans on Upbit. Binance market tailing behind. All other venues basically flat (Coinbase barely participating). Nearly 30M $XRP market bought on top exchanges over the last hour.” That earlier burst of concentrated buying was later offset by the latest wave of concentrated selling, producing what he characterized as a “pump AND dump” sequence centered on Upbit’s order flow.

Taken together, the data depict a two‑stage move in which initial Korean spot accumulation drove price expansion, followed days later by heavy Korean liquidation into a structurally thin global order book, accelerating XRP’s descent. Dom’s monitoring focus now rests on whether the identified bid interest around $3 can stabilize price and preserve the shorter‑term bullish structure he references. As of the charts published, that support zone remained the critical near‑term level.

Notably, derivative positioning intensified the move: CoinGlass data shows that XRP futures long positions suffered approximately $82.8 million in liquidations yesterday, second only to Ether and ahead of Bitcoin, with total market long liquidations exceeding $630 million. This forced deleveraging likely compounded the spot pressure as cascading margin calls translated into additional market sell orders, reinforcing the rapid downside extension initiated on Upbit.

At press time, XRP traded at $3.09.