Whales Dive Into BNB—Fueling Crypto’s Meteoric Surge Past $801 ATH

Big money just placed its bets—and BNB's the winner. The crypto powerhouse smashed through $801 today, setting a blistering new all-time high. Here's what's pumping the rally.

Institutional fuel ignites the fire

Forget retail traders—this surge reeks of hedge fund algorithms and over-leveraged VC plays. The 'smart money' is piling into Binance's native token, turning it into the sector's unexpected heavyweight champ.

ATH? More like AT-this-rate-we'll-need-a-new-chart

BNB's 30% monthly tear laughs at 'stablecoins' and mocks Bitcoin's sideways slog. Meanwhile, traditional finance bros still think 'blockchain' is a new Equinox class.

Warning: Contains traces of irony

Let's be real—half these whales will dump at $802 to buy a Maldives island. But for now? The casino's open, and the house always wins.

Spike In Volume And Derivatives Trading

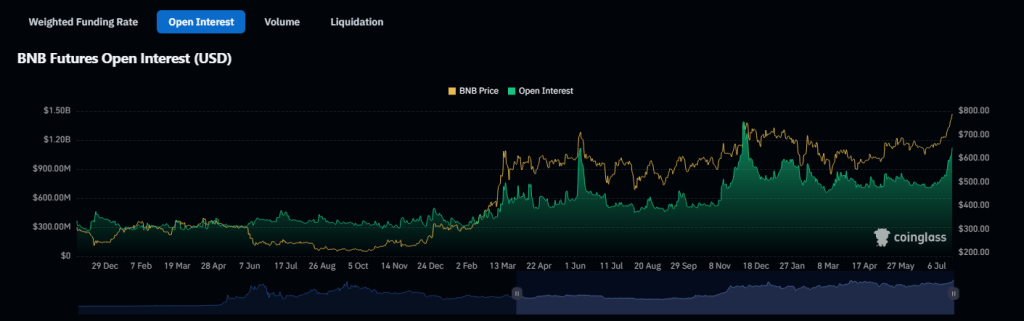

Volume trading around BNB has increased strongly. According to Coinglass data, daily volume ROSE over 40% to over $3 billion. Derivatives volume surged 31% to $2.18 billion, while open interest in BNB futures increased 19% to $1.23 billion.

These represent an expanding tide of speculation and demand for the asset, perhaps fueled by fresh money flowing into the market.

A good deal of this movement seems to be riding on bullish momentum forming around BNB’s recent price action. The token has been in an uptrend for weeks now, and this breakout above its previous highs indicates buyers are remaining bullish, even as there are indications that the market is heating up.

Meanwhile, the relative strength index (RSI) is also well into overbought conditions at 87.50. When the RSI crosses above 70, it generally means that a pullback may be imminent.

Nevertheless, the uptrend is still in place. BNB is well above its 20-day simple moving average of $704. Price is higher with good volume, and this is a combination that is commonly used to confirm trend strength.

Nano Labs Buys $90 Million Worth Of BNB

Institutional buying could be propelling the rally. On July 22, China-founded Web3 infrastructure company Nano Labs Ltd announced it had added 120,000 BNB tokens to its holdings—worth around $90 million. According to the company, it bought over-the-counter at an average cost of $707 per BNB.

Nano Labs stated that it views BNB as a strategic reserve asset and will continue to add to its holdings. It also stated that it will invest in companies that are dedicated to the BNB ecosystem.

Such a long-term commitment brings an element of confidence for retail investors tracking the token’s movements closely.

All the HYPE aside, there are beginning to appear some warning signs. BNB is now trading above the top Bollinger Band, an indication that the token may be getting stretched.

Featured image from Unsplash, chart from TradingView