Bitcoin Holders Dig In Their Heels – Supply Squeeze Signals Major Price Breakout Ahead

Diamond hands just got harder. Bitcoin’s supply crunch hits DEFCON levels as long-term holders refuse to budge—even as Wall Street fund managers hyperventilate into their gold-plated coffee cups.

The HODL strike continues

On-chain metrics reveal a staggering truth: over 65% of BTC hasn’t moved in a year. This isn’t investor patience—it’s a full-scale supply siege. Exchanges are bleeding coins faster than a hedge fund manager’s moral compass.

Why the sudden scarcity?

Three words: institutional FOMO 2.0. With spot ETF inflows devouring 12,000 BTC monthly and miners hoarding like dragons, available supply could evaporate before traditional finance finishes its third martini lunch.

The coming liquidity crisis

When the last weak hand finally sells, the resulting vacuum could launch prices into uncharted territory. Of course, bankers will call it ‘irrational exuberance’—right before quietly reallocating 5% of their portfolios ‘for research purposes.’

One thing’s certain: in the battle between scarcity and Wall Street’s infinite money printer, physics always wins. Tick tock, next block.

Supply Activity Signals Early Stage Of Bitcoin Macro Expansion

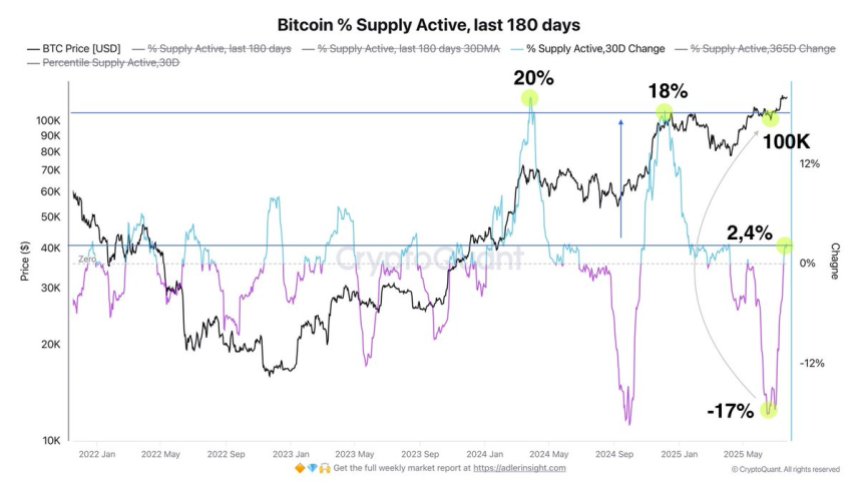

Top analyst Axel Adler recently shared key insights pointing to a potential early phase in Bitcoin’s ongoing macro cycle. According to Adler, supply activity began rising in June 2025 as BTC crossed the $100,000 mark. Over the past 30 days, this metric has climbed from negative territory to +2.4%, signaling the beginning of a shift in holder behavior. While the increase confirms early signs of distribution, it remains modest compared to previous cycle peaks.

Historically, major bull markets see this 30-day % Supply Active rise dramatically. Adler highlights that the current pace lags behind prior peaks—like those seen when BTC reached $70,000 in spring 2024 or when it breached $100,000 in December 2024—suggesting that the market still has a considerable buffer before entering a heightened distribution phase. This delayed spike in activity implies that most long-term holders remain committed and are not yet ready to offload their coins.

As Bitcoin consolidates NEAR the $120,000 level, this growing yet restrained activity indicates a healthy cycle structure. Adler predicts that if BTC continues to climb and hold above $120,000, the 30-day % Supply Active will likely move into the 8–10% range. Ultimately, it could revisit the 18–20% zone seen at past distribution tops.

BTC Holds Strong Above $115K Amid Consolidation

The 12-hour Bitcoin chart reveals a clear consolidation phase following the recent all-time high. BTC is currently trading around $118,267, trapped in a tight range between the $122,077 resistance and the $115,724 support. Despite a minor rejection from the $120K area, the structure remains bullish as long as price holds above the 50 and 100-period SMAs, which are now aligned between $113K and $110K—signaling solid mid-term support.

Volume shows decreasing momentum during this consolidation, typical of a healthy pause after a strong breakout. BTC previously surged above $120K on strong volume, but has since failed to establish a new high, instead forming a sideways pattern. This suggests market indecision or accumulation before the next leg.

A break above $122,000 could trigger the next push toward the $130K level, while a breakdown below $115,724 WOULD open room for a deeper retrace, potentially toward the $113,000 area near the 50-SMA. As long as buyers defend the lower range, the trend remains intact, and a breakout seems likely—especially if macro indicators or on-chain signals support further upside.

Featured image from Dall-E, chart from TradingView