Ethereum’s Whale Activity Explodes: $100B Weekly Volume Marks 3-Year High

Big money is flooding back into Ethereum—and it's moving at a pace we haven't seen since the last bull run frenzy.

The whales are back in town

Network scanners just caught institutional-sized transactions worth $100B in a single week—the kind of volume that makes retail traders feel like they're playing with pocket change. Suddenly those 'Ethereum is dead' takes from six months ago aged like milk left in a crypto miner's basement.

Liquidity tsunami hits DeFi

DEX volumes spiked 300% as this capital wave crashed through lending protocols and NFT markets. Funny how 'overpriced gas fees' become tolerable when there's nine-zero trades at stake—almost like Wall Street discovered their MetaMask wallets again after three years of pretending not to notice crypto.

The smart money's betting heavy on ETH's infrastructure play post-Merge. Now we wait to see if this is the start of a new paradigm—or just another 'buy the rumor, sell the news' cycle that leaves bagholders whispering 'Layer 2 solutions' like a prayer.

Institutions Rotate From BTC Into Ethereum

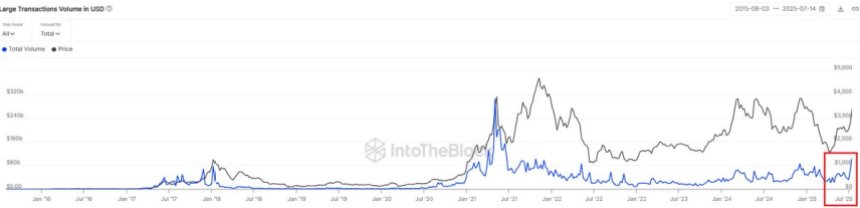

Sentora data confirms a major shift underway: big-money Ethereum is back. Last week, on-chain transfers over $100,000 totaled more than $100 billion—the highest weekly volume since 2021. This spike in high-value transfers reflects renewed institutional interest, reinforcing Ethereum’s role as the leading altcoin amid evolving market dynamics.

The timing of this surge is critical. Ethereum’s price has rallied aggressively from $2,500 to $3,800 in a matter of weeks, and institutional capital appears to be rotating from Bitcoin into ETH. While Bitcoin remains in a tight consolidation range just below its all-time high, Ethereum’s upside momentum and on-chain strength suggest it may now be leading the charge. This rotation has sparked discussions about the beginning of “Ethereum season,” a pattern seen in previous market cycles when ETH outperforms BTC and capital begins to flow into the broader altcoin market.

Some analysts believe this could mark the early stages of a long-awaited altseason. Historically, Ethereum leads such phases, acting as the gateway for investors to explore high-beta assets across the crypto ecosystem. If ETH maintains current strength and breaks above the $4,000 level, it could trigger a broader market expansion.

ETH Price Holds Above Key Support After Parabolic Rally

Ethereum is undergoing its first meaningful pullback since beginning a powerful surge from the $2,500 region in early July. After reaching a local high of $3,801, ETH is now trading around $3,662, down approximately 2.7% on the day. Despite the minor correction, the overall structure remains bullish. The current price sits above the $3,600 zone, a level that now acts as key short-term support.

Volume has slightly decreased during this pullback, suggesting that selling pressure remains relatively controlled. ETH is still trading well above its 50-day, 100-day, and 200-day moving averages, reinforcing the strength of the uptrend. The next major resistance lies around $3,800–$3,850, which aligns with previous peaks seen in early 2024.

A successful consolidation above $3,600 could provide the foundation for a new leg higher toward the $4,000 mark. However, failure to hold this support level might trigger a retest of the $3,450–$3,500 area, followed by stronger support around $3,000 and the $2,850 breakout zone.

Featured image from Dall-E, chart from TradingView