Solana DeFi Roars Back: TVL Smashes $14B Barrier as SOL Price Soars

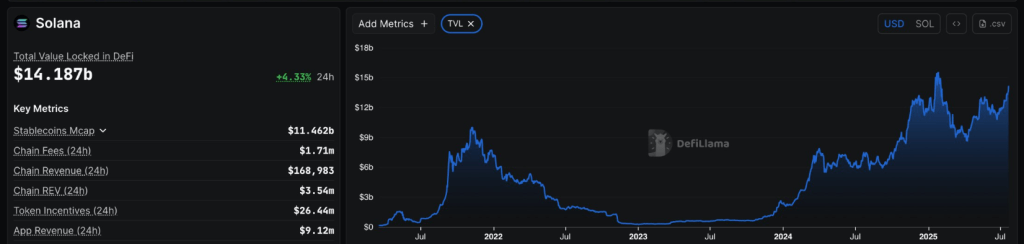

Solana's DeFi ecosystem just flexed its comeback muscles—total value locked (TVL) blasted past $14 billion as SOL's price rally ignites a liquidity frenzy.

The Lazarus chain stakes its claim

Once left for dead after 2022's cascade of collapses, Solana's DeFi landscape now outpaces most rivals. Validators are humming, liquid staking derivatives are multiplying, and yield farmers are piling back in like it's bull market o'clock.

Wall Street's watching—through clenched teeth

Traditional finance still can't decide whether to ape in or short the rally. Meanwhile, degens are locking in APYs that'd make a hedge fund manager cough up their oat milk latte. The irony? This resurgence happens just as SEC Chair grumbles about 'unregulated casino games'—right before his weekly golf game with Citadel's Ken Griffin.

DeFi TVL Rises With Price

Based on reports, Solana’s total value locked in DeFi hit $14.18 billion. That’s the highest level in six months, back to where it stood in January when SOL first reached its all‑time high.

A big chunk of that gain comes from the token’s own price climbing. When SOL moves up, every coin locked in lending pools and vaults gets worth more on paper. Users haven’t needed to rush in and lock fresh tokens to boost TVL numbers.

The overall ecosystem feels larger. Yet true usage growth may be slower than those headline figures suggest. Experts are keeping a close eye on how many new deposits actually show up. After all, token value and real‑world demand don’t always rise at the same pace.

DEX Trading Activity Shows Uptick

Between July 14 and July 20, Solana’s decentralized exchanges handled over $22 billion in trading volume. That’s up from close to $19 billion the week before.

Raydium led with $8.4 billion, followed by Orca at almost $6 billion and Meteora at $5.3 billion. Based on data, traders are coming back. But weekly volumes still sit far below the $98 billion peak set in mid‑January.

That gap signals a market that’s warming up but not yet boiling over. Volume gains show renewed interest among active users. It also hints that fresh strategies and new tokens may be finding feet after a slower spell.

According to on‑chain figures, about 355 million SOL remain staked with validators. That stake is worth roughly $69 billion, or about 65% of all tokens in circulation.

Those coins aren’t counted in DeFi TVL or in DEX volumes. Instead, they’re busy securing the network and validating transactions.

Meanwhile, SOL is predicted to increase another 3.50% and hit $210 by August 21, 2025. Sentiment is currently bullish while the Fear & Greed Index is at 71 (Greed).

In the past 30 days, SOL experienced 19/30 green days and 8.61% price fluctuations, indicating both strength and volatility in today’s market, data from CoinCodex shows.

Featured image from Meta, chart from TradingView