Ethereum Ignites Crypto Frenzy: $4 Billion Floods Market in Just 7 Days

Crypto's back with a vengeance—and Ethereum's holding the matches. Last week saw a staggering $4 billion pour into digital assets, marking one of the heaviest inflows since the 2021 bull run.

Where's the money going? The smart money's betting on ETH as institutional players finally wake up to DeFi's potential. Meanwhile, Bitcoin ETFs keep vacuuming up capital like Wall Street's latest shiny toy.

Not everyone's convinced though. 'Color me shocked—speculators chasing yield in an overleveraged market,' quipped one hedge fund manager between sips of his $28 artisanal cold brew. The numbers don't lie: when ETH moves, the altcoin casino follows.

Will this rally have legs? That depends on whether the Fed keeps playing nice—and whether crypto's retail tourists remember to take profits this time.

Record Inflows Hit New High

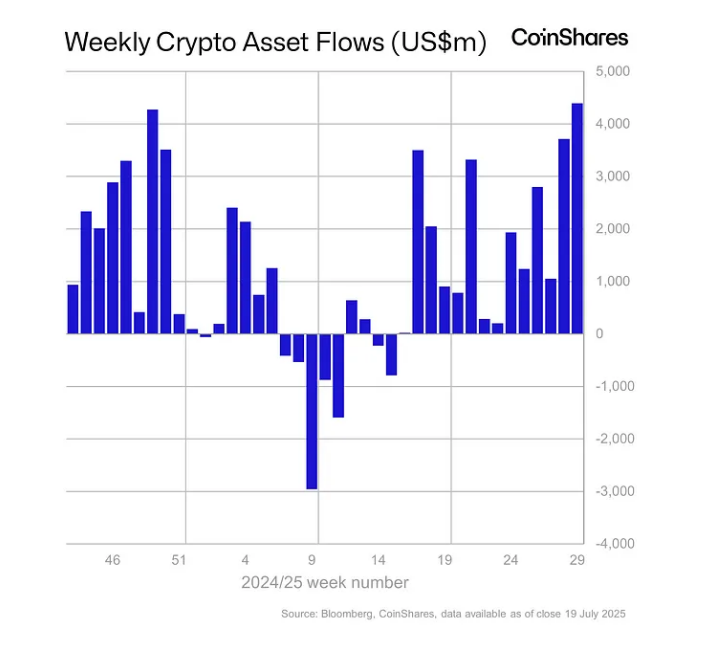

Last week’s $4.40 billion haul wasn’t just a marginal uptick. It smashed the old record by $120 million. Investors have now pumped capital into these funds every week since early April, showing a clear shift toward digital assets as part of broader portfolios.

Last week digital asset products saw all-time high weekly inflows of US$4.39bn, bringing YTD inflows to US$27bn, pushing AuM to a record US$220bn. ethereum attracted a record US$2.12bn in inflows, while Bitcoin saw inflows of US$2.2bn. https://t.co/y32mEP8Oa2

— Wu Blockchain (@WuBlockchain) July 21, 2025

Total AUM of $220 billion means these products now rival many traditional asset classes in sheer scale. And with $39 billion in weekly turnover, bid‑ask spreads are likely tighter—making it easier for big players to MOVE in and out without major price swings.

Ethereum Leads The Charge

Based on reports, Ethereum was the standout draw. It pulled in a little over $2 billion—nearly double its previous weekly high of $1.2 billion. Over the past week, ether climbed 24.5%, briefly topping $3,800 for the first time in more than seven months.

That price pop clearly caught buyers’ eyes. Bitcoin stayed strong too, with $2 billion in inflows, even if that was down from $2.7 billion the week before. Notably, ETPs made up 55% of Bitcoin’s total exchange volume, signaling that institutions are hunting exposure via these regulated vehicles.

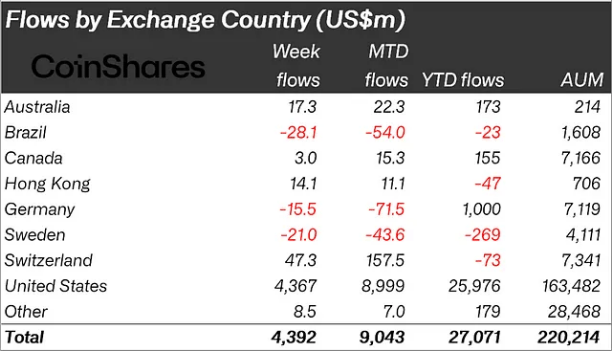

Regional flows tell their own story: the US was by far largest with $4.30 billion of last week’s inflows. Switzerland contributed $47 million, Australia $17 million, and Hong Kong $14 million.

Meanwhile, Brazil and Germany experienced minor outflows of $28 million and $15 million as domestic investors booked profits or changed strategy.

The sheer magnitude of US demand is evidence of both regulatory certainty regarding spot crypto ETFs and increasing comfort on the part of asset managers to apply those products.

Featured image from Meta, chart from TradingView