Rare Satoshi-Era Bitcoin Hits Market: Galaxy Digital Dumps 1,500 BTC on Binance

Whale alert: A crypto giant just unloaded prehistoric Bitcoin onto retail traders.

Galaxy Digital's 1,500 BTC move—mined when blocks were still worth double digits—lands amid a frothy market. The timing? Impeccable, as always.

These coins haven't budged since your grandpa first heard 'blockchain.' Now they're getting dumped where degens chase 100x memecoins. How poetic.

Pro tip: When institutions sell early Bitcoin to Binance users buying at all-time highs, someone's getting the better end of that trade. (Spoiler: It's not the people clicking 'market buy.')

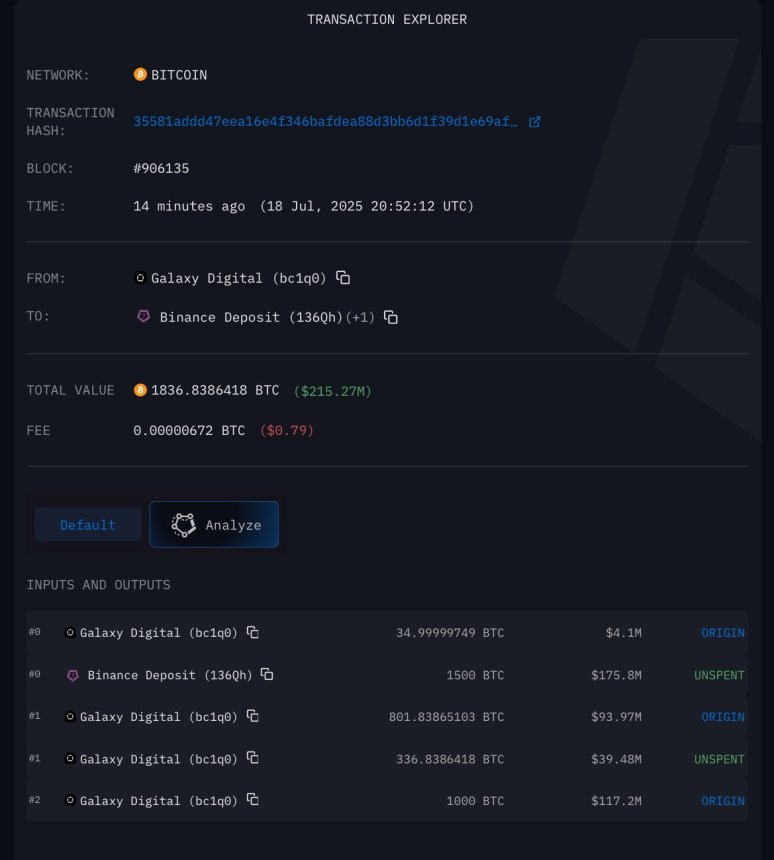

Whale Starts Selling: 1,500 BTC Sent To Binance

Darkfost has confirmed that Galaxy Digital has just moved 1,500 BTC to a Binance deposit address. These coins were previously part of the massive 80,000 BTC linked to a Satoshi-era whale who recently reactivated their wallet. The latest transfer suggests that a portion of this historic stash is officially up for sale.

At current prices, the 1,500 BTC represents around $180 million in market value. More importantly, it marks one of the fastest and most significant offloads ever recorded from a single wallet, with the total 80K BTC valued at roughly $9.54 billion. While they have only moved a small fraction to exchanges so far, the sale could signal larger intentions.

Some view this transfer as a potential warning sign, especially given the current consolidation above $115K. In their view, such high-volume activity from a long-term holder might precede further profit-taking or even a broader correction. Others, however, see it as a smart and well-timed MOVE from an investor who has held since Bitcoin’s earliest days and is finally realizing some gains.

BTC Price Holds Tight Range After ATH

Bitcoin is currently trading at $118,000, consolidating within a tight range between $115,730 and $123,230, as shown in the 12-hour chart. This comes after a strong breakout earlier this month that pushed BTC to a new all-time high of $123,230. Since then, price action has shown signs of cooling without a major pullback, suggesting bulls remain in control, but short-term momentum is slowing.

The chart displays a healthy structure, with BTC trading well above its 50-day, 100-day, and 200-day simple moving averages, which are currently at $111,819, $108,563, and $102,963. This confirms strong trend support from long-term holders and momentum investors.

Volume has increased during the move higher, indicating conviction behind the breakout, but the last few candles show lower follow-through volume, consistent with a consolidation phase. If BTC holds above $115,730, the structure remains bullish and could lead to another breakout toward $130,000 and beyond. A break below this level, however, could open the door for a deeper retracement, with the $112K–$111K zone acting as key moving average support.

Featured image from Dall-E, chart from TradingView