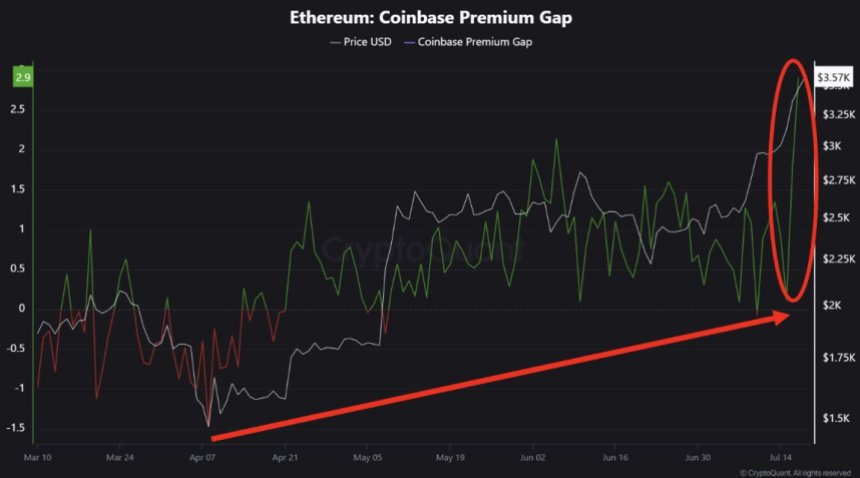

🚨 Coinbase Premium Spikes: Wall Street Goes All-In on Ethereum as Institutional FOMO Kicks In

Whales are circling Ethereum—and this time, it's not just retail traders driving the frenzy. Coinbase's premium signals a tidal wave of institutional demand crashing into ETH markets.

The big money playbook:

While Main Street debates 'crypto winter,' hedge funds are quietly accumulating Ethereum at levels not seen since the 2021 bull run. The Coinbase Pro premium—typically a tell for institutional activity—just flashed its most aggressive buy signal in years.

Why institutions won't sit this cycle out:

With BlackRock's ETH ETF approval looming and DeFi yields again outpacing Treasury bills, fund managers face a brutal choice: explain missing the rally or explain dabbling in 'that internet money.' Spoiler: career risk wins every time.

The closer: When Coinbase's institutional desk gets this busy, it's either the start of something big—or proof that even suits fall for greater fool theory when FOMO hits. Place your bets.

US Whales Lead the Charge as Ethereum Buying Activity Accelerates

According to a recent report by CryptoQuant analyst Crypto Dan, Ethereum is seeing a notable increase in buying activity, particularly from US-based whales. The steady rise in accumulation, combined with a clear premium on Coinbase, suggests that high-net-worth players are positioning themselves ahead of further upside.

Supporting this trend, daily inflows into Ethereum spot ETFs have surged to new all-time highs. This sharp spike reflects growing institutional confidence in ETH as a Core digital asset, especially following recent regulatory clarity in the US. With Ethereum now trading above $3,600, demand continues to outpace supply across multiple channels.

What makes this rally especially interesting is the current market environment. On-chain metrics show that Ethereum is not yet significantly overheated. Indicators such as NUPL (Net Unrealized Profit/Loss) suggest room for further expansion before excessive euphoria sets in. This creates favorable conditions for ETH to consolidate at higher levels before potentially breaking out again.

However, the coming weeks will be crucial. If strong inflows and bullish momentum persist into late Q3 2025, analysts warn it could trigger signs of overheating. While we are not there yet, repeated vertical moves without retracement should prompt caution. Investors may need to reassess risk levels if the pattern continues.

Ethereum Breaks Key Resistance With Strong Weekly Candle

Ethereum is currently trading at $3,620 with two days left before the weekly candle closes, up more than 21% so far. This ongoing rally has pushed ETH firmly above the $2,852 resistance level — a crucial zone that capped price action for months.

The move comes with high volume and follows a breakout above the 50-, 100-, and 200-week moving averages, now all reclaimed as support at $2,654, $2,664, and $2,430, respectively. With momentum accelerating and buyers clearly in control, market attention is shifting toward the next key resistance at $3,742, marked by the weekly wick high from December 2024.

Although the candle has not yet closed, its current size and structure highlight growing bullish strength. This surge builds on Ethereum’s 70% rally from mid-June, suggesting that an expansion phase may be underway.

If ETH holds near or above current levels by Sunday, it WOULD confirm one of the strongest weekly performances this year and potentially trigger further upside. Until then, traders are watching closely to assess whether this breakout can sustain its pace or if a near-term pullback is due after such an aggressive move.

Featured image from Dall-E, chart from TradingView