Crypto Whale Rakes In $15M—Now Doubling Down On Ethereum Short

A single trader just pocketed $15 million in profits—and they're betting against Ethereum next. Here's why the market's sweating.

Whale Watching: Big Money Moves

While retail investors chase memecoins, this whale quietly executed a textbook exit. Now their sights are set on ETH's downside. Timing? Impeccable—right as gas fees spike and DeFi TVL wobbles.

The Short Playbook

Insiders whisper the position involves OTC derivatives, not just spot sales. Classic hedge fund tactics meet crypto's wild west—because why risk your own capital when you can leverage others'?

Market Ripples Ahead?

If this whale's right, we could see cascading liquidations below $3K. If wrong? Another 'hedge fund manager' quietly rebrands as a 'Web3 visionary.' Either way, grab popcorn—the smart money's making its move.

Ethereum Under Pressure Below $3,500

The liquidation value of the position is at $3,505 — NEAR where ETH traded previously in January 2025. That point is now serving as very powerful resistance. If the price exceeds that level, the position stands to be completely liquidated.

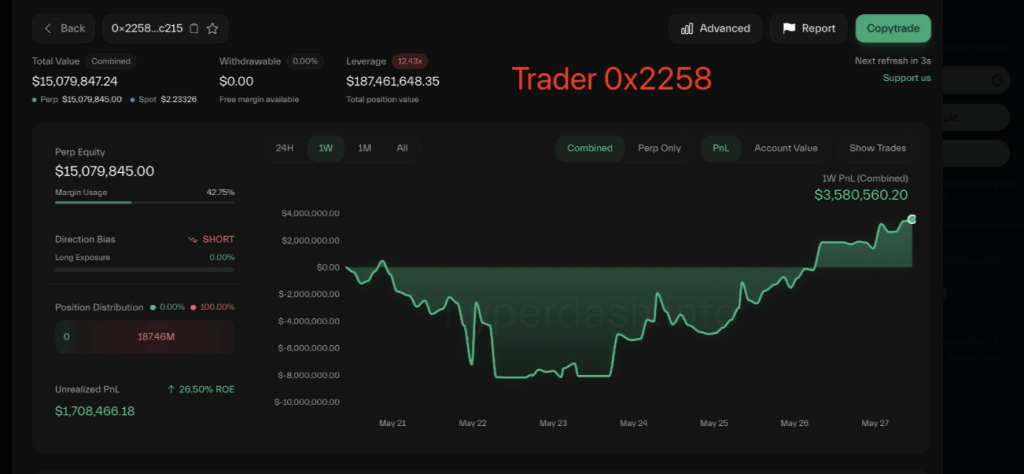

Whale 0x2258, who’s already made over $15M, is shorting $ETH with 18x leverage, holding a position of 20,474 $ETH($62.5M).

This whale has previously profited big by trading against James Wynn.https://t.co/BALllYbUXbhttps://t.co/NhOE1YD4QN pic.twitter.com/7k5ZE81Noa

— Lookonchain (@lookonchain) July 15, 2025

Despite that narrow buffer, the trader seems confident. The use of 18x leverage suggests a high-conviction call that ETH will drop further or, at the very least, won’t bounce past that resistance level in the short term.

This kind of heavy shorting is raising eyebrows in a market that’s still undecided on whether ethereum can regain bullish momentum alongside Bitcoin.

Track Record Of Outsmarting James Wynn

This isn’t the first time “0x2258…” has stepped in with bold trades. The wallet has gained a reputation for taking positions that go directly against crypto influencer James Wynn—often with profitable results.

Back in May, Wynn went long on ETH and Bitcoin. Almost immediately, 0x2258 shorted both. When Wynn closed his positions, 0x2258 did the same and walked away with $1.36 million. The next day, as Wynn flipped bearish, 0x2258 went long and bagged another $2.54 million.

The back-and-forth continued. By May 26, the whale had locked in $5.6 million in profits in just three days. Since then, the strategy has snowballed into more than $15 million in realized gains, most of it from flipping against Wynn’s positions.

Big Bet Reflects Uncertainty In ETH’s PathWhile Bitcoin continues to break through key resistance zones, Ethereum seems stuck in a tougher fight. Traders like 0x2258 appear to believe that ETH lacks the strength right now to push past the $3,500 level.

Still, shorting with this level of leverage is a double-edged sword. If ETH bounces sharply, traders like 0x2258 could get caught in a squeeze, forced to buy back in at a loss—driving the price up even faster.

So far, though, the whale is winning again. Whether it ends in another multi-million-dollar gain or a hard reset depends on what ETH does next. For now, the market is waiting to see what happens next.

Featured image from Meta, chart from TradingView