Bitcoin Retail Demand Surges Back – $0–$10K Transfer Volume Flips Green in Bullish Reversal

Retail investors are diving back into Bitcoin—small wallet activity just turned positive for the first time in months.

The comeback no one saw coming

After months of sideways action, transfers under $10K are ticking up again. Not exactly institutional money—but hey, someone’s gotta keep the Lambo dealers in business.

Why it matters

When the little guys start moving coins, it’s often a leading indicator. Last time this happened? Right before the 2024 rally that left Wall Street scrambling to explain why they’d been shorting ‘digital tulips.’

The cynical take

Sure, the banks will call this ‘speculative froth’—right up until their quarterly reports show 40% of revenue coming from crypto ETFs they swore they’d never touch.

Retail Demand Reawakens As Crypto Week Advances In Washington

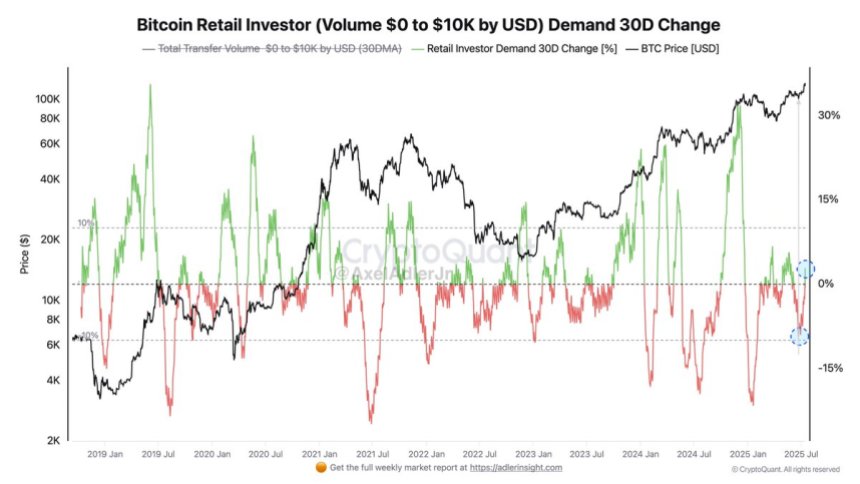

Top analyst Axel Adler has highlighted a critical on-chain signal that points to the return of retail investors in the Bitcoin market. The 30-day change in demand for small transfer volumes ($0–$10K) has moved out of negative territory for the first time in months. This shift indicates a meaningful increase in activity from smaller holders—widely interpreted as retail participants—after a prolonged period of dormancy.

Retail involvement plays a crucial role in sustaining long-term bullish trends. While institutional demand often drives initial breakouts, it is the broad participation from everyday investors that adds momentum and staying power to rallies. The reappearance of retail buying interest not only strengthens Bitcoin’s current price structure but also suggests growing confidence in the asset’s outlook, despite recent volatility.

This renewed demand comes at a pivotal time. “Crypto Week” is underway in the US Congress, where lawmakers are actively debating and voting on three major cryptocurrency bills. The outcomes of these discussions are expected to shape the regulatory landscape for years to come and could provide the clarity that both retail and institutional investors have long awaited.

For now, the uptick in small-scale BTC transfers is a strong signal. That retail investors are re-engaging just as the crypto industry prepares for potentially historic policy changes.

BTC Holds Above $118K After Reclaiming Breakout Zone

Bitcoin is currently trading at $118,914 on the daily chart. After a sharp rally pushed it to a new all-time high of $123,200 earlier this week. The price has since retraced, but BTC continues to hold above key support levels, signaling bullish resilience. The recent dip toward $117,000 was met with buyer interest, as seen in the long lower wick and a moderate bounce on rising volume.

The chart shows that BTC is comfortably trading above the 50-day, 100-day, and 200-day simple moving averages (SMAs). Currently at $108,040, $102,116, and $97,362, respectively—all of which are upward sloping. This confirms a strong bullish structure, with momentum still favoring buyers in the medium to long term.

With volatility increasing and volume surging, Bitcoin’s consolidation above $118K could act as a launchpad for a second leg higher. A strong close above $120K WOULD likely confirm continued bullish momentum heading into the final stretch of “Crypto Week.”

Featured image from Dall-E, chart from TradingView