🚀 Crypto Bulls, Pop the Champagne: Congresswoman Leaks Powell’s Ouster—Markets Set to Soar

Washington just handed crypto traders the ultimate bullish catalyst. A bombshell leak confirms Jerome Powell’s days at the Fed are numbered—and digital assets are primed for liftoff.

### The Fed’s Reckoning

D.C. insiders whisper Powell’s exit could trigger the most crypto-friendly monetary pivot since Satoshi mined the genesis block. No more taper tantrums. No more rate hike threats. Just pure, unfiltered liquidity pumping into BTC and altcoins.

### Wall Street’s Worst Nightmare

While traditional finance scrambles to hedge against a dovish regime change, decentralized protocols are already pricing in the chaos. Smart money’s flooding into perpetual swaps—because nothing breaks the banking system faster than politicians meddling with monetary policy.

*‘They’ll replace him with someone who prints money faster than a degenerate degen farms yield,’* snarks a hedge fund manager (between sips of a $28 oat milk latte).

### The Countdown Begins

Strap in. The next Fed chair won’t just cut rates—they’ll bulldoze the dollar’s credibility. And crypto’s army of diamond-handed anarchists? They’ve been waiting for this moment since 2009.

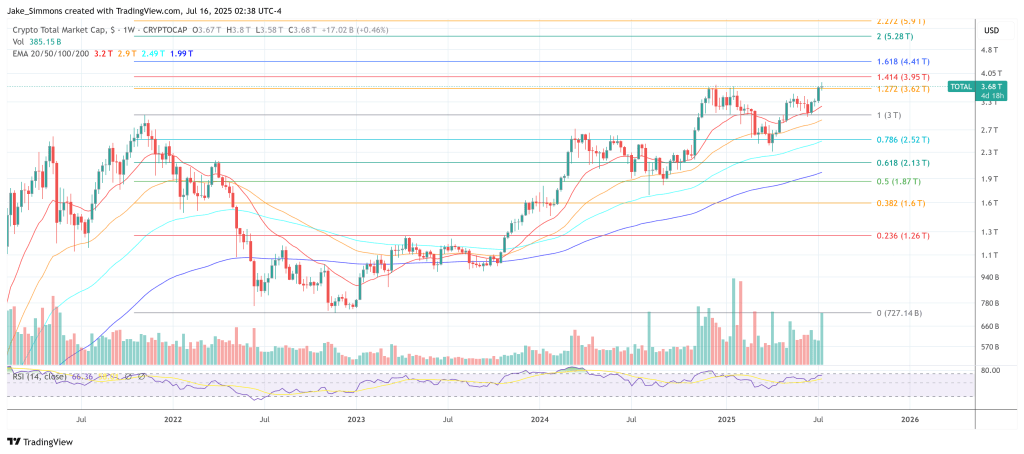

Crypto Markets Sense A Massive Bull Run

The Bitcoin and crypto prices haven’t shown any reaction to the rumor yet. After piercing $123,000 on Monday, BTC is still 4.5 percent below the record high. The entire crypto market seems to be in a wait-and-see position. However, long-term, the implication could be profound for the crypto markets. “I cannot think of a more bullish catalyst for Bitcoin in the past five years than the complete and utter humiliation of Jerome Powell,” wrote macro commentator Julian Figueroa, pointing to what he called the “façade” of central‑bank independence collapsing in real time.

Long‑time trader Byzantine General echoed the ambivalence: “Powell was actually a great Fed chair. But… if he resigns then it’s very likely that whoever comes next will lower rates, which is bullish for our cryptographic currencies.”

Should President Trump succeed in replacing Powell with a more accommodating successor—one prepared to deliver the “three‑percentage‑point” rate cut he has publicly demanded—the Federal Reserve WOULD likely be forced to shelve its balance‑sheet runoff precisely as Washington ramps up fresh fiscal stimulus.

That synchronous pivot away from quantitative tightening would flip the liquidity regime from drain to deluge, recreating the macro backdrop that powered the crypto market’s 2020‑21 vertical ascent and positioning it for the next major bull run.

At press time, the total crypto market cap stood at $3.68 trillion.