Bitcoin Bulls vs Bears: Long/Short Ratio Crashes After ATH—Who’s Really in Control?

Bitcoin’s post-ATH hangover hits hard as bears flip the script. The long/short ratio—a key sentiment gauge—just nosedived into negative territory. Here’s what’s really happening.

The ATH comedown: After euphoric highs, Bitcoin’s market structure is showing cracks. Traders are scrambling to adjust positions as leverage flips bearish for the first time in weeks.

Liquidity games: Watch for whale-sized stop hunts below $70K—because nothing says 'free market' like a few well-timed spoof orders. (Wall Street would be proud.)

What’s next? Volatility is back on the menu. Whether this is a healthy reset or the start of something uglier depends on who’s holding the leverage—and who’s getting liquidated.

Bitcoin Retraces As Bearish Sentiment Rises

Bitcoin has pulled back more than 5% since reaching its all-time high of $123,000 earlier this week, with current price action testing the strength of short-term support levels. While retracements are common after major breakouts, some analysts note that Bitcoin’s decline has been sharper than that of ethereum and many altcoins, which have either held their ground or continued to climb.

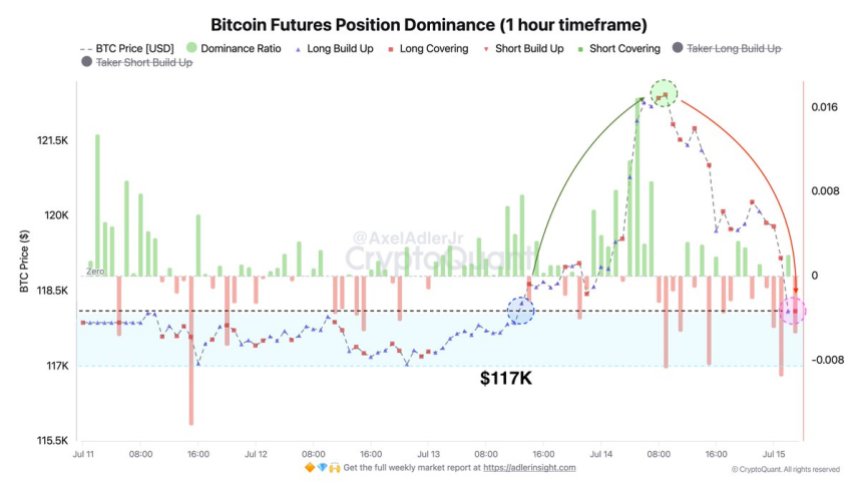

Top analyst Axel Adler pointed out a significant shift in sentiment following the ATH. According to his insights, bears began aggressively shorting immediately after the price peak, leading to a sharp drop in bullish dominance. Most notably, the long-to-short ratio flipped into negative territory for the first time in weeks, signaling a clear rise in short interest across derivatives platforms.

This pivot in positioning reflects growing caution among traders and raises the stakes for bulls. The $117,000 level is now seen as a key support zone—if bitcoin fails to hold above it, a deeper correction could follow, potentially dragging the broader market down with it.

The timing is especially critical. This week, the US Congress kicks off “Crypto Week,” a series of discussions and potential votes on important legislation that could reshape the regulatory landscape for digital assets. The outcome of these debates may act as a catalyst for renewed bullish momentum—or deepen the correction if uncertainty dominates. As markets brace for clarity, all eyes remain on Bitcoin’s ability to defend $117K and reclaim its short-term trend.

BTC Pulls Back: $114K–$117K Key Zone to Watch

The 4-hour chart shows Bitcoin retracing sharply after reaching an all-time high of $123,200 earlier this week. Currently trading at $116,900, BTC has dropped over 5% from its recent peak, marking its first significant correction since the breakout above $109,300.

This pullback brings Bitcoin back toward the $114,000–$117,000 zone, which now acts as short-term support. This area coincides with the rising 50-period simple moving average (SMA) at $114,466 and is closely aligned with the previous breakout structure. A successful retest of this level could provide the foundation for a new leg higher.

However, failure to hold this zone could open the door for a deeper correction toward the $109,300 support level, which served as a multi-week resistance throughout May and June. The bearish momentum on the latest candles, combined with high sell volume, reflects rising short-term uncertainty. Despite this, Bitcoin remains above all major moving averages on this timeframe (50, 100, and 200 SMAs), indicating that the broader trend is still intact.

Featured image from Dall-E, chart from TradingView