Ethereum Soars as Bank of America Dives Into Digital Asset Tracking—Is Traditional Finance Finally Waking Up?

Bank of America just blinked—and Ethereum caught the glow.

The banking giant's new digital asset tracking service signals a quiet surrender: even legacy institutions can't ignore crypto's gravitational pull anymore. Forget 'exploring blockchain'—this is direct exposure dressed in institutional drag.

Why Ethereum? Smart contracts aren't just disrupting finance—they're rewriting the rulebook. While BofA hedges with tracking tools, DeFi protocols are busy rendering their middlemen obsolete.

One cynical take? Banks love blockchain... as long as they can control the rails. But with ETH's ecosystem growing more autonomous by the day, this might be less a victory lap than a desperate foot in the door.

Prediction: The 'tracking' phase won't last. Once institutions taste the yield, they'll demand the keys—and that's when things get interesting.

Stablecoin Legislation Under The Lens

Based on reports, this week’s Crypto Week in the US House of Representatives could reshape the stablecoin sector. Lawmakers are debating three major bills: the GENIUS Act, the CLARITY Act, and the Anti‑CBDC Surveillance bill.

House Financial Services Chair French Hill told a “Think Crypto” podcast that dollar‑backed coins WOULD solidify the US dollar’s global lead. If Congress backs clear rules, the rails that already carry the most volumes could see fresh inflows.

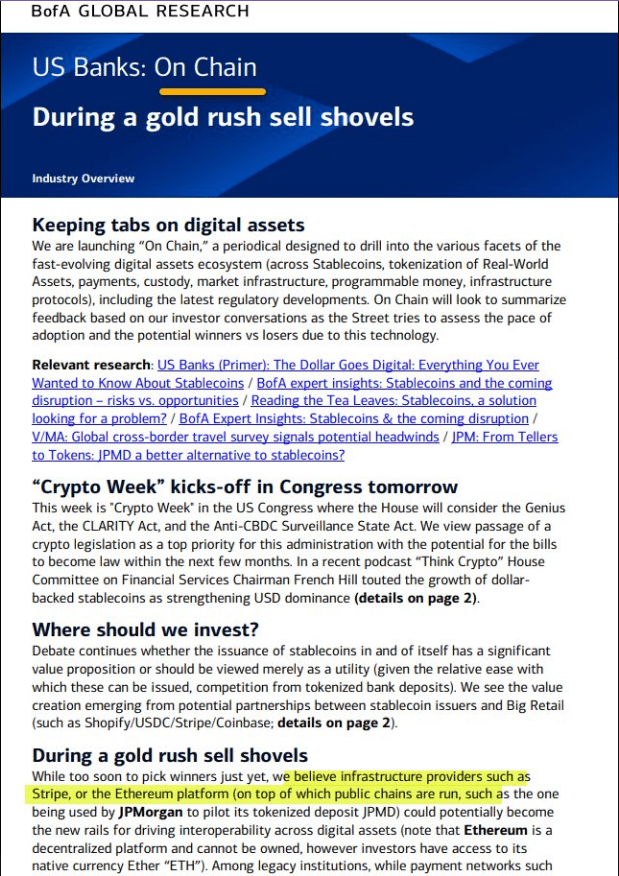

BofA launches new weekly periodical ‘On Chain,’ designed to “drill into the various facets of the fast-evolving digital assets ecosystem.”

First call: Bullish ETH pic.twitter.com/sERRZiTgMq

— matthew sigel, recovering CFA (@matthew_sigel) July 14, 2025

Rails For The Future

Bank of America called out infrastructure providers like Stripe and the ethereum network as prime plays for anyone looking to get stablecoin exposure.

That nod isn’t just for the token itself. It’s a bet on the whole stack—wallets, apps and payment tools that ride on Ethereum’s code. Investors who pick up Ether now could tap growing on‑chain activity as stablecoin use climbs.

The report also mentioned Treasury Secretary Scott Bessent predicting that the dollar‑pegged stablecoin market may swell to $2 trillion in the next five years. That forecast has fund managers circling the charts.

Thomas Lee, Fundstart CIO and new chairman of BitMine, even dubbed stablecoins the “ChatGPT of crypto.” His firm now holds Ether in its treasury. The MOVE shows how big players are gearing up for a stablecoin surge on Ethereum.

Other sectors are racing alongside stablecoins. BlackRock CEO Larry Fink said tokenization could expand 4,000 times over time. He sees on‑chain assets tied to real‑world items booming soon. Some say XRP and Ether are the go‑to tokens for that play. But Ethereum already has the advantage of scale.

It isn’t all smooth sailing. Regulation could tighten or split along different chains. New networks chase faster speeds and lower fees. That competition could chip away at Ethereum’s lead. Still, the network’s mix of smart‑contract tools and high stablecoin volumes gives it a strong head start.

For now, plenty of eyes are on Congress and on‑chain data. If US lawmakers set clear stablecoin rules, Ethereum may keep its crown as the top hub. Investors looking for exposure will likely track Ether flows and watch the bills as they move through committee. The weeks ahead could spell out the next big chapter for the network.

Featured image from Pexels, chart from TradingView