Ethereum Shorts Hit All-Time High: How to Capitalize on the Coming Breakout

Ethereum bears are piling in at record levels—just as the smart money starts positioning for a violent reversal. Here’s how to play it.

### The Short-Squeeze Powder Keg

With ETH shorts stacked like Jenga blocks, even a modest rally could trigger cascading liquidations. Traders betting against Ethereum now face the same risks as 2021’s meme-stock frenzy—just with more blockchain jargon and less CNBC hype.

### Breakout Triggers to Watch

Spot ETH ETF approvals (finally), Layer-2 adoption spikes, or even Bitcoin’s halving aftershocks could light the fuse. Meanwhile, Wall Street funds quietly accumulate—because nothing screams 'contrarian play' like fading the crowd when leverage hits extremes.

### The Cynical Take

Of course, this could all be another 'hedge fund hotel' trap—where retail gets squeezed in both directions while prime brokers collect fees. But that’s crypto: where the house always wins… unless you’re the house.

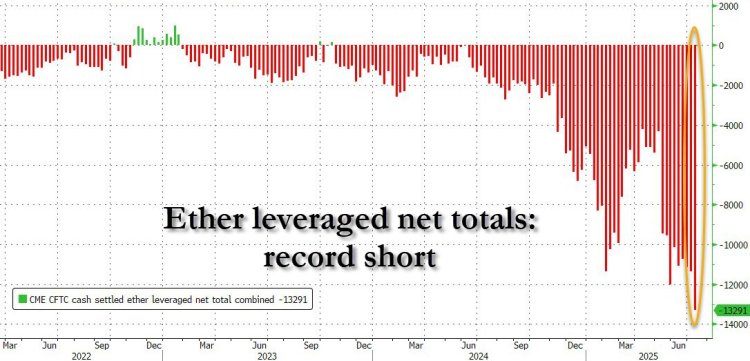

Ethereum Leverage Positions Reach Record Short Levels

In a post on X, market expert Zerohedge revealed an interesting development for Ethereum, and that is the fact that Ethereum shorts have now reached new records. The chart showed the Ether Leveraged net totals, and it came out to a -13291, beating the previous high that was set back in May at -12000.

This rise in Ethereum shorts proves that there is still a lot of disbelief in the current market rally, and many traders expect the Ethereum price to fall again. However, looking at the historical performance when it comes to shorts reaching record levels, it shows a trend that this could mean the rally could be sustained.

For example, back in May 2025, when it set its previous peak of -12000, the ethereum price had rallied from below $1,800 to above $2,600 before the month was over. This trend is also playing out now as the Ethereum price has crossed $3,000, as the Ether shorts have reached a new peak.

How To Stay Positioned For ETH

Given that the Ethereum price seems to be headed into what might be a parabolic rally after clearing $3,000, crypto analyst Luca on X has outlined how they intend to position for the surge. Luca explains that with the new week, the Ethereum price is at a key point. This is because it is approaching the 0.618 Fibonacci Retracement level, and this level is important because it has been a point of consolidation for the altcoin in the past.

As such, the analyst explains that he intends to keep holding his positions on Ethereum. So far, Luca revealed that he has only de-risked Bitcoin positions as the pioneer cryptocurrency has hit all-time highs, but as the end of the cycle draws closer, the focus remains on altcoins.

He maintains that the Ethereum price, alongside altcoins, will end up outperforming Bitcoin once the dominance drops. When this dominance drop happens, the analyst says that is when to begin de-risking altcoin positions. For now, though, the analyst expects Ethereum and altcoins to keep trailing Bitcoin as the dominance still remains high above 64% and BTC is yet to enter its distribution phase.