Bitcoin Exchange Inflows Surge Post-$123K ATH – Profit-Taking or Market Cooldown Ahead?

Bitcoin's record-shattering rally hits a potential inflection point as exchange deposits spike.

Whale alert: On-chain data shows the largest inflows since the 2021 bull run. Are holders cashing out or just reshuffling?

The $123,000 peak triggered classic trader psychology – everyone loves gains until they fear losing them. Now the market faces its first real test of conviction.

Meanwhile, traditional finance pundits still can't decide if crypto is 'digital gold' or a 'speculative bubble' – proving only that suits move slower than blockchain.

Bitcoin Exchange Inflows Warn Of Pullback

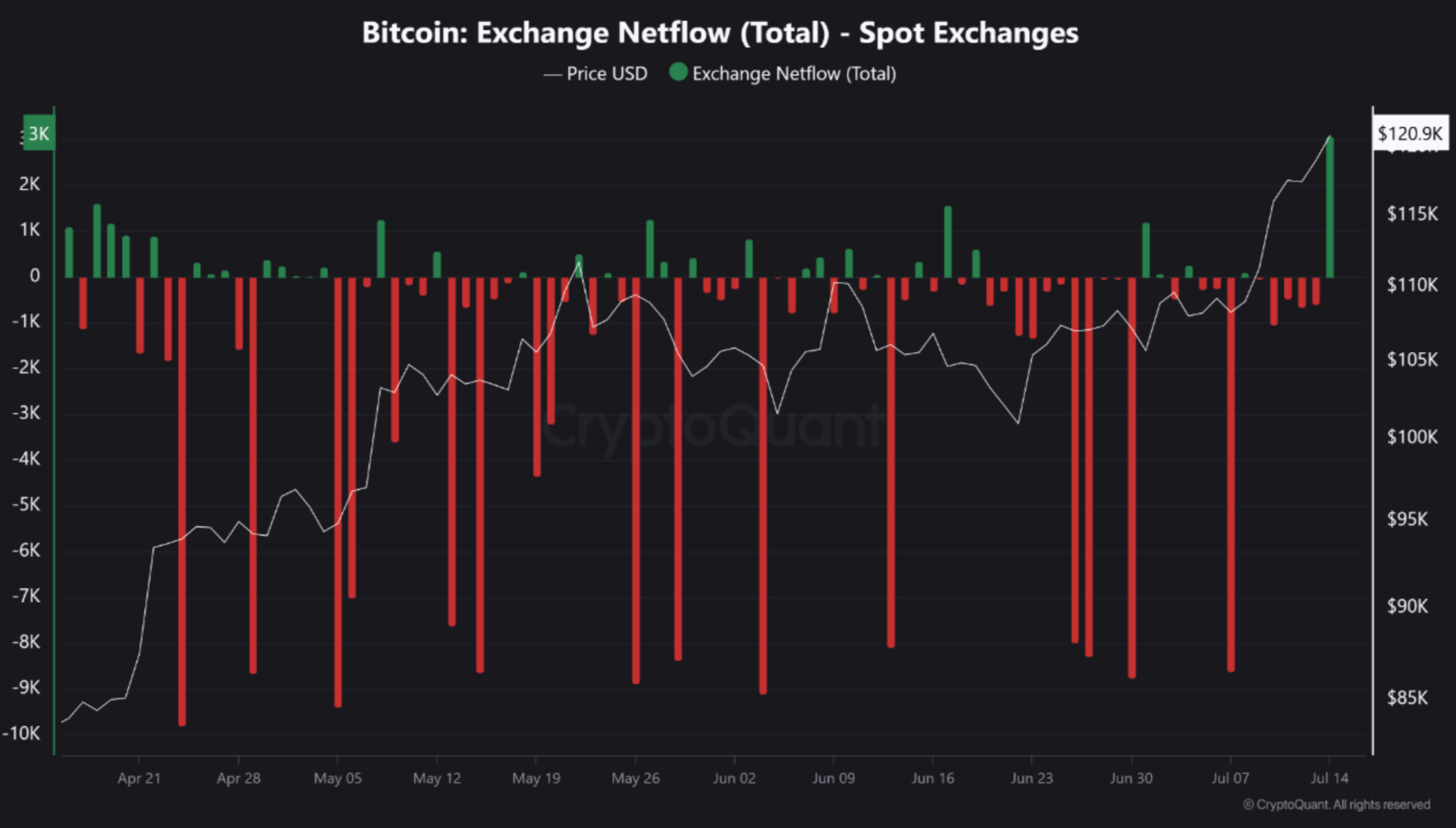

According to a CryptoQuant Quicktake post by contributor Tarekonchain, BTC is beginning to show signs of short-term cooling. Notably, exchange inflows recorded a sharp uptick right after Bitcoin hit its fresh ATH.

The following chart shared by the analyst highlights exchange netflows to spot platforms, with notable spikes in inflows to centralized exchanges. This typically indicates profit-taking behavior by short-term holders and some whales.

Tarekonchain noted that such on-chain activity is usually indicative of a local top that could lead to a healthy price correction or consolidation in the coming days. They added:

It’s a classic pattern we’ve seen after previous parabolic rallies – profits are realized, weak hands exit, and price finds a new base.

That said, the analyst noted that despite the warning signs of a looming price correction, the overall market structure remains largely bullish. For instance, long-term holders are still holding their BTC, not keen on selling at current price levels.

Supporting the bullish thesis, spot bitcoin exchange-traded funds (ETFs) continue to attract strong capital. For the week ending July 11, they saw $2.72 billion in net inflows – a clear sign of ongoing institutional interest.

Whales Preparing To Sell?

In a separate post, CryptoQuant contributor Crazzyblockk pointed to an uptick in whale activity on Binance. The Binance Whale Activity Score shows that deposits from large wallets have spiked dramatically.

Whales reportedly deposited as much as 1,800 BTC to Binance in a single day, with more than 35% of transactions valued at over $1 million, hinting at strategic positioning ahead of expected volatility.

Crazzyblockk highlighted two possible scenarios following the surge in deposits from large-scale investors. First, it is likely that these investors are sitting on healthy profits and may be getting ready to secure some gains after a historic run.

Alternatively, they might be aiming to leverage Binance’s DEEP liquidity to hedge or open new positions as the market experiences heightened volatility. Either way, this sell-side pressure on Binance is likely to weigh on BTC’s bullish momentum.

Despite rising inflows and increased whale activity, market sentiment remains broadly positive. Retail investor participation is still muted compared to previous bull runs, suggesting the current rally might still have room to grow. At press time, BTC trades at $119,449, up 0.8% in the past 24 hours.