Bitcoin’s 30-Day Funding Rate Plunge Signals Imminent Bull Run – Here’s Why

Perpetual traders just flashed their first major buy signal in months.

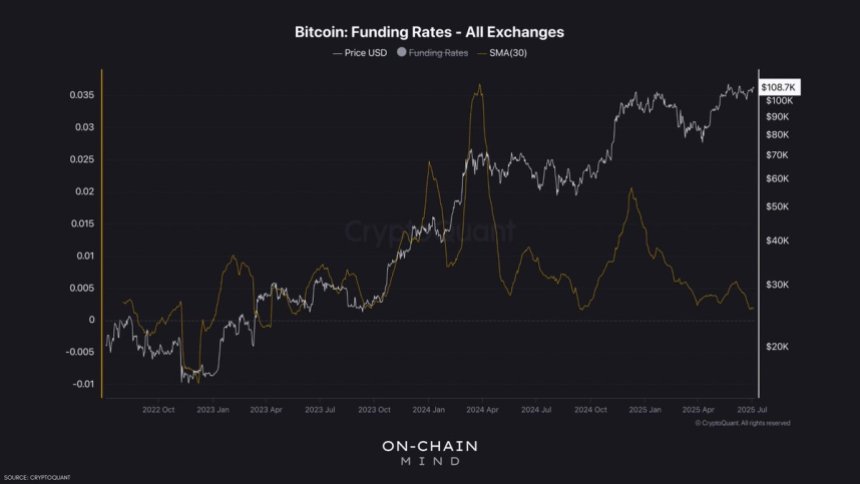

Funding Rates Crash to Multi-Week Lows

Bitcoin's 30-day average funding rate nosedived this week – a classic reset before big upside moves. When leveraged longs stop overpaying for positions, markets often coil for explosive rallies.

The Contrarian Playbook

Retail crowds chase green candles while smart money loads up during fear cycles. With funding rates now neutralized, the stage gets set for the next leg up. Just don't tell the CFTC – they're still trying to regulate last year's bull market.

The Bottom Line

History doesn't repeat, but it rhymes. Every sustained BTC rally begins with flushed-out leverage. This time? Wall Street's algos will front-run the move before your bank's 'digital asset strategist' finishes their third coffee.

Calm Before The Breakout: Bitcoin Gains Strength Above $107K

Bitcoin is up more than 3% since the start of July, holding firmly above the $107,000 local low despite repeated resistance at the $110,000 level. This sustained strength signals underlying buyer support and growing momentum as BTC continues to consolidate just below all-time highs. The $110K resistance remains a critical ceiling — once breached, analysts expect a strong MOVE into price discovery as bullish momentum builds.

So far, the market has digested a wave of macroeconomic and geopolitical developments. Global trade dynamics — including rising tariffs, export restrictions, and deglobalization trends — continue to shape sentiment. Yet, compared to the sharp volatility seen earlier this year, both Bitcoin and US equities appear more resilient. This suggests that much of the uncertainty has already been priced in, reducing the downside risk for risk assets like BTC.

A key technical factor reinforcing the bullish case is the low 30-day average of funding rates. This indicator reflects a neutral-to-cautiously optimistic market environment — a stark contrast to overheated bullish phases that often precede corrections. Calm periods like this often set the stage for explosive moves, particularly when supply squeezes and strong demand meet a macro environment ripe for risk-taking. With BTC coiling tightly and sentiment balanced, a breakout could be imminent.

BTC Holds Steady as Bulls Eye $109,300 Breakout

The 4-hour chart shows Bitcoin (BTC) consolidating within a tight range, holding above the key support at $107,000 and testing resistance around $109,300. This price level has consistently acted as a local ceiling, with several failed breakout attempts in late June and early July. However, the bulls continue to defend higher lows, signaling strength and setting the stage for a potential breakout.

The 50, 100, and 200 simple moving averages (SMAs) are stacked close together and gradually trending upward, suggesting the consolidation phase could soon transition into a more directional move. Volume remains low, which often precedes a volatility spike, especially NEAR key resistance levels.

The $103,600 support remains the crucial line in the sand for bulls. A breakdown below that level WOULD invalidate the short-term bullish structure and likely lead to a deeper retrace. On the upside, a daily close above $109,300 with volume confirmation could trigger a rally toward price discovery above the all-time high.

Featured image from Dall-E, chart from TradingView