Ethereum Squeeze Alert: $2,800 or $2,350 – Which Liquidity Zone Breaks First?

Ethereum's price action just turned into a high-stakes poker game. The second-largest crypto by market cap coils between two make-or-break liquidity zones—$2,800 as resistance, $2,350 as support. No fancy technicals here: whales are stacking orders at these levels like Wall Street banks hoarding taxpayer bailouts.

Volatility incoming?

Traders eyeing the tightening range should prep for two scenarios. A clean break above $2,800 could trigger algorithmic buying frenzies—liquidity begets liquidity in crypto’s perpetual motion machine. But lose $2,350? That’s when ‘max pain’ memes start trending as leveraged longs get vaporized faster than a DeFi rug pull.

Smart money’s playing both sides. Institutional flows quietly accumulate ETH while retail obsesses over meme coins—classic ‘dumb money’ divergence. Meanwhile, gas fees remain stubbornly high because Ethereum loves burning cash as much as your average Web3 startup.

Prediction? Price discovers gravity eventually. The only question is whether it’s upward or downward trajectory from here—and who gets left holding the bag.

Ethereum’s Next Move Could Ignite Altseason

Altcoins remain nearly 50% below their all-time highs, but bullish momentum is quietly building. Ethereum, the leader of the altcoin market, has been consolidating in a well-defined range between $2,400 and $2,700 since early May. This prolonged sideways action has kept much of the altcoin sector in a state of indecision. Now, traders and analysts agree: Ethereum must break out to lead the next major move.

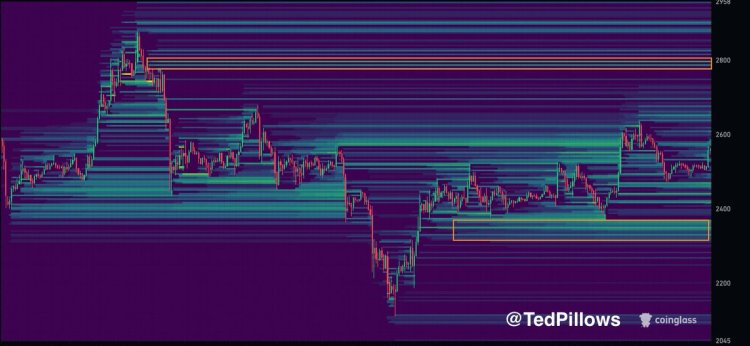

Market analyst Ted Pillows identifies two key liquidity levels for ETH: $2,800 on the upside and $2,350 on the downside. These zones represent the most likely destinations for price in the short term, depending on which side of the range breaks first. If Ethereum pushes above $2,800 with strength, it WOULD likely trigger renewed risk appetite and a broad-based altcoin rally. On the other hand, a breakdown below $2,350 could lead to deeper corrections across the board.

So far, bulls have defended the $2,500 level well, and growing open interest suggests that investors are positioning for an expansion. A decisive breakout in either direction will resolve weeks of consolidation and determine the short-term trend. Until then, Ethereum remains the gatekeeper of altcoin momentum—its next move could define the path for the entire market.

ETH Tests Resistance Amid Range-Bound Structure

Ethereum is currently trading at $2,563, hovering just below the $2,600 mark, a level that has acted as short-term resistance throughout June and early July. As shown in the 12-hour chart, ETH has been trapped in a horizontal consolidation structure between $2,400 and $2,700, with multiple failed attempts to break either side convincingly.

The price remains above the 50, 100, and 200 simple moving averages (SMAs), which is a positive signal for bulls. The 100 SMA at $2,532 and the 200 SMA at $2,206 have offered strong dynamic support during recent pullbacks, reinforcing the current uptrend structure.

Volume remains moderate, suggesting that market participants are waiting for a clear breakout before entering with conviction. A decisive close above $2,600 would open the door for a move toward $2,800, where large liquidity clusters have been identified by Coinglass.

However, failure to maintain this short-term momentum could push ETH back toward the $2,400 support zone. Bulls have defended this level several times, and a break below it would likely invalidate the bullish setup and increase the risk of a deeper correction.

Featured image from Dall-E, chart from TradingView