Bitcoin’s Real Value Could Skyrocket Past $110K—Here’s Why Experts Are Bullish

Forget the price tags you see today—Bitcoin’s true worth is lurking in the shadows, waiting to explode. Analysts insist the king of crypto is still wildly undervalued, with fundamentals pointing to a six-figure future.

### The $110K Benchmark: Why It’s Just the Start

Market veterans argue Bitcoin’s scarcity, adoption curve, and institutional demand create a perfect storm for a valuation reset. Meanwhile, Wall Street still can’t decide if it’s a 'digital gold' or a speculative meme—classic finance indecision.

### The Cynic’s Corner

Sure, $110K sounds outrageous… until you remember banks charge $50 for a wire transfer that takes three days. Maybe disruption isn’t so overpriced after all.

Undervalued At $110K

According to Altcoin Daily, bitcoin at $110,000 is “undervalued,” with the analysts arguing there’s plenty of room to run. That bold claim has fans cheering, and some even dream of $1,000,000 down the road.

Bitcoin at $110k is undervalued! [screenshot this]

— Altcoin Daily (@AltcoinDaily) July 3, 2025

Other users have pushed back, asking what on‑chain data or metrics back up this view. They point out that until Bitcoin clears resistance at $110,500, a real breakout isn’t confirmed.

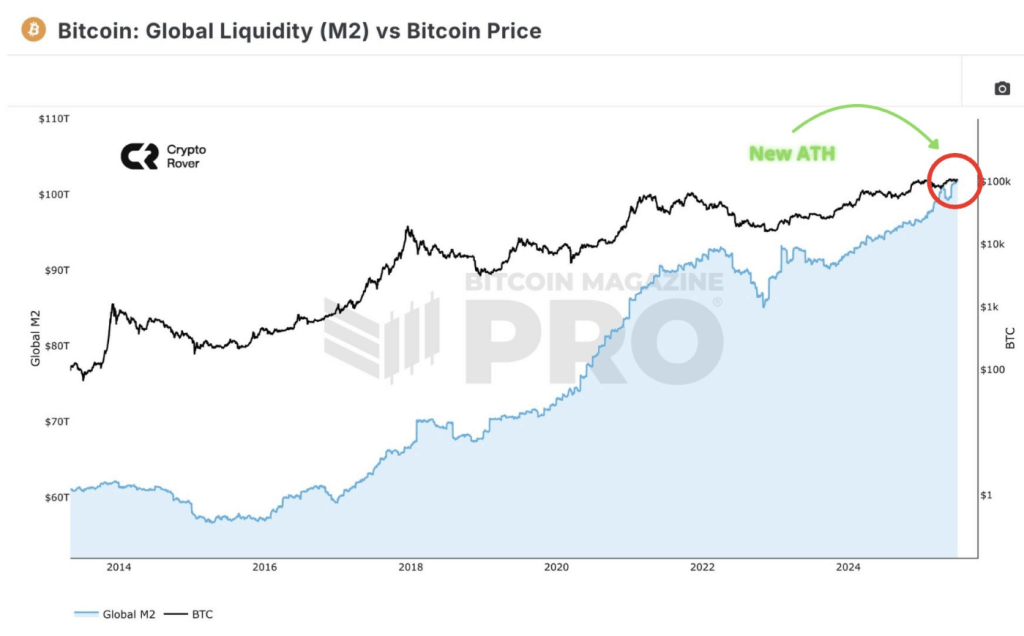

Based on reports from market trackers, global liquidity is on the rise. Market observers picked up on that, saying more cash floating around can push Bitcoin higher.

Rising liquidity often fuels big moves in risk assets. Still, traders keep an eye on futures funding rates and miner sell‑pressure, looking for clues if a pullback is brewing.

Global Liquidity just hit a new ATH.

Bitcoin will follow! pic.twitter.com/gH1Kl2D1Zw

— crypto Rover (@rovercrc) July 3, 2025

Some followers argue that inflation and new tariffs could dampen Bitcoin’s rally. Others note that central banks are still buying time before any rate hikes, which may give crypto another boost.

The back‑and‑forth on social media reads like a mini war room, with short comments and DEEP threads floating around. Plenty of voices, but few hard answers.

Past Bull RunsAltcoin Daily wasn’t shy about past calls either. Just days earlier, they said that once Bitcoin tops $150,000, investors WOULD wish they’d bought more at lower prices. That kind of hindsight talk can be stirring, but it doesn’t change the here‑and‑now charts or the macro calendar.

Based on remarks by Matt Hougan, Chief Investment Officer at Bitwise, now could be a good time to buy Bitcoin. Hougan pointed to RAY Dalio’s warnings about US debt, which has swelled past $7 trillion in annual spending against $5 trillion in revenue.

With each household on the hook for roughly $230,000, Dalio says holding Bitcoin can act as a hedge against future money‑print risks.

Price Action On CrosshairInvestors will be watching both price action and big‑picture events. A solid break above $110,500 might pull in more buyers. But if inflation surprises on the upside or tariffs hit harder, odds could shift quickly.

For now, Bitcoin’s story is still unfolding—and the next few days could tell us a lot about where it’s headed.

Featured image from Meta, chart from TradingView