Bitcoin Holds Firm: These 2 Critical Support Levels Could Dictate the Next Big Move

Bitcoin's price action remains in a tight range—but don't mistake consolidation for complacency. Traders are eyeing two key support levels that could make or break the next leg.

The Floor Beneath Bitcoin's Feet

While traditional markets obsess over Fed whispers, crypto's heavyweight keeps testing its footing. A breakdown below these levels? That's when things get spicy.

Why This Range Matters More Than Ever

Institutional money's waiting on the sidelines—like over-caffeinated day traders—for confirmation of either a bounce or a bust. Meanwhile, retail 'hodlers' keep stacking sats like there's no tomorrow (and for some altcoins, there might not be).

Remember: In crypto, 'support' is just resistance that hasn't failed yet. And Wall Street's 'risk managers'? They're still trying to short BTC with PowerPoint slides from 2018.

On-Chain Data Reveals Strong Bitcoin Support At $106,500 And $98,500

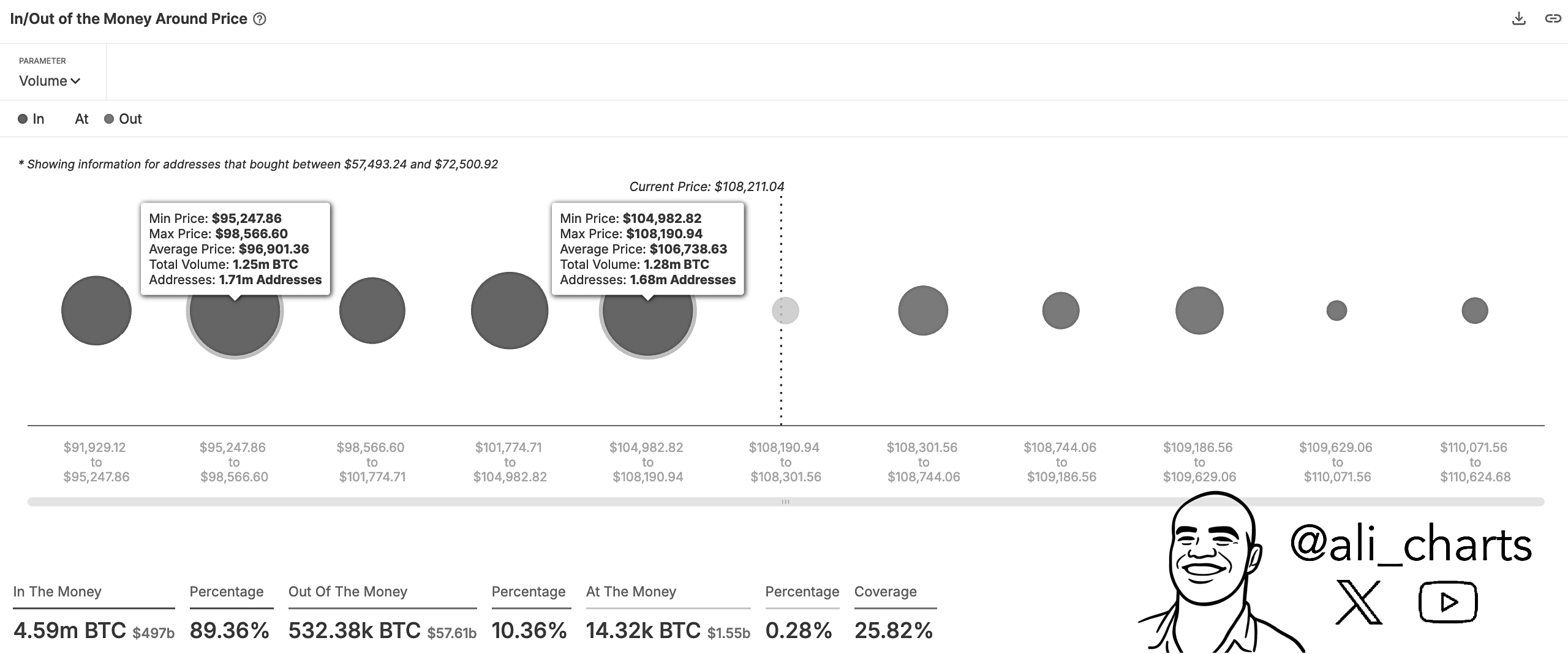

In an X post on July 5, Ali Martinez shares a potentially impactful on-chain insight on the Bitcoin market. Using data from the In/Out Money Around Price (IOMAP) Chart from Sentora, the analyst shares that major support zones have emerged that could play a crucial role in shaping the BTC’s short-term price direction.

The IOMAP chart analyzes bitcoin wallet addresses and the average prices at which they acquired BTC, giving insights into potential zones of buying or selling pressure. Essentially, it shows where holders are currently in profit i.e. in the money” or at a loss i.e. out of the money.

From the chart, it is observed that 1.68 million addresses bought 1.28 million BTC between $104,982 and $108,190, with an average acquisition price of $106,738. Historically, such large concentrations of buying activity tend to FORM strong support zones, as holders may defend their positions from slipping into loss. Therefore, this development makes the $106,700 range a formidable near-term support level.

A second significant support level is identified in the $95,247 to $98,566 range, where 1.7 million addresses acquired 1.25 million BTC at an average price of $96,901. Should Bitcoin lose its footing above $106,000, this lower range WOULD act as the next major cushion, potentially absorbing downward momentum. However, a decisive price close below $96,901 would confirm significant bearish intent by the Bitcoin market.

Bitcoin Market Overview

According to data from the IOMAP chart, around 89.36% of all BTC addresses are “in the money,” meaning their holdings were purchased at a lower price than the current market value. This is generally considered a bullish signal, suggesting the majority of market participants are in profit and thus less pressured to sell.

Meanwhile, only 10.36% of addresses are “out of the money,” highlighting the relatively low risk of widespread panic selling, unless Bitcoin were to break below these critical levels highlighted above. At press time, the premier cryptocurrency continues to trade at $108,154 reflecting a 0.24% gain in the past day. Meanwhile, it’s daily trading volume is down by 27.09% and valued at $31.04 billion.