Shiba Inu’s Dirty Little Secret: 62% of Supply Hogged by Just 10 Whales—Most Centralized Top Coin

Shiba Inu’s decentralization claims just took a hit—hard. A deep dive into its supply distribution reveals a whale-sized problem.

The Whale Club Dominates

Ten addresses control 62% of SHIB’s total supply. That’s not just concentration—it’s a stranglehold. For a token masquerading as the 'people’s crypto,' the irony is thicker than a Wall Street bonus.

Centralization in Decentralized Clothing

Among top cryptocurrencies, Shiba Inu now wears the crown for the most lopsided distribution. Bitcoin maximalists are grinning. Ethereum devs are facepalming. And the SHIB army? Probably tweeting 'HODL' while the whales plot their exit.

A Cynic’s Footnote

Nothing says 'financial revolution' like a handful of anonymous wallets holding more power than the Fed. But hey—at least the memes are still free.

Shiba Inu Has 62% Of Its Supply Controlled By Top 10 Whales

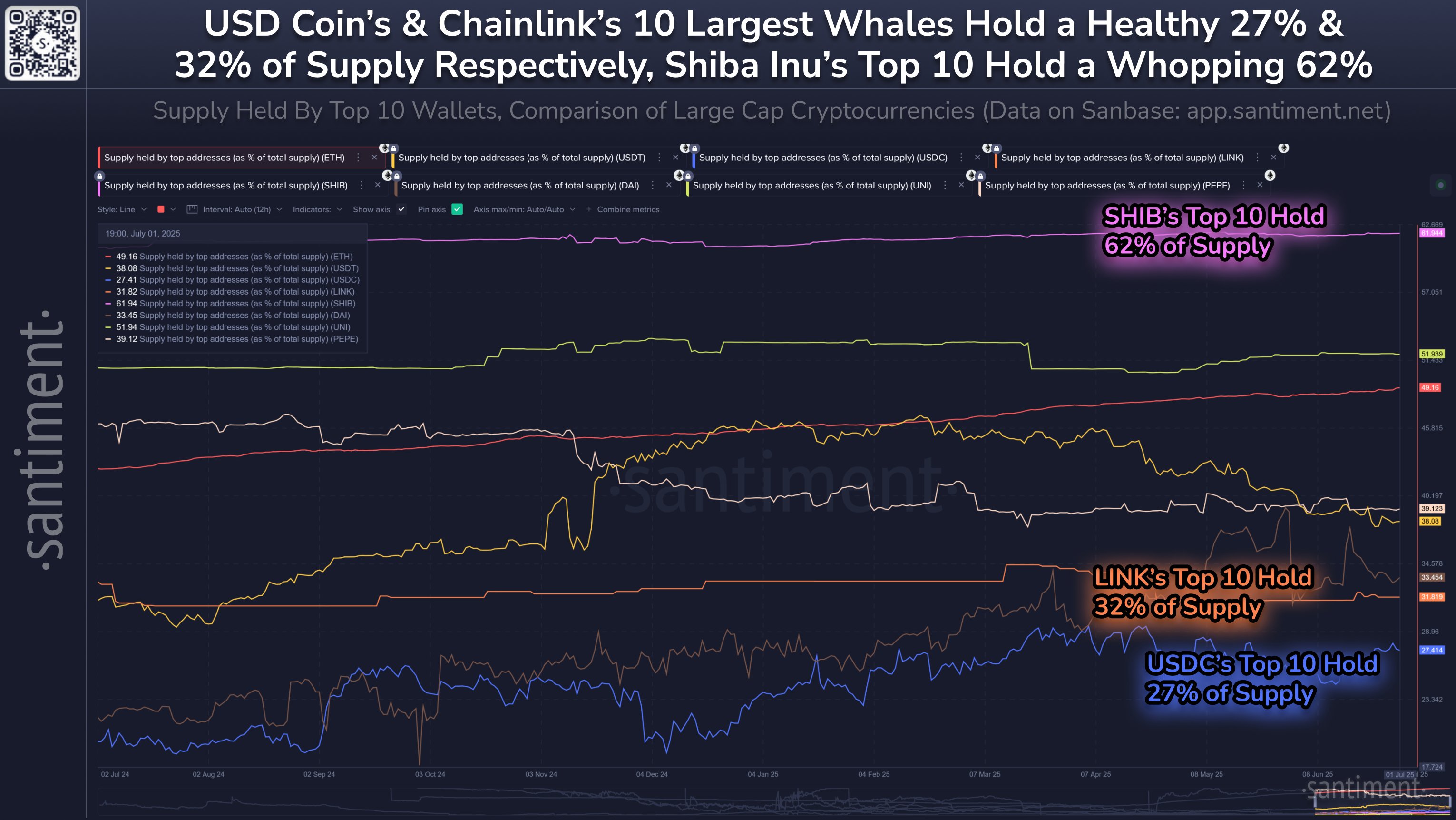

In a new post on X, the on-chain analytics firm Santiment has shared how some top coins currently compare against each other in terms of the percentage of supply held by the ten largest wallets on the respective networks.

Below is a chart showing the trend in this metric for eight cryptocurrencies: Shiba Inu, Ethereum, Pepe, USDT, USDC, DAI, chainlink (LINK), and Uniswap (UNI).

As is visible in the graph, the stablecoin USDC has the lowest amount of supply concentrated on the top 10 addresses among these assets at around 27%. Chainlink and DAI come close with the metric sitting at 32% and 33%, respectively.

Others like Uniswap and Ethereum, however, have a more significant part of their supply under the control of these humongous entities: 51% and 49%, respectively.

One asset that particularly stands out is Shiba Inu, with a massive 62% of its supply belonging to the ten largest whales on the network. For comparison, the other memecoin on the list, Pepe, has the same metric at 39%.

Generally, the centralization of supply on just a few hands isn’t a constructive sign for any cryptocurrency’s stability, as tokens signify power on the network. It’s especially relevant in the case of a proof-of-stake (PoS) asset like Ethereum.

As Santiment explains,

As a retail trader, it’s generally safer to hold coins with less supply held by the most elite whales. There is less risk of sudden dumps or price manipulation should an asset’s largest whales decide to exit their positions.

Given this, the assets like Ethereum, Uniswap, and Shiba Inu that currently have a majority of their supply or close to it in the hands of the top 10 whales may not be in the best position right now.

In some other news, the cryptocurrency market sentiment is on the verge of extreme greed, according to the Fear & Greed Index. The Fear & Greed Index is an indicator created by Alternative that inputs a few different factors to determine the investor mentality as a score lying between zero and hundred.

As displayed above, the cryptocurrency Fear & Greed has a value of 73 at the moment. This corresponds to the presence of a strong sentiment of greed present among the traders.

Historically, markets have often moved in the direction that goes contrary to the expectations of the crowd. The probability of a contrary MOVE is especially strong in the extreme ends of the index. For now, the market is still outside of the extreme greed zone, but only by a couple of units.

SHIB Price

At the time of writing, Shiba Inu is trading around $0.0000115, up over 3% in the last seven days.