Dogecoin’s Silent Storm: Analyst Warns Shorts Are Playing With Fire—Here’s the Explosive Price Target

Dogecoin’s been lurking in the shadows—but one analyst says the meme coin’s coiled spring could snap violently against short sellers.

Brace for impact.

The ‘quiet setup’—a textbook consolidation pattern—has DOGE primed for a breakout. And when it goes, it’ll leave burned shorts in its wake. No fancy indicators needed: the chart’s screaming accumulation.

Price target? The analyst’s call lands at $0.45—a 120% moonshot from current levels. ‘This isn’t hopium,’ they insist. ‘It’s liquidity hunting season.’

Of course, Wall Street’s still calling it a ‘joke.’ Then again, they said the same about Bitcoin at $1,000. (Cue the world’s smallest violin.)

One thing’s certain: in crypto, the market doesn’t care about your thesis. It only cares who’s left holding the bag.

Dogecoin Is Quietly Coiling For A Potential Breakout

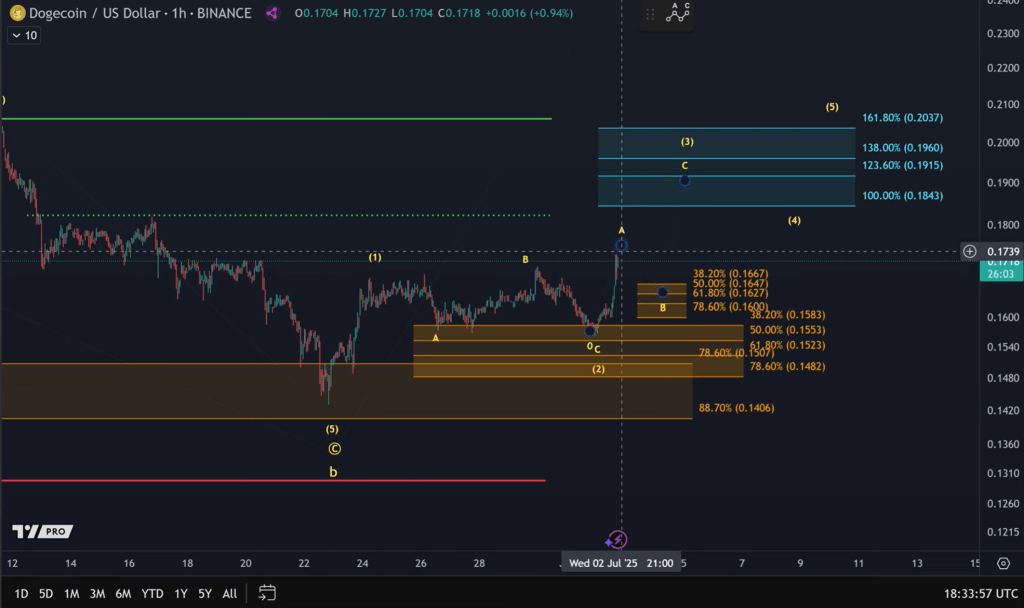

In a video update recorded on 2 June, the analyst dissected the one-hour chart and concluded that the advance from the 22 June low is best counted as a three-wave move. “Because wave 1 … was only a three-wave move, the third wave should unfold as an ABC structure,” he said, underscoring that the rally lacks the five-wave DNA of a trend reversal. Even so, as long as Dogecoin defends what he called a “micro-support area between $0.16 and $0.166,” the diagonal remains valid and a measured target at $0.196—the 138 percent Fibonacci extension of wave 1—“remains plausible.”

The roadmap is conditional. First, the current A-wave has to finish; then a corrective B-wave should follow, “and in the C-wave we could then rally to round about $0.196.” A probe toward $0.182 before that pullback cannot be ruled out, but the analyst warned viewers not to assume a straight shot higher. “Please be aware that we could be dealing with very choppy and messy structures,” he said.

If bulls do force a full five-wave climb from the July swing low, that sequence would mark the first leg of a larger five-wave advance—a textbook signal that the broader down-trend from Dogecoin’s March peak may finally be exhausted. Failure to hold $0.16, however, would invalidate the diagonal count and expose the June lows near $0.151, where on-chain data show a thin LAYER of spot bids and little derivative support.

Market context is mixed. CoinGecko data show Dogecoin’s 24-hour turnover has topped $1.5 billion, roughly in line with last week’s average, while the memecoin’s correlation with Bitcoin has weakened to 0.62, its lowest reading since early May.

In the short term, though, all eyes are on the $0.16 band. As More Crypto Online summed up, “The diagonal pattern basically remains plausible as long as we’re holding that $0.16 level.” Should that floor survive the inevitable B-wave turbulence, Dogecoin’s “quiet setup” might indeed detonate shortly—propelling the token toward $0.196 and potentially signalling a more durable trend change.

Notably, the upper boundary of Dogecoin’s long-running descending channel in the daily chart, now situated near $0.20, lines up almost exactly with More Crypto Online’s bullish target. A decisive breakout through this confluence WOULD not only pierce the ceiling that has capped prices since the December 8 high at $0.4843 but could also validate the analyst’s call for a trend reversal.

At press time, Doge traded at $0.174.