Ethereum Network Roars to Life—Mega On-Chain Surge Hints at Explosive Move Ahead

Wake up—Ethereum's blockchain just kicked into hyperdrive.

Whales are making moves. Gas fees are spiking. And the network's humming like a reactor about to go critical.

Here's what's fueling the frenzy—and why traditional finance won't see it coming until their Bloomberg terminals catch fire.

Smart money's already positioning. Retail's scrambling to ape in. And that 'stable' bond portfolio? About as exciting as watching paint dry on a bank vault.

Buckle up. The next leg up starts now—with or without Wall Street's permission.

Rising Hoards Signal Confidence

The pace of ETH going into cold wallets has shot up sharply over the past few months. It’s a bigger build‑up than in past cycles. If history is any guide, that sort of MOVE usually precedes a price surge.

Long‑term holders often buy early and hold tight before a big run. This kind of confidence from big players can spark wider interest.

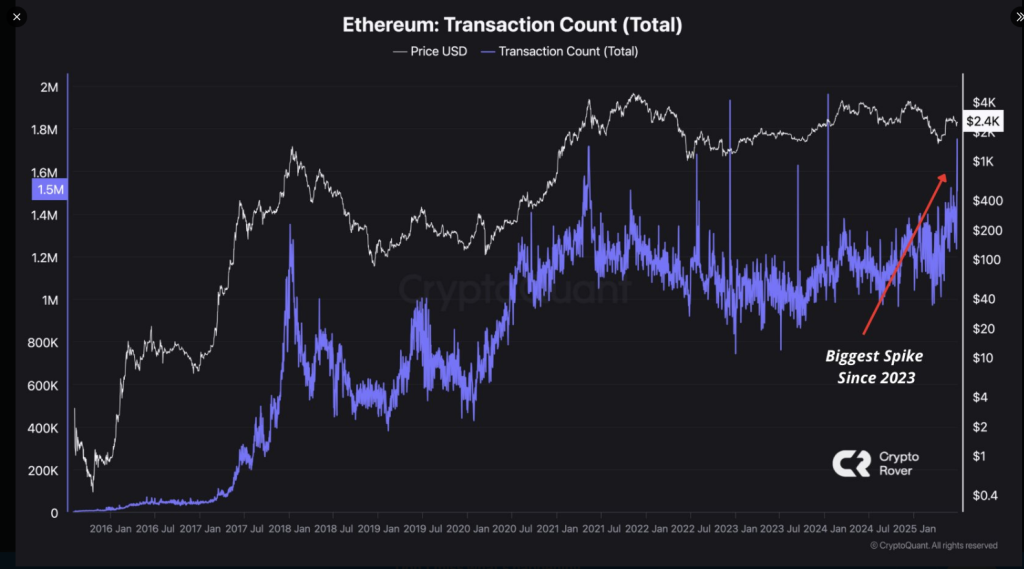

Network Traffic Hits Peak

Based on reports, daily transactions on Ethereum just topped 1,500,000. That’s the most since early 2023. A rise in on‑chain transfers often points to more users, more apps and more trading.

When people send coins or use smart contracts, they fuel network fees and show real demand. High activity can pull in more traders looking to catch the next wave.

Technical Barriers RemainETH is trading NEAR $2,460 and it hasn’t cleared two key hurdles yet. The 50‑day moving average sits just above price, as does the 200‑day line. Those are tough barriers for any asset.

Momentum tools aren’t screaming “buy” yet, either. The RSI sits around 49 and the MACD has flattened out after a stretch of weak readings. On‑balance volume is low, which means big buyers are still cautious.

What Comes Next For ETH?Even with strong on‑chain signs, price needs to break past $2,600 before bulls can charge ahead. If Ethereum can push through that level, the road to $3,000 WOULD look clear.

Traders will watch for volume spikes and a steady move above those moving averages. If it fails, the big holders could be stuck on the sidelines, holding bags that lose value.

Featured image from Unsplash, chart from TradingView