Bitcoin Teeters on Edge: Weekly Support Break Sparks Crash Fears

Bitcoin's price just did something it hasn't done all year—and traders are sweating bullets.

The king of crypto just closed below its last major weekly resistance level. Now, the $60K question: Is this the start of a brutal bear market or just another fakeout?

The line in the sand

That key level everyone was watching? Shattered like a meme coin's promises during a bull run. Technical analysts are scrambling to update their charts, while 'HODL' memes are getting quieter by the minute.

Market psychology flip

Fear's creeping back in faster than a hedge fund manager chasing 2% yields. Retail traders who bought the dip are now wondering if they caught a falling knife—while institutional players quietly adjust their leverage.

One thing's certain: The crypto market never lets you get comfortable. Just ask the 'stablecoin yield farmers' who thought 20% APY was normal. (Spoiler: It wasn't.)

Bitcoin Price Risks Crash With Weekly Close Below Resistance

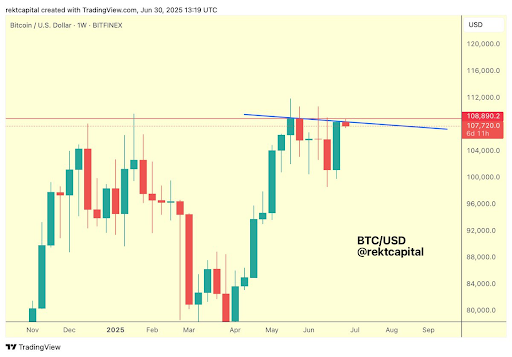

In an X post, Rekt Capital revealed that the Bitcoin price has closed below the final major weekly resistance at around $108,890. Based on this, he remarked that a possible early-stage Lower High resistance may be developing at around $107,720, with BTC at risk of crashing. The analyst added that Bitcoin will need to reclaim $108,890 as support on the daily to invalidate this Lower High.

In an earlier X post, Rekt Capital highlighted how significant it would have been if the bitcoin price had closed above this final major weekly resistance. He noted that BTC had never performed such a weekly close. As such, if that had happened last week, he claimed it would not only be “historic” but would enable BTC to enjoy a new uptrend into new all-time highs (ATHs).

However, the bitcoin price now appears to be on a downtrend, having failed to hold above the $107,720 level successfully. BTC had reached an intraday high of $107,970 but has since then been on a decline and is now at risk of losing the $106,800 macro level. Crypto analyst Kevin Capital has warned that BTC being below this level puts it in the danger zone.

Meanwhile, based on historical bull market cycles, Rekt Capital has suggested that the Bitcoin price still has some more upside left. In an X post, he stated that history suggests that Bitcoin may end its bull market in two to three months.

BTC Still Fuel In The Tank

Despite the recent Bitcoin price drop, crypto analyst Titan of Crypto declared that the flagship crypto still has fuel in the tank. He claimed that the weekly market structure remains strong with a series of higher highs and higher lows. The analyst added that the Relative Strength Index (RSI) is pushing towards its trendline.

His accompanying chart showed that the Bitcoin price could still rally to as high as $140,000 between September and November later this year based on these higher highs and lows. Crypto analyst Stockmoney Lizards also recently predicted that BTC could reach as high as $145,000 by September. He alluded to dojis that had formed for the flagship crypto in its current corrective channel and declared they were bullish for Bitcoin.

At the time of writing, the Bitcoin price is trading at around $106,800, down in the last 24 hours, according to data from CoinMarketCap.