$2 Billion Floods Into Bitcoin Spot ETFs as Wall Street Finally Wakes Up – Here’s Why It Matters

Wall Street’s late-night crypto FOMO just went mainstream. Bitcoin spot ETFs just vacuumed up $2 billion in fresh capital—institutional money is betting big on digital gold.

### The institutional dam breaks

Hedge funds and asset managers are diving in headfirst, scrambling for exposure through regulated vehicles. No more shady OTC desks or sketchy offshore exchanges.

### Why the sudden rush?

TradFi finally cracked the code: Bitcoin isn’t going away. After years of dismissive snorts, the suits now see what retail investors knew back in 2017—just with better suits and expense ratios.

### The cynical take

Nothing gets Wall Street excited like a product they can slap 2% management fees on. But hey—if it brings liquidity and legitimacy, we’ll take the institutional U-turn.

This isn’t your cousin’s crypto gamble anymore. When $2 billion moves in weeks, the game changes. Buckle up.

Bitcoin ETFs On Impressive 14-Day Positive Streak Despite Market Uncertainty

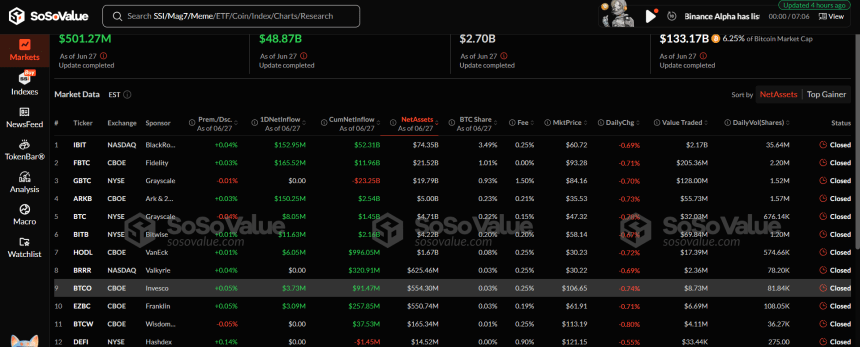

On Friday June 27, the 12 US bitcoin ETFs registered net inflows of $501.27 million bringing the aggregate deposits of the last week to a staggering $2.22 billion. According to data from ETF tracking site SoSoValue, the clean streak of daily inflows from last week extends the ETFs’ positive performance to 14 consecutive days. In analyzing individual ETF data from this week, the BlackRock IBIT registered $1.31 billion in net deposits solidifying its position as the market’s unrivalled leader. Meanwhile, Fidelity’s FBTC and Ark/21 Shares’ ARKB also experienced substantial cumulative inflows of $504.40 million and $268.14 million, respectively.

Grayscale’s BTC, VanEck’s HODL, Valkyrie’s BRRR, Invesco’s BTCO, and Franklin Templeton’s EZBC also recorded moderate net flows ranging from $1million – $25 million. In familiar fashion, Grayscale’s GBTC produced the only net outflows losing $5.69 million in withdrawals, but still retains its position as the third largest Bitcoin ETF with $19.79 billion in net assets. Following this week, the US Bitcoin Spot ETFs have now recorded $4.50 billion in net flows in June signaling a resolute demand from institutional investors despite Bitcoin market troubles. Notably, the premier cryptocurrency has witnessed extensive corrections since hitting a new all-time high of $111,790 on May 22. Over the last month, BTC has made no new price discovery trading largely between $100,000 and $110,000 to form a descending price channel. While this price performance reflects a neutral market sentiment, the high influx of capital into the Bitcoin ETFs signal a long-term confidence by institutional investors on Bitcoin’s price appreciation prospects.

Ethereum ETFs Log $283 Million In Deposit To Close Out H1 2025

In other developments, SoSoValue data also reveals that US ethereum Spot ETFs notched up a cumulative inflow of $283.41 million over the last week extending their positive streak to seven consecutive weeks. In June alone, these ETFs saw total inflows of $1.13 billion, marking their largest monthly gain in 2025.

As of the time of writing, the total net assets of the Ethereum ETFs stand at $9.88 billion, accounting for 3.37% of Ethereum’s market capitalization. Meanwhile, Ethereum continues to trade at $2,441 with Bitcoin prices set around $107,339.