🚀 Bitcoin Buy-Side Pressure Explodes: Taker Buy Volume Rockets to New Highs

Whales are loading up—and they're not being subtle about it.

### The Surge No One Saw Coming

Bitcoin's buy-side pressure just hit ludicrous speed. Taker buy volume spiked like a caffeinated algo trader, shredding through resistance levels like they were hot wax paper. This isn't accumulation—it's a full-scale FOMO assault.

### Why Traders Are Losing Their Minds

Liquidity pools got drained faster than a hedge fund's morality. The order books? Imbalanced like a Wall Street bonus structure. Meanwhile, shorts are getting squeezed harder than a middle manager during earnings season.

### The Cynic's Corner

Of course, this rally conveniently ignores the 17 macroeconomic headwinds—but since when did crypto care about fundamentals? Enjoy the ride while the music's playing. Just remember: every 'parabolic move' has two sides.

Bitcoin Faces Uncertainty As Bulls Defend Structure

Bitcoin is currently facing a critical test, trading in a tight range after failing to break above its all-time high. Although bulls have managed to defend the overall structure and keep BTC above key moving averages, the price action has not provided a clear directional signal. The asset is roughly 6% down from its $112K peak, and while some traders expect an imminent breakout toward new highs, others warn of a potential retrace below the $100K psychological level.

This divide among analysts stems from ongoing geopolitical instability — particularly in the Middle East — and tightening macroeconomic conditions. The Fed’s commitment to elevated interest rates and rising US Treasury yields continues to weigh on risk sentiment, making it difficult for BTC to build sustained momentum. Despite the uncertainty, buyers have shown signs of strength, with many looking to confirm the recent bounce as a solid bottom.

Top analyst Maartunn highlighted one key bullish signal: heavy spikes in Taker Buy Volume, which indicate aggressive market orders being filled on the buy side. This suggests that high-conviction buyers are stepping in at current levels, potentially front-running a larger MOVE to the upside.

While this is a positive sign for short-term sentiment, bitcoin must still reclaim the $109K–$112K range to invalidate the risk of a broader correction. Until then, traders remain cautious. If BTC closes a daily candle below the $103.6K support or loses the $100K level again, it could trigger a wave of liquidations and send prices lower. On the other hand, holding above $105K and building volume could set the stage for the next leg up. The coming days will be crucial in defining Bitcoin’s path forward.

BTC Surges Above Key Support As Buyers Step In

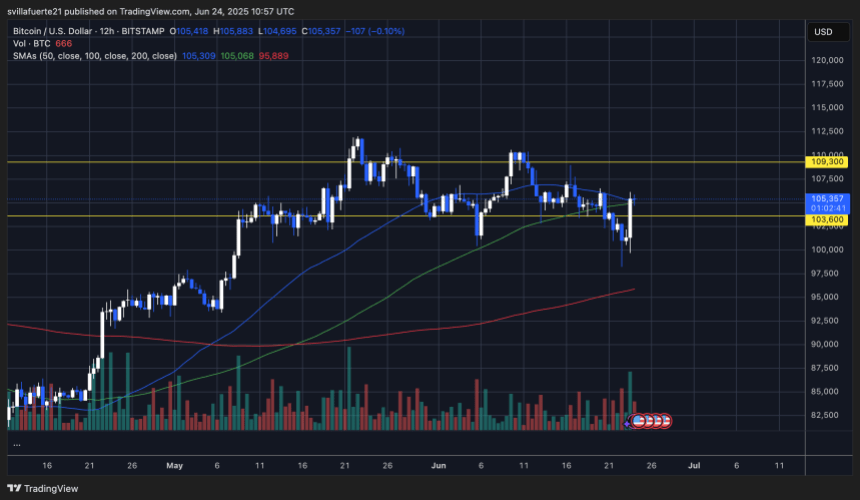

The 12-hour chart for Bitcoin reveals a strong bullish reaction after a brief dip below the $103,600 support level. The price rebounded sharply, reclaiming both the 100 and 50-period moving averages (green and blue lines, respectively), with BTC now trading around $105,357. This move confirms the importance of the $103,600 zone as a high-demand area, which has acted as a launchpad multiple times since early May.

Volume surged on the recent bounce, indicating aggressive buying activity. The spike suggests whales and institutional buyers likely absorbed the panic selling triggered by geopolitical events earlier in the week. Price is now approaching the $109,300 resistance level, a key ceiling that capped multiple rallies in May and June.

The short-term momentum remains constructive as long as BTC holds above the moving averages. However, a rejection NEAR $109K could confirm a broader consolidation range between $103K and $109K. If bulls manage to flip $109,300 into support, the path to retest the all-time highs around $112K opens up.

Featured image from Dall-E, chart from TradingView