Bitcoin Mirrors 2021 Bull Run—But Brace for the Final Plunge, Warns Top Analyst

History doesn't repeat, but it often rhymes—and Bitcoin's chart is currently reciting a chilling verse from its 2021 playbook.

The patterns are uncanny: parabolic rallies, retail FOMO, and that telltale volatility that makes traditional investors clutch their pearls. But here's the kicker—we haven't seen the main event yet.

Why the Déjà Vu Matters

Technical analysts are flashing red alerts as BTC retraces the same fractal that preceded its last brutal 50%+ correction. The same indicators that screamed 'sell' in April 2021 are lighting up again—only this time with three years of institutional baggage attached.

The Silver Lining for Crypto Degens

Every crash plants seeds for the next bull run. Remember how 2021's bloodbath set the stage for 2023's 200% rally? Market veterans see this potential reset as the ultimate 'buy the dip' opportunity—assuming you survive the margin calls.

Wall Street's schadenfreude won't last. They'll be the first to rebrand their crypto ETFs as 'discount opportunities' when the bleeding stops—because nothing smells better than commissions on retail panic selling.

Bitcoin Price Mirrors 2021

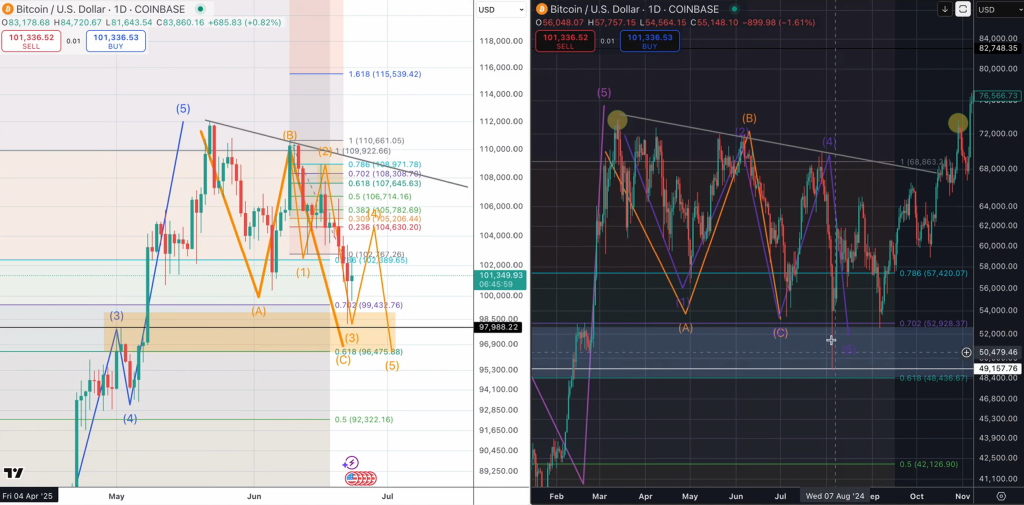

On side-by-side charts of the current cycle and the 2021-to-2024 arc, the analyst argued that Bitcoin is “the same exact pattern—run-up, one high, back down, second high,” followed by an ABC corrective sequence that in 2021 bottomed only after a second, deeper flush. “Gut says no,” he told viewers when asked whether last Friday’s sell-off had already marked capitulation. “We’ve been talking about this ABC since March… people were calling for new lows; I said nope, we got five waves at the top, we got an ABC and then we go— and that’s when the alts take off.”

His base case now envisions a relief rally toward the $107,000–$108,000 band—the level where a trend-line projected from the two post-halving peaks intersects—before a final leg lower drives price into what he calls the “pain box” sandwiched between the 0.702 and 0.618 Fibonacci retracements of the entire rally from last October’s $58,000 breakout. In 2021 that zone ultimately wicked to the exact 0.618, a MOVE he believes could repeat, implying spot levels between roughly $96,500 and $92,000. “This measurement fits the parameter now… if it wants to turn around and rip, great,” he conceded, “but there’s still a very good chance that was not the end.”

Internally, the analyst parses the current drop as the developing C-wave of a larger flat, subdividing into a classic five-wave impulse. Wave three, he notes, appears complete; wave four “could come up high,” granting altcoins a short-lived pop, “but hopefully, again, sooner than later, we roll over.” He cites 2021’s July fractal, when bitcoin bounced 20% before sliding a final time, as a psychological template. “When there’s a big news narrative event,” he observed, “we’ll get a little relief—people think it’s done—then wham, one more thing to scare retail.”

Macro sentiment, he argues, remains fragile. The Chicago Mercantile Exchange gap at $92,000 is drawing “average-retail” bids, a setup he characterises as a “washing machine” in which professional money fronts liquidity only to fade it. “Retail is just a washing machine, man… that buy isn’t going to get filled,” he warned. Still, he reiterated long-term optimism, revealing he “hammered some buys” during Monday’s dip and advising his followers to dollar-cost average—“not financial advice”—through the turbulence.

Quantum Ascend’s upside target for the ensuing impulsive advance is comparatively restrained: $132,000, a level he says enjoys “two pieces of confluence” and WOULD coincide with “the alts moment” when Bitcoin dominance finally cracks. “We will eventually work our way back up near the top of this B-wave… flag a little, and then boom,” he predicted, referencing November 2021’s so-called “Trump pump” that ignited a multisector altcoin surge.

For now, traders watch the 0.702–0.618 pocket and the mooted relief ceiling at $108,000. Should Bitcoin slice through support without that interim bounce, the analyst says, the flush could conclude “sooner than later,” clearing the runway for what he calls “the next few months—our moment.” In his sign-off he urged viewers to “be an adult, live through it,” but also confessed palpable excitement: “I feel really good about where we’re at.” Whether the market shares his confidence will likely become clear once the final C-wave verdict arrives—perhaps, he hopes, within the week.

At press time, BTC traded at $105,077.