Bitcoin Smashes Records: $15 Billion Floods In During 10-Week Fund Frenzy

The king of crypto isn't just marching—it's sprinting. Bitcoin's 2025 rally has turned into a full-blown capital tsunami, with institutional money piling in at a pace that'd make traditional finance blush.

The $15 billion elephant in the room

That's not a typo. Fifteen billion dollars has entered Bitcoin products this year alone—enough to buy three NFL teams or bail out a mid-sized bank (not that those ever need rescuing). The 10-week inflow streak marks the longest institutional buying spree since the 2021 bull run.

Wall Street's worst-kept secret

While suits in New York still publicly fret about volatility, their trading desks keep loading up. Funny how risk appetite returns when there's money to be made—and bonuses to be paid.

The real question? Whether this is the calm before the storm—or proof the storm has already arrived. Either way, the smart money's betting Bitcoin's just getting warmed up.

Bitcoin And Ethereum Lead The Pack

According to CoinShares data, Bitcoin pulled in $1.114 billion this week alone. It has now logged $2.37 billion month-to-date and $12.7 billion YTD, across nearly $152 billion in assets under management. ethereum chipped in with its ninth straight week of gains, adding $124 million in weekly inflows.

That pushed its month-to-date total past $1 billion and its YTD figure to $2.43 billion, across $14.29 billion of assets. Investors aren’t scooping up bearish bets, either: short Bitcoin products saw just $1.4 million in outflows this week and $8.7 million since January.

Altcoins See Mixed Results

Solana attracted $2.80 million this week and nearly $3 million month-to-date, lifting its YTD flows to almost $86 million. XRP pulled in $2.70 million weekly and $10.55 million month-to-date, taking its year-long total to $268 million across $1.205 billion in managed assets.

But funds that package multiple tokens bled $5.76 million this week and almost $17 million for the month—though they’re still up $58 million in 2025. Other altcoin vehicles are in rough shape, with $509 million of outflows since January.

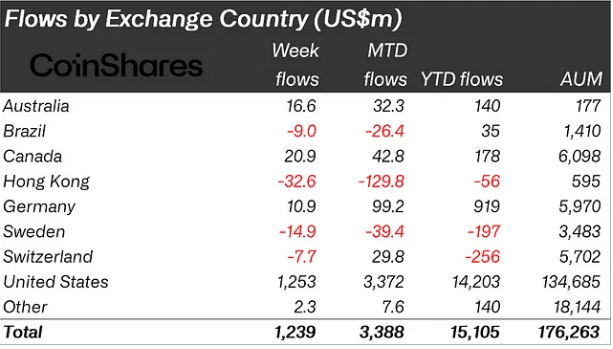

Regional Trends Highlight The USThe United States led global flows with $1.25 billion in weekly inflows. That’s $3.37 billion month-to-date and $14.30 billion YTD, out of $135 billion under management. Canada added nearly $21 million this week and $42.8 million for June.

Germany chipped in almost $11 million while Australia booked $16.6 million. Brazil bucked the trend with $9 million of outflows this week and $26.4 million in June, but it’s still about $34.8 million ahead for the year.

Smaller Tokens Struggle For AttentionSome newer names drew mixed reactions. Sui saw $8.5 million drain this week despite $3.3 million of gains so far in June. Litecoin eked out $0.21 million in weekly inflows and clos to $6 million YTD.

Cardano and chainlink grabbed $0.34 million and $0.6 million this week, respectively. But smaller “other” products pulled in only $2.75 million against heavy selling since January.

Institutions are still finding reasons to back crypto even as global events and holiday thins slow trading. Total weekly flows hit $1.23 billion, taking June’s total to $3.38 billion and the year’s to $15 billion, across $176 billion in overall assets. Based on these trends, big spenders aren’t ready to abandon digital tokens. They’re treating pullbacks like offers they can’t pass up.

Featured image from Unsplash, chart from TradingView