Bitcoin’s $95.5K–$97K CBD Heatmap Zone: The Ultimate Make-Or-Break Battle Line

Bitcoin's grinding sideways action just got a lot more interesting—the CBD heatmap paints a $95,500–$97,000 zone as the next do-or-die battleground.

Why this range matters now: Liquidity clusters here could trigger either a violent breakout or a brutal rejection. No middle ground.

Traders are glued to the heatmap like it’s a Netflix thriller—except the only popcorn here is margin calls and liquidations.

Meanwhile, Wall Street still can’t decide if Bitcoin’s a ‘digital gold’ or a ‘speculative asset’—classic hedge fund indecision while retail stacks sats.

$95,500–$97,000: Bitcoin’s Line In The Sand

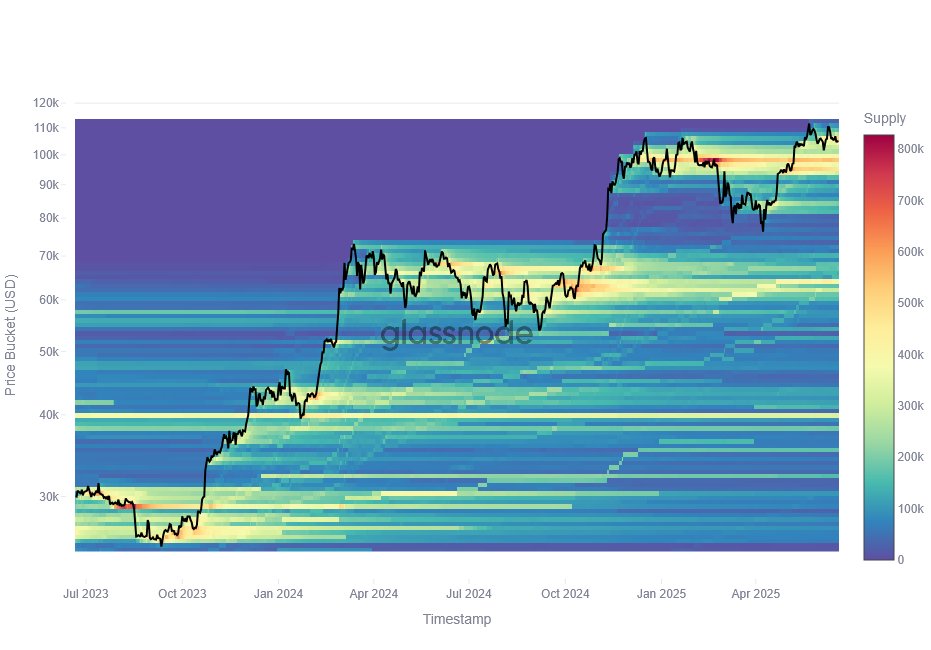

In a recent X post, Glassnode shares an insight into the Bitcoin market based on data from Cost Basis Distribution (CBD) heatmap. The CBD is a common on-chain metric that tracks the price levels at which tokens were last purchased or sold. When a substantial amount of coins are traded within a specific price range, it forms a supply cluster capable of acting as a support or resistance level.

According to Glassnode’s report, the Bitcoin’s CBD heatmap shows the first dense supply cluster below the current market price lies at $95,500 – $97,000 price zone. Interestingly, this range rests just below the short-term holders (STH) cost basis suggesting a confluence of technical and on-chain metric to present a high-stake battleground. Therefore, Glassnode analysts explain that holding the market price above this threshold reinforces bullish momentum and boosts Bitcoin chances of re-entering a price discovery mode. However, a breakdown below the $95,500 price level could trigger panic selling supporting bearish projections for the mid-term to short-term. Interestingly, prominent market analysts including anonymous X expert with username Mr. Wall Street has backed the latter scenario stating Bitcoin is due for a further price drops. Mr. Wall Street strictly warns Bitcoin WOULD not hold above the $100,000 psychological support zone forecasting a price fall to around the $93,000 – $95,000 which Glassnode predicts should induce widescale market liquidations.

Bitcoin Market Overview

At the time of writing, Bitcoin is trading at $103,753 with a cumulative 1.27% decline in the past week. During this period, the flagship cryptocurrency remained largely under $106,000 barring a weak price breakout between June 16 and June 17. On a monthly scale, Bitcoin has now recorded a 6.10% loss, signaling a gradual shift in momentum with bearish forces regaining control of the market. Meanwhile, with a market cap of $2.05 trillion, the “digital gold” continues to rank as the largest cryptocurrency with a reported market dominance of 64.3%.