Crypto Funds Bleed Record Outflows—Why Altcoin Traders Are Loading Up Now

Crypto''s institutional exodus hits historic highs—just as retail sharks start circling.

While big money flees, altcoin accumulators spot blood in the water. The smart money''s playing a different game.

When Wall Street zigs, degens zag. The real question: who''s timing the market better—the suits or the meme lords?

(Funny how ''risk management'' always means ''panic selling at the bottom'' for hedge funds.)

Bitcoin and Ethereum Bear the Brunt of The Crypto Outflows

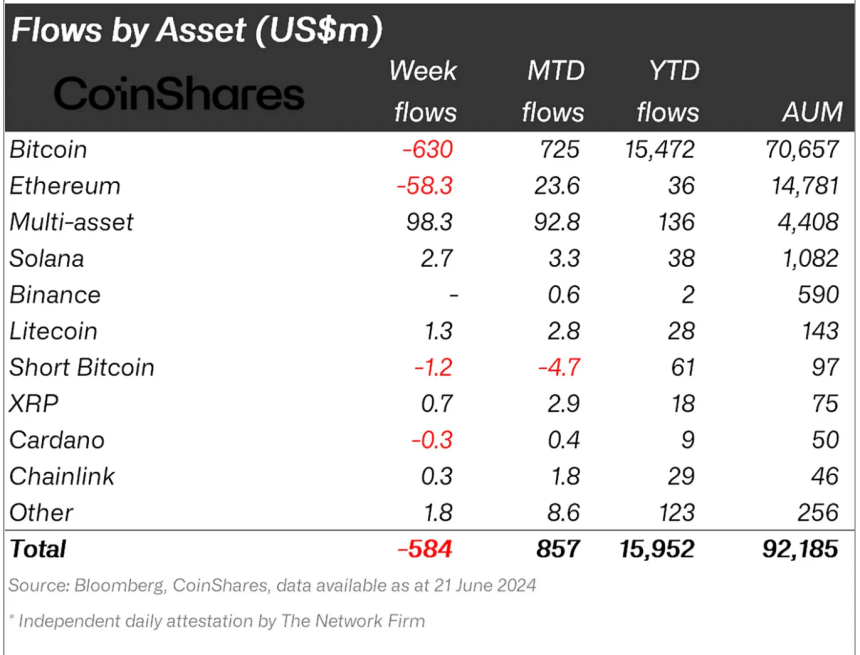

Bitcoin accounted for the majority of this week’s outflows, with $630 million leaving BTC investment products. Despite the significant movement of funds out of long bitcoin positions, short Bitcoin products also recorded outflows totaling $1.2 million.

This suggests that investors are not currently betting heavily on downside exposure, opting instead to stay on the sidelines amid uncertain market conditions. ethereum similarly saw negative flow activity, with $58 million in outflows, continuing the trend of cautious investor behavior across major assets.

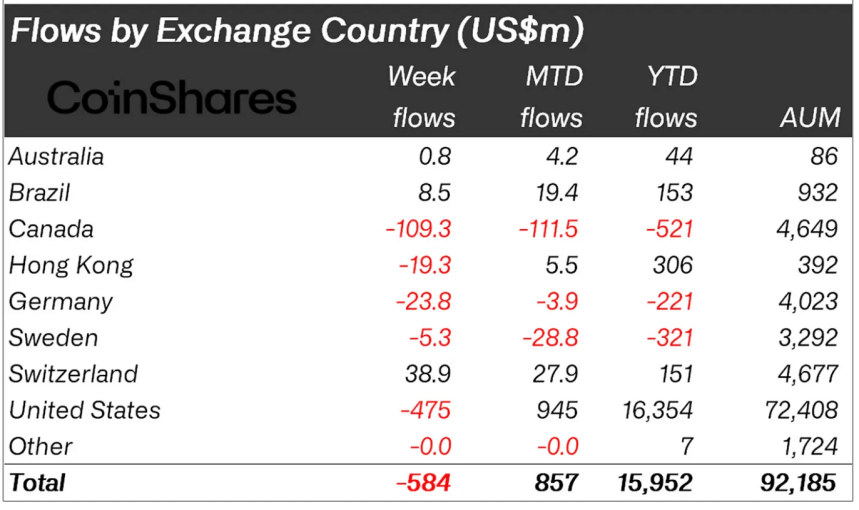

The report also highlighted geographical breakdowns, noting that the United States led all regions with $475 million in outflows, followed by Canada at $109 million. Germany and Hong Kong recorded smaller outflows at $24 million and $19 million, respectively.

In contrast, Switzerland and Brazil stood out as exceptions to the broader trend, bringing in net inflows of $39 million and $48.5 million, respectively. This divergence suggests that local factors or institutional strategies in those regions may be driving different investment behaviors.

Altcoins Draw Selective Support

While sentiment remained bearish for large-cap assets, some altcoins managed to attract capital inflows. Solana, Litecoin, and Polygon saw modest but notable gains of $2.7 million, $1.3 million, and $1 million, respectively.

These inflows may reflect opportunistic positioning by investors seeking exposure to assets that have underperformed recently. Additionally, multi-asset investment products, which spread exposure across various cryptocurrencies, recorded $98 million in inflows.

This signals that some investors are using recent price weaknesses to gain diversified access to the market rather than concentrating bets on single tokens.

The continued divergence in fund flows highlights the complex sentiment currently influencing crypto markets. With macroeconomic uncertainty still dominating investor outlooks, digital asset markets remain reactive to both global monetary policy signals and evolving regional investment trends.

Featured image created with DALL-E, Chart from TradingView