Ethereum ETF Inflow Streak: How ETH Price Reacted Over 19 Critical Days

Money talks—especially when Wall Street starts funneling cash into crypto for 19 straight days. Here''s how Ethereum''s price responded to the ETF buying spree.

The setup: Institutional investors placed their bets. The result? A textbook case of supply shock meets speculative frenzy.

Breaking down the action: Every inflow day stacked pressure on ETH''s limited liquidity. Market makers scrambled while retail traders front-ran the whales—classic crypto theater.

The punchline? Another reminder that in crypto, fundamentals matter less than which way the money hose is pointing. Just don''t tell that to the CFA holders.

ETH ETFs Snap 19-Day Positive Inflow Streak

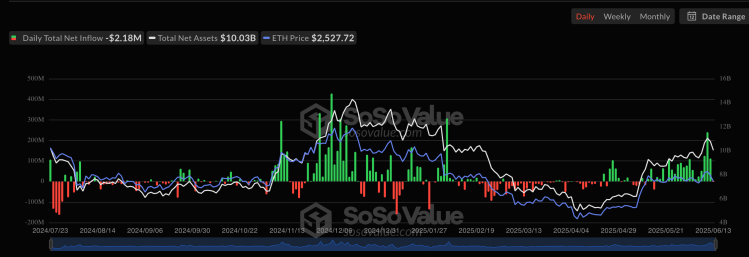

However, this positive record came to an end on Friday, June 13th, with the spot ETH ETFs registering their first net outflow in the past 20 days. According to the latest market data, the crypto-linked financial products posted a total daily net outflow of $2.14 million to close the week.

This round of withdrawals could be linked to the escalating tensions between Israel and Iran on Thursday evening, with risk assets like crypto and stocks feeling most of the impact. Data from SoSoValue shows that the Fidelity ethereum Fund (with the ticker FETH) contributed to most of the withdrawals on the day, recording a net outflow of $8.85 million.

Grayscale’s Ethereum Mini Trust (ETH) was the only other fund that recorded any significant activity, posting a positive net inflow of $6.67 million on Friday. Cumulatively, the activities of these two exchange-traded funds led to a negative outflow day, ending the 19-day positive inflow streak.

Nevertheless, this single-day performance barely made a dent in the Ethereum ETFs’ record over the past week, which stands at $528.12 million. This significant performance extends the exchange-traded funds’ weekly streak to five consecutive weeks of positive inflows — registering a total capital influx of $1.384 billion in that span.

Ethereum Price And Growing Spot ETF Demand

As seen with Bitcoin and its spot ETFs, the Ethereum price tends to react to the activity of the ETH exchange-traded funds investors. As such, periods of significant capital inflows for the spot ETFs have been correlated with upward price movements for the cryptocurrencies.

However, the price of Ethereum didn’t exactly follow this trend during its recent 19-day period of substantial capital inflows. This positive streak started on May 16, with the Ethereum price ranging between the $2,500 and $2,600 region on the day.

While the altcoin’s price has exceeded this level since then, it has not been able to mount a sustained upward run. Recently, the Ethereum price broke above the $2,800 level on Thursday, June 12, before crashing down towards $2,500 due to the military actions in Asia.

As of this writing, the price of ETH stands at around $2,511, reflecting an over 1% decline in the past 24 hours. With the Ethereum price still pretty much where it was at the start of the positive ETF inflow streak, there is a worry about what could be holding back the second-largest cryptocurrency.