Bitcoin Teeters at $104K Support – Brace for $97K Plunge if It Fails

Bitcoin''s knife-edge dance at $104K has traders sweating—another 7% drop looms if support cracks.

Critical level under siege

The king of crypto flirts with disaster as bulls and bears battle at the $104K line. Lose this foothold, and the next stop could be $97K faster than a Wall Street ''strategist'' backpedaling on their price prediction.

Technical breakdown ahead?

Market depth looks thinner than a banker''s excuses when BTC tanks. With leveraged positions stacked like Jenga blocks, any sustained move below $104K might trigger cascading liquidations. ''Support'' could turn to ''supports nobody'' in minutes.

Remember: In crypto, 7% is just Tuesday. But watch those stop-losses—the only thing more predictable than a flash crash is some hedge fund VP calling it ''healthy consolidation''.

Bitcoin Holds The Line Above $100K Amid Geopolitical Risks

Bitcoin is showing notable resilience amid global turmoil, holding above the $100K mark despite rising uncertainty linked to escalating Middle East tensions. As the market heads into Monday, investors are bracing for potentially volatile sessions, depending on further developments between Israel and Iran. A sharp rise in oil prices could add additional macro pressure, making the start of the week a decisive moment for risk assets.

BTC continues to trade within a consolidation range after falling 5% from its all-time high of $112K. Analysts widely agree that bitcoin is in a transitional phase—either preparing for an explosive breakout into price discovery or setting the stage for a deeper retracement. Many believe that a confirmed breakout above $112K could trigger the next major leg higher, marking the beginning of a new expansion cycle for the entire crypto market.

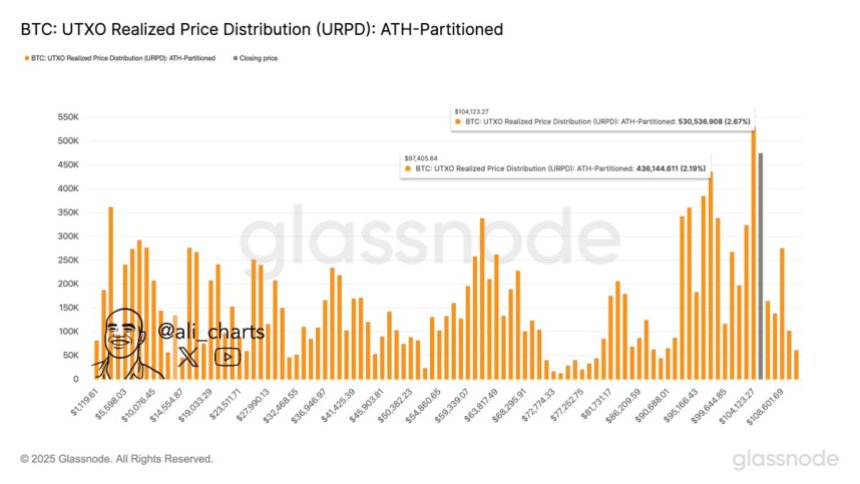

However, caution remains critical at current levels. Martinez pointed to key on-chain data from the UTXO Realized Price Distribution, identifying $104,124 as a pivotal support zone. This price level is where a large volume of BTC last moved, suggesting strong buyer interest. If BTC holds this level, it could FORM a solid base for continuation. But if it breaks down, the next area of interest lies around $97,405—potentially sparking broader fear across the market.

In the coming days, Bitcoin’s response to geopolitical news and macroeconomic signals, particularly oil price movements and bond yield reactions, will be crucial. For now, the bulls remain in control, but the path forward demands close attention and calculated positioning.

BTC Price Analysis: Bulls Defend Key Support

Bitcoin is currently trading at $105,502, showing signs of strength after defending the crucial $103,600 support level. This price zone has acted as a consistent floor over the past week and continues to be a key pivot for short-term market structure. After a steep drop from the $112K high, BTC bounced off this support with a strong wick on high volume, signaling buyer interest and a potential short-term bottom.

The chart shows that Bitcoin is consolidating between $103,600 and $109,300, with the 50, 100, and 200-period SMAs converging just above the current price, indicating a decision point is near. A clear break above $106,800 could trigger momentum to test $109,300 again, while a failure to hold above $104,500 WOULD expose BTC to downside risk.

Volume remains relatively muted compared to the spike during the June 13 drop, suggesting that most of the panic selling has cooled for now. However, price remains below the 200 SMA, reinforcing that bulls must reclaim this zone to confirm continuation.

Featured image from Dall-E, chart from TradingView