Bitcoin Funding Rates Flip Negative on Binance – Is the Market Primed for a Violent Short Squeeze?

Perpetual traders just got a flashing warning sign as Bitcoin's funding rates dip into negative territory on Binance. When shorts overcrowd the trade, the market has a nasty habit of punishing them—with interest.

Could this be the setup for another explosive squeeze? The last time funding turned this sour, BTC ripped 28% in 10 days. Of course, Wall Street's quant algos will pretend they saw it coming all along.

Bitcoin Funding Rates Turn Negative On Binance

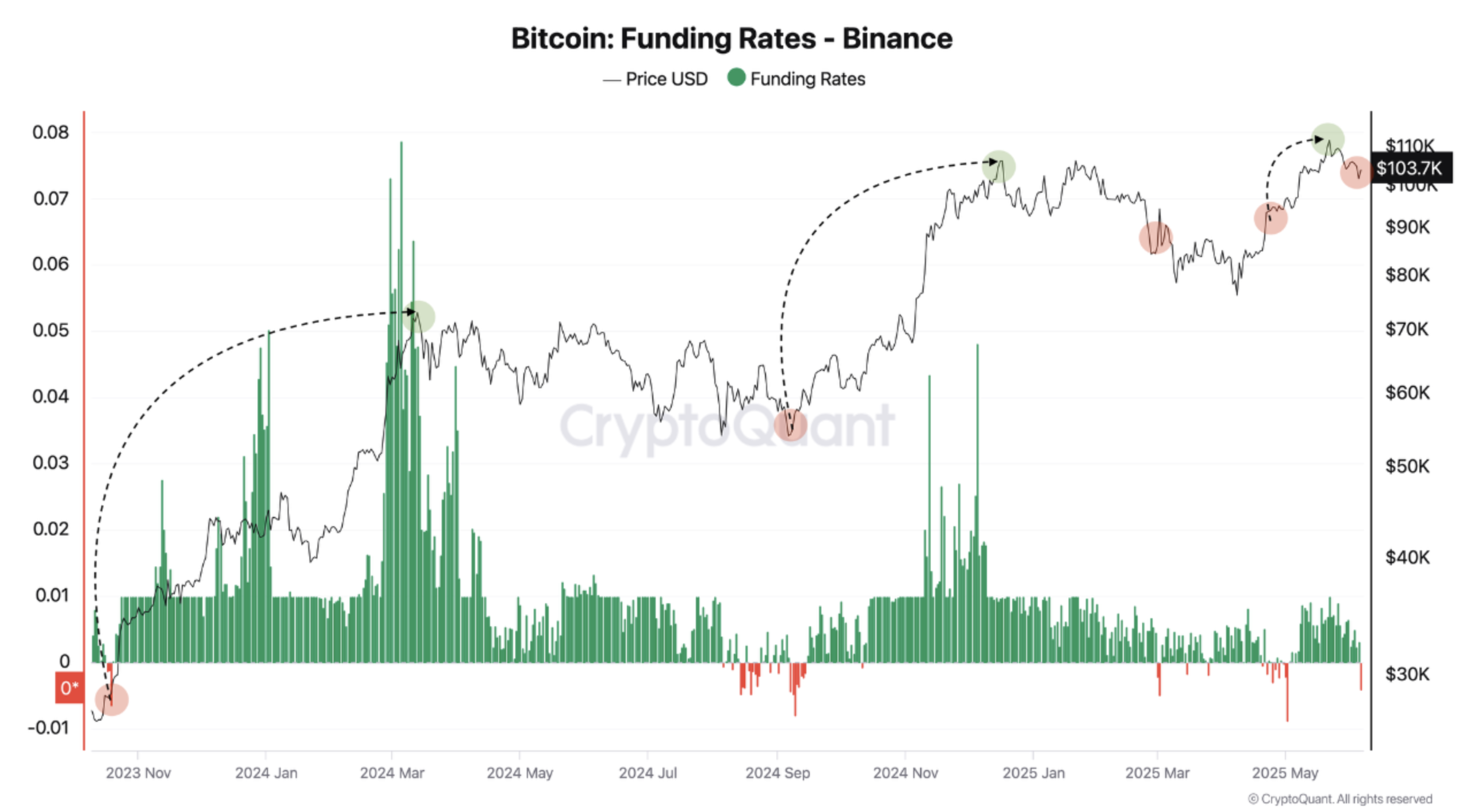

According to a CryptoQuant Quicktake post by contributor Darkfost, BTC funding rates on Binance have once again turned negative, even as the top cryptocurrency continues to trade above the $100,000 mark at the time of writing.

The analyst attributed the sudden reversal in funding – from +0.003 to -0.004 – to the public spat between TRUMP and Musk on social media. This rapid shift reflects growing fear among market participants amid heightened uncertainty.

Following the sentiment shift, BTC fell from the mid-$100,000 range to a low of $100,984, according to CoinGecko. Over the past two weeks, the asset has declined by 4.1%.

That said, the current dip may offer a prime buying opportunity to investors. If bitcoin rebounds strongly, it could result in a strong resurgence in buying pressure, leading to a short squeeze that may propel BTC’s price further up.

Darkfost highlighted that there have been three instances during the current market cycle when BTC witnessed such deep negative funding. Notably, each of these instances were followed by a strong upward MOVE in the cryptocurrency.

For example, on October 16, 2023, BTC dipped into negative funding territory before rallying from $28,000 to $73,000. A similar pattern played out on September 9, 2024, when the asset surged from $57,000 to $108,000.

The most recent case was on May 2, 2025, when BTC jumped from $97,000 to a new all-time high (ATH) of $111,000. If history repeats, then the market may see a new ATH for BTC in the coming weeks. Darkfost noted:

Such extreme readings often mark moments of maximum pessimism, precisely the kind of sentiment that can precede a strong bullish reversal when the short term negativity is gone.

Large Investors Increase BTC Exposure

Meanwhile, Bitcoin whales – wallets holding large amounts of BTC – continue to accumulate at a rapid pace. Notably, new whales have acquired BTC worth $63 billion, reflecting strong confidence in the asset’s near-term prospects.

Supporting this bullish outlook, recent analysis by QCR Capital indicates that large investors expect BTC to surge to as high as $130,000 by the end of Q3 2025. Additionally, the realized cap held by long-term holders has surpassed $20 billion, reinforcing positive sentiment.

That said, some analysts urge caution, expecting BTC to crash below $100,000 before resuming its bullish momentum. At press time, BTC trades at $104,069, down 0.5% in the past 24 hours.