XRP’s Stealth Surge: How the ‘Boring’ Token Became a Treasury Darling

Quietly—almost defiantly—XRP has been stacking wins while flashier cryptos hog the headlines. Messari’s latest data reveals institutional accumulation at levels that’d make a Bitcoin maximalist sweat. Here’s the twist: it’s not retail FOMO driving this rally.

The compliance edge

Ripple’s legal clarity post-SEC battle gave corporates the green light. No other top-10 crypto offers that blend of regulatory certainty and cross-border liquidity. Treasury desks love boring—and XRP plays the part perfectly.

Liquidity without the drama

While stablecoins face political landmines and BTC swings like a meme stock, XRP’s 3-second settlements and predictable volatility make it the spreadsheet hero CFOs never knew they needed. (Take that, ‘productive assets’.)

The kicker? This isn’t some DeFi degens’ pump—it’s old-school money building positions while crypto Twitter sleeps. Maybe banks weren’t the villains after all. Just late.

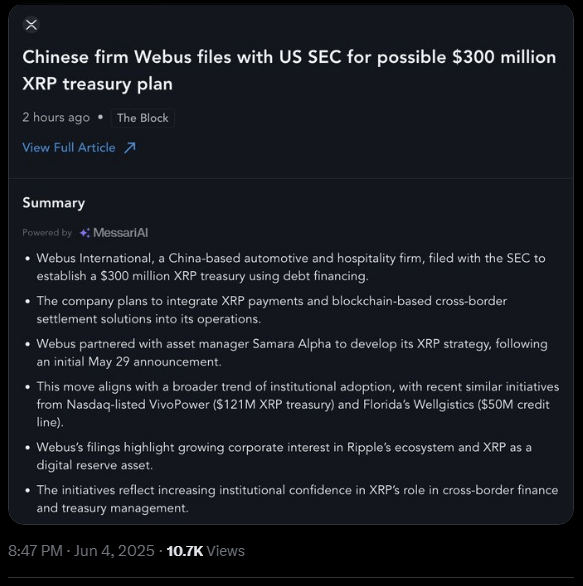

Webus International Plans Huge Reserve

According to filings with the US Securities and Exchange Commission, Webus International aims to raise $300 million through non-equity funding. The company will tap its existing cash, credit lines backed by institutions, and support from shareholders.

Companies are exploring the XRP treasury strategy:

– Webus International: $300M – VivoPower: $121M – Wellgistics: $50M pic.twitter.com/C9rldXDdDG

— Messari (@MessariCrypto) June 4, 2025

Once the money is in hand, Webus intends to buy XRP and hold it as part of its treasury. The plan comes with a partner: Samara Alpha Management. Webus says the altcoin will help the firm with global payment services. They think it can MOVE value quickly across borders, and this treasury could back that.

VivoPower’s XRP Ambition

Based on reports, VivoPower is setting aside about $121 million to build its own XRP stash. The public announcement highlights a recent private placement led by Prince Abdulaziz bin Turki Abdulaziz Al Saud of Saudi Arabia.

Most of the $121 million raised will go straight into the coin. VivoPower even wants to rebrand itself as the world’s first company focused on XRP. That’s a bold goal for a firm listed on Nasdaq. If everything goes to plan, XRP WOULD play a big role in how VivoPower manages money and transactions.

Wellgistics Health, a healthcare company you might not expect to dive into cryptocurrency, has its own $50 million set aside for XRP. The cash came in last month and is meant for PX (purchase and hold XRP) and to use XRP for real-time payments.

Wellgistics says it wants to cut out delays and fees that come with old‐school payment methods. By sending and receiving XRP, the company believes it can move money faster when it pays vendors or gets paid by customers. It’s a sign that even outside tech or finance, firms see value in holding crypto.

Growing Interest Among FirmsThis trio isn’t alone. In December, Worksport said it would buy both XRP and Bitcoin, using 10% of its operating cash to build reserves. More recently, Ault Capital Group pledged $10 million to XRP this year to boost its move into financial services.

On top of that, the US government mentioned XRP as one of the assets it might add to a digital asset stockpile. That’s a signal to private companies that holding XRP is worth a look.

Featured image from Unsplash, chart from TradingView