Bitcoin Hits $111K ATH—But Don’t Break Out the Champagne Yet, Warns Certified Analyst

Bitcoin’s surge to a record $111,000 might look like a victory lap—until you hear why one certified expert is pumping the brakes.

Price ≠ prosperity. The market’s still playing tricks, and Wall Street’s ’experts’ are probably just repositioning their bags.

Failed Breakout Indicates Weakness Rather Than Strength

Particularly, bitcoin failed to reach a new all-time high against currencies such as the Euro, British Pound, Japanese Yen, and the Swiss Franc. The same applies to BTC/XAU, Bitcoin’s price measured against gold, which currently lags far behind its former peak of 41 ounces per Bitcoin. At the time of writing, that pair is still hovering at 32 ounces, a significant difference that suggests the upward momentum is isolated to the US Dollar.

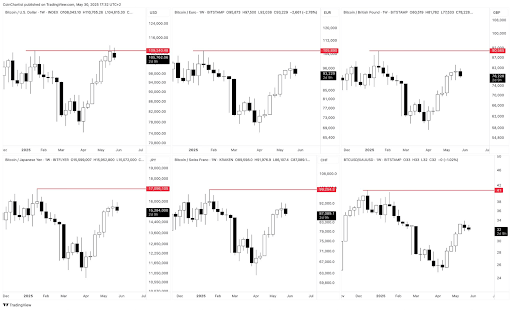

This divergence leads Severino to argue that the move could be a byproduct of the USD’s weakness rather than Bitcoin’s strength. A true bullish breakout, he says, WOULD have been evident across multiple currency pairs and asset benchmarks. His skepticism is further reinforced by the structure of the charts, as seen in the six comparative panels he shared on the social media platform X. Most of them show Bitcoin forming lower highs or simply failing to match the previous all-time level.

For instance, Bitcoin priced in euros is still well below its peak of €105,890, currently trading around €93,229. Similarly, Bitcoin has failed to breach the 17 million mark against the Japanese Yen and now sits at ¥15.28 million. The same trend is repeated in the Swiss Franc and British Pound pairings, with BTC / Swiss Franc failing to cross 99,254 and BTCGBP forming a lower high at $78,228. These price actions make it difficult to argue that Bitcoin is in a universally strong position, particularly when measured in anything other than USD.

Caution With Next Monthly Candle Open

In conclusion, Tony Severino warns traders and investors not to be misled by the surface-level Optimism that comes with a new all-time high in BTCUSD. A single breakout, especially one lacking confirmation from cross-pair strength and fundamental indicators, does not necessarily signal the start of a new wave five or a sustained bullish trend for the Bitcoin price.

According to him, the May monthly candle close and the June monthly candle open will be important in determining the next direction. If the current indecision tilts bearish, technicals could teeter back bearish towards a larger correction.

At the time of writing, Bitcoin is trading at $104,850 after reaching a 24-hour low of $103,832. This is a brief recovery from its June open of $104,646.