TRX Bulls Charge Ahead as Retail Activity Signals Another Leg Up

Retail traders are piling into Tron (TRX) again—and this time, analysts say the momentum could stick. On-chain data shows wallets under $10k are gobbling up TRX at levels not seen since its 2021 peak.

Why the sudden love? Blame the yield chasers. Tron’s staking rewards still outpace traditional savings accounts by a laughable margin—assuming you ignore the occasional ’rug pull’ in DeFi-land.

Technical charts paint a clearer picture: TRX just shattered its 200-day moving average, with volume spikes suggesting this isn’t just another dead-cat bounce. One trader notes the coin’s recent consolidation mirrors patterns before its 80% rally last quarter.

Of course, no crypto rally comes without caveats. Regulatory clouds still hang over Justin Sun’s empire, and let’s be honest—most retail ’investors’ still think TA is a Taylor Swift album.

TRX Futures Market Signals Good Accumulation Opportunity

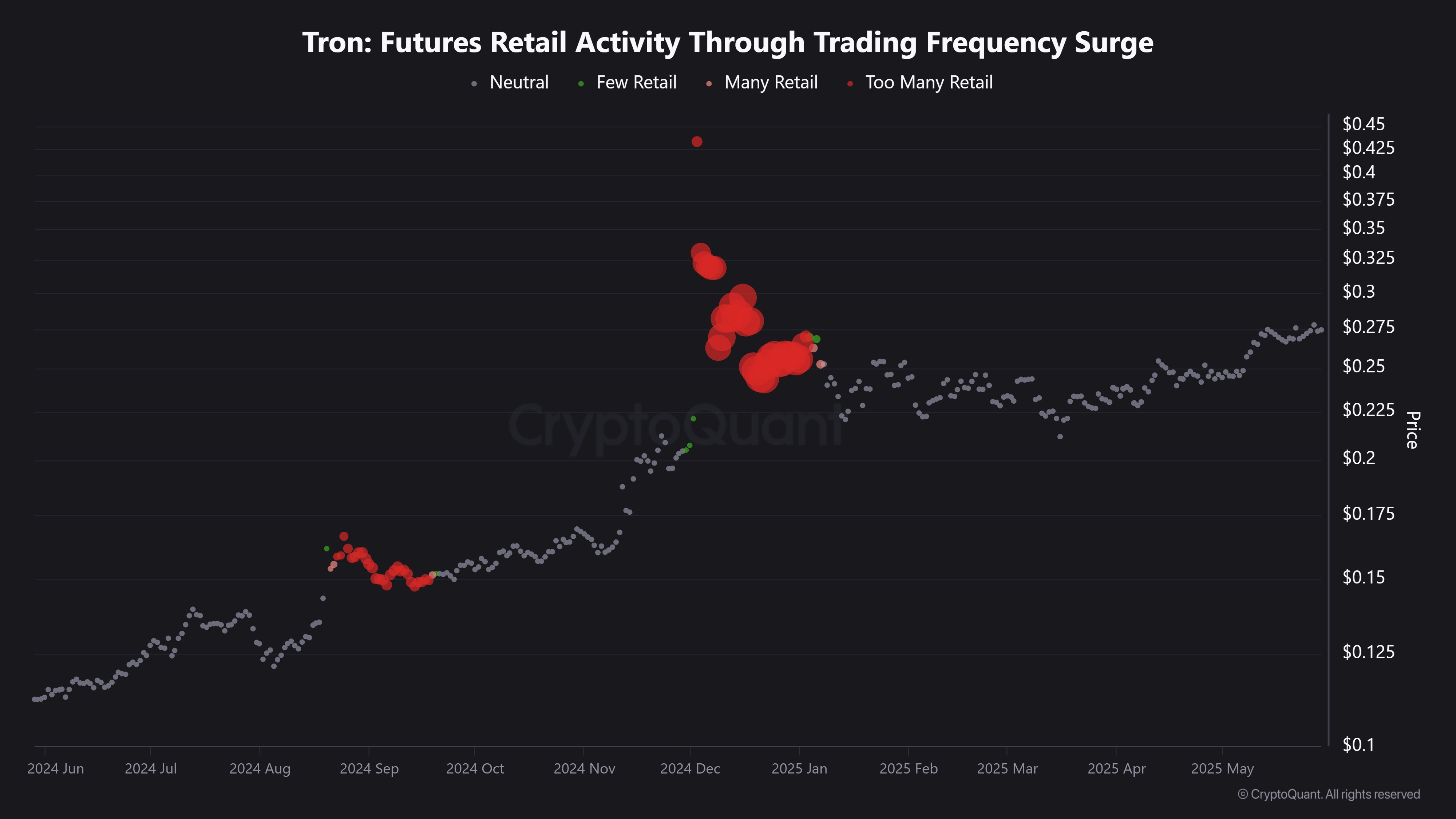

In an X post on May 30, Burak Kesmeci postulated that TRX remains in a prime position for further price gains based on developments in futures retail activity.

Using data from CryptoQuant, the analyst explains that TRX previously reached a market of $0.45 in December 2024 which aligned with a period of peak retail speculation as indicated by the cluster of red dots on the chart. During this period, many traders likely Leveraged long, trading the rally in anticipation of a sustained price uptrend.

However, TRX prices soon crashed to $0.21 during a broader market correction that lasted for the majority of the first trimester of 2025. This period is marked by a sparse amount of gray dots suggesting a neutral retail participation in the futures market. Amidst resumed crypto bull market rebound, TRX prices have risen to around $0.27. However, retail activity has remained neutral with no significant uptick in speculation or emergence of a “mad crowd” as seen in December 2024.

According to Burak Kesmeci, these findings indicate there is significant potential for an upswing in the TRX market as retail futures activity is far from overheated. However, there is a need for macroeconomic and geopolitical tensions to subside before these projected gains can occur. Recently, the crypto market produced a negative reaction to reports of the US and China failing to find a common ground in an ongoing trade talk amidst a 90-day truce before both countries.

TRX Price Prediction

At the time of writing, TRX trades at $0.26 reflecting a 2.87% decline in the past day. Meanwhile, the token’s daily trading volume is valued at $806.98 million. According to data from CoinCodex, TRX investors are strongly bullish despite recent losses as evidenced by the Fear & Greed Index of 60.

Coincodex analysts project TRX to soon rediscover its bullish FORM with forecasted price targets of $0.32 and $0.29 in the next five and thirty days respectively. In addition, they paint a positive long-term outlook with a price target of $0.51 in six months.