Bitcoin Smashes $100K: Here’s Why Bulls Are Cheering—And Why Skeptics Aren’t Convinced

Digital gold just got gilded. Bitcoin’s blistering rally past $100,000 marks a psychological milestone for crypto believers—and fresh ammunition for Wall Street naysayers.

The good news? Institutional adoption is accelerating faster than a DeFi exploit. BlackRock’s spot ETF now holds more BTC than MicroStrategy, while sovereign wealth funds quietly accumulate. Lightning Network capacity hits record highs as El Salvador doubles down on Bitcoin bonds.

The bad news? Old-school finance sharks smell blood. ’When your Uber driver starts quoting stock-to-flow models,’ quips one JP Morgan analyst, ’it’s time to check your stop-loss orders.’ Meanwhile, the SEC quietly greenlights another futures ETF—because nothing says ’decentralization’ like CME derivatives.

One thing’s certain: Whether this is the start of hyperbitcoinization or just another bull trap, the volatility will be spectacular. Buckle up.

Good News: A Bullish Long-Term Signal Still Intact

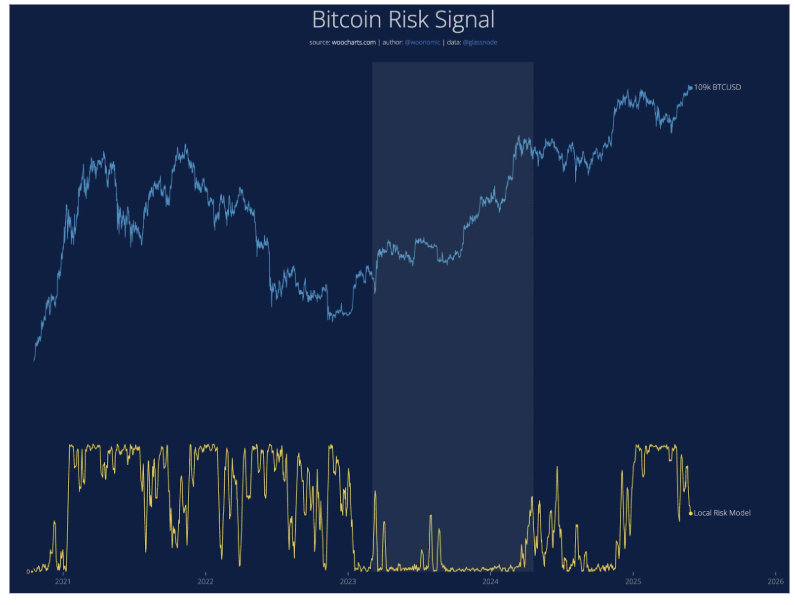

According to Woo, one of the strongest long-term signals, the bitcoin Risk Signal, is currently trending downwards. This drop indicates that buy-side liquidity is currently dominant in the long-term environment, setting the stage for another strong leg upward.

The lower the risk reading, the safer it is to hold or accumulate Bitcoin, and this signal’s current decline shows a relatively low-risk environment for long-term investors.

Woo noted that this long-term setup is intact, and with Bitcoin trading well above the psychological six-figure mark, the momentum is still in favor of the bulls in the long term.

At the time of writing, the local risk model, as shown in the chart below, is currently in the mid-range, having declined from peak levels in early 2025, and is expected to continue trending downwards. In another analysis, Willy Woo noted the next significant MOVE could push it above $114,000 and trigger liquidations of short positions.

Bad News For Bitcoin Price

Although the long-term picture is still favorable, the short-term models, including the Speculation and SOPR (Spent Output Profit Ratio) metrics, are flashing caution. Using this indicator, WOO noted that the strength of the rally from $75,000 to $112,000 has started to weaken, especially with flat capital inflow in the past three days.

Keeping this in mind, Bitcoin’s price action this week is critical. “If we do not get follow through, then we will be up for another consolidation period,” the analyst said. If spot buying fails to pick up strongly in the coming week, which is the first week of June, especially with U.S. markets reopening after a long weekend, there will be a chance for a bearish pivot.

The good and bad news can be summed up as follows: if buying pressure opens up quickly, Bitcoin could break above $114,000 and head toward the next major liquidity zone between $118,000 and $120,000. Failure to push higher could confirm bearish divergences and set the stage for another round of consolidation.

At the time of writing, Bitcoin is trading at 103,700, down by 1.5% and 3.9% in the past 24 hours and seven days, respectively.

Featured image from Unsplash, chart from TradingView