Bitcoin’s Short-Term Holders Cash Out—Is the Rally Running Out of Steam?

Whale-sized sell orders hit the market as Bitcoin’s weekend warriors take profits—just in time for Wall Street to pretend they saw it coming.

Short-term holders are flipping coins like hotcakes again, dumping at levels last seen before minor corrections. Classic ’buy the rumor, sell the news’ behavior—except this time, the news is that there’s no news.

Will this trigger the dreaded ’local top’? Maybe. But let’s be real—since when has crypto ever followed textbook patterns for long?

Here’s When BTC Price Could Begin To Witness Significant Correction

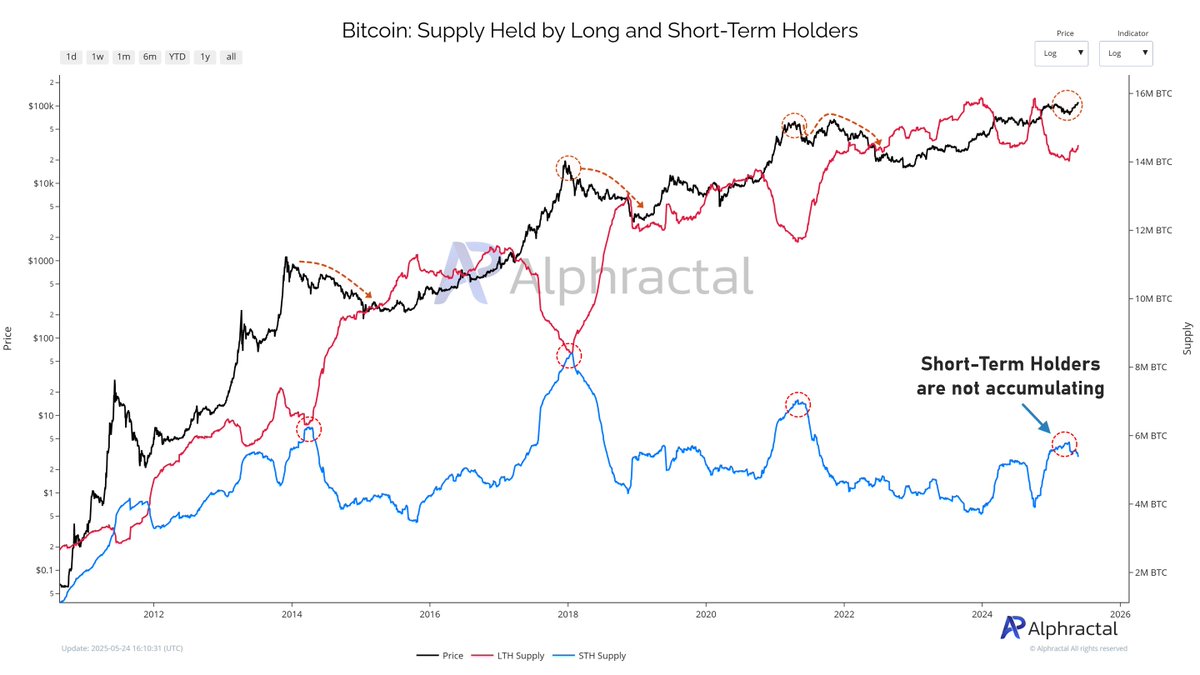

In a new post on the social media platform X, investment data firm Alphractal revealed that the Bitcoin short-term holders (STH) are starting to distribute their coins. The short-term holders are known to be the most reactive group of investors, as seen with the BTC investors shaving off their holdings following the recent increase in the Bitcoin price.

This on-chain revelation is based on the changes in the bitcoin Supply Held By Short-Term Holders indicator, which tracks the total amount of BTC owned by investors for less than 155 days. As shown in the chart below, this metric has been dwindling over the past few weeks, signaling ongoing distribution by short-term investors.

From a historical perspective, when the supply held by STH witnesses an abrupt decline, the price of Bitcoin is likely NEAR major cycle tops. In essence, the reactive investors offload their assets as the price increases, slowing down the coin’s demand. Alphractal noted that this is “a classic sign” that the bull cycle might be close to its final stages.

The on-chain analytics firm also highlighted that the Short-Term Holder realized price currently sits at $94,500, acting as the final support level preventing this investor group from going underwater. On the other hand, the Long-Term Holder realized price currently stands at around $33,000, suggesting a clear behavioral divergence between long-term and short-term investors.

In the end, Alpractal noted that the bitcoin price still managed to reach new all-time highs in 2021 despite the STH distribution. Hence, the market intelligence platform believes that the BTC price still has room for some upside movement, even though macro on-chain signals and the halving cycle pattern suggest a significant correction could begin after October 2025.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits just beneath $109,000, reflecting a 0.4% increase in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is up by over 5% in the last seven days.