Bitcoin’s NVT Signal Screams ’Buy’ as Bull Run Defies Gravity

Forget the Fed, forget the macros—Bitcoin’s Network Value to Transaction (NVT) ratio just flashed its most bullish signal since the 2021 rally. Traders scrambling for exits? Not here. The metric—which compares market cap to on-chain transaction volume—is behaving like a coiled spring.

Why this matters: When NVT diverges from price action, it’s often a leading indicator. Right now, it’s screaming ’undervalued’ despite BTC hovering near all-time highs. Either the network’s utility is exploding, or speculators are asleep at the wheel (we’d bet on the former).

The kicker? This surge comes as Wall Street’s ’smart money’ keeps warning about a bubble. Funny how those warnings always sound like FOMO dressed up in a suit.

Bitcoin Advanced NVT Holds Above Key Level: Bullish Continuation Remains In Play

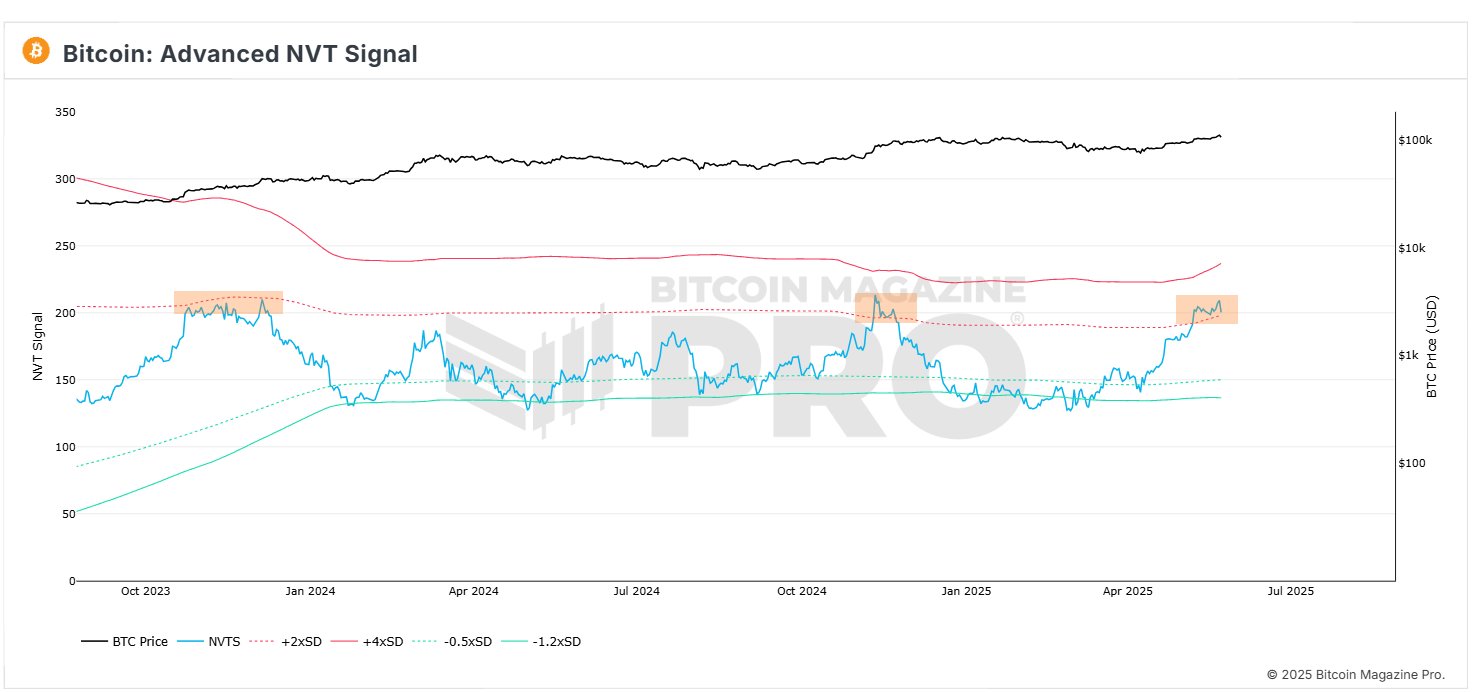

The Advanced Network Value to Transactions (NVT) metric is an on-chain valuation model that compares Bitcoin’s market cap to its daily USD transaction volume. It is used to evaluate whether an asset is overvalued or undervalued relative to usage.

Generally, higher Advanced NVT values indicate heightened investor speculation, while sustained levels above key thresholds have often coincided with major bull runs. According to Burak Kesmeci in an X post on May 24, the Bitcoin Advanced NVT signal has recently crossed above the +2 standard deviation (+2xSD), a historically significant boundary that signals a period of bullish market strength and robust investor confidence.

As seen in Q4 2023 and Q4 2024, an advanced NVT crossover above the +2xSD highlighted in orange in the image below has previously served as a launchpad for bullish continuations, resulting in extended periods of upward momentum.

Although the Advanced NVT signal is presently turned downward, Kesmeci explains that as long as this metric remains above the +2xSD level, bitcoin is likely to maintain its uptrend, indicating there is strong potential for the cryptocurrency to enter new price territory in the coming weeks.

With Bitcoin surpassing its former all-time high in the past week, the premier cryptocurrency continues to look likely to attain the lofty price targets being set by several market analysts. However, macroeconomic factors, most notably US trade policy, remain a major influence capable of inducing significant setbacks as seen since the start of 2025.

Bitcoin Market Overview

At press time, Bitcoin is trading at $107,835 following price gains of 4.02% and 15.37% in the past seven and thirty days, respectively. Meanwhile, the market’s daily trading volume is down by 31.58% and valued at $45.94 billion.

According to data from blockchain analytics firm Sentora, the Bitcoin network experienced a 51.03% increase in network fees, signaling a significant rise in transactions and user activities.

Meanwhile, exchange inflows were valued at $184 million, which Sentora has described as “mild” relative to previous weeks. This development indicates that many investors opted against selling their BTC holdings despite a new all-time high, signaling long-term market confidence.

With a market cap of $2.13 trillion, Bitcoin continues to rank as the largest cryptocurrency and the fifth-largest asset in the world.