Ethereum Holds Critical Support—Is the Bull Run Loading?

Ethereum’s price refuses to buckle under pressure, clinging to a key support level like a trader gripping their last leveraged position. The charts whisper ’accumulation’—but will the market listen?

Technical Outlook: Bulls Dig In

The $3,000 zone has become Ethereum’s Alamo, with buyers defending it harder than a VC protects their token allocation. Daily RSI coils near 50—neutral territory where breakout moves often brew.

Liquidity Watch: Whales Circling

Order books show thick bids stacking beneath current price, while overhead resistance looks thinner than a DeFi project’s revenue model. One solid push could trigger a cascade of FOMO buys.

Macro Factors: Crypto’s Tideshow

Traditional markets wobble as the Fed plays interest rate Jenga—yet crypto volatility sits at 2025 lows. When complacency peaks, surprises tend to follow (ask anyone who shorted BTC at $20K).

Closing Thought: Ethereum’s consolidation reeks of potential energy, like a coiled spring—or a degens’ leverage building before liquidation. The breakout, when it comes, will either mint new geniuses or fresh cautionary tales.

Ethereum Price Aims Higher

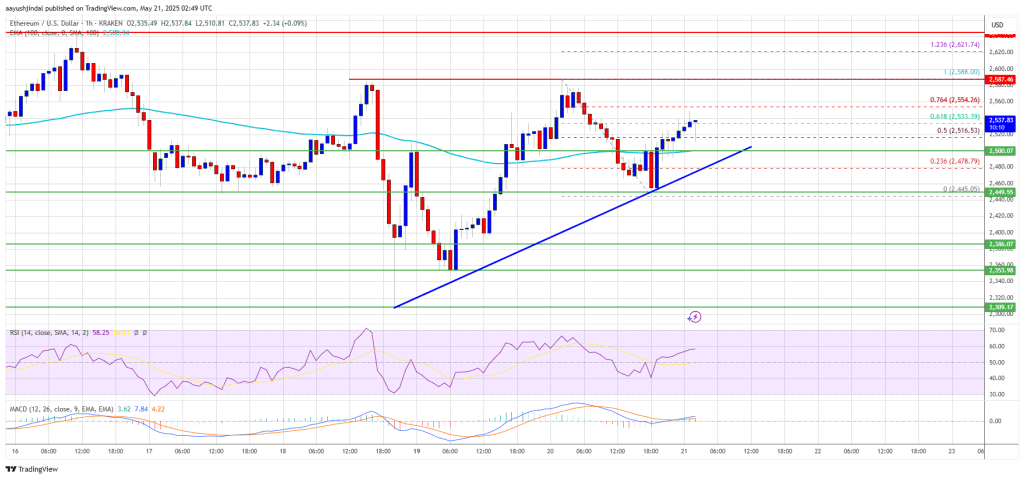

Ethereum price started a downside correction below the $2,500 level, unlike Bitcoin. ETH traded below the $2,480 and $2,460 support levels. However, the bulls were active NEAR the $2,450 zone.

A low was formed at $2,445 and the price started a fresh increase. There was a move above the $2,480 and $2,500 levels. The price surpassed the 50% Fib retracement level of the downward wave from the $2,588 swing high to the $2,445 low.

Ethereum price is now trading above $2,520 and the 100-hourly Simple Moving Average. There is also a connecting bullish trend line forming with support at $2,500 on the hourly chart of ETH/USD.

On the upside, the price could face resistance near the $2,555 level. It is near the 76.4% Fib retracement level of the downward wave from the $2,588 swing high to the $2,445 low. The next key resistance is near the $2,585 level. The first major resistance is near the $2,620 level. A clear move above the $2,620 resistance might send the price toward the $2,650 resistance.

An upside break above the $2,650 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,720 resistance zone or even $2,800 in the near term.

Another Decline In ETH?

If ethereum fails to clear the $2,620 resistance, it could start a fresh decline. Initial support on the downside is near the $2,500 level and the trend line. The first major support sits near the $2,450 zone.

A clear move below the $2,450 support might push the price toward the $2,420 support. Any more losses might send the price toward the $2,320 support level in the near term. The next key support sits at $2,250.

Technical Indicators

Hourly MACDThe MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSIThe RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,450

Major Resistance Level – $2,620