Bitcoin Roars Back: $880 Million Floods In as Crypto’s King Retakes the Throne

After months of sideways action, Bitcoin just pulled off a liquidity heist—$880 million poured into BTC products last week as traders ditch ’wait-and-see’ for ’buy-and-hold.’

The trigger? Institutional FOMO meets a macro landscape where traditional finance looks about as stable as a Jenga tower in an earthquake. Even Wall Street’s goldbugs are sneaking glances at crypto charts.

This isn’t 2021’s meme-fueled mania. The inflows are hitting regulated products—the kind that let suits pretend they’re not gambling. (Spoiler: They totally are.)

Next resistance level? The psychological $100K mark. But with miners hoarding and ETFs sucking up supply, this rally might have longer legs than a caffeine-fueled algo trader.

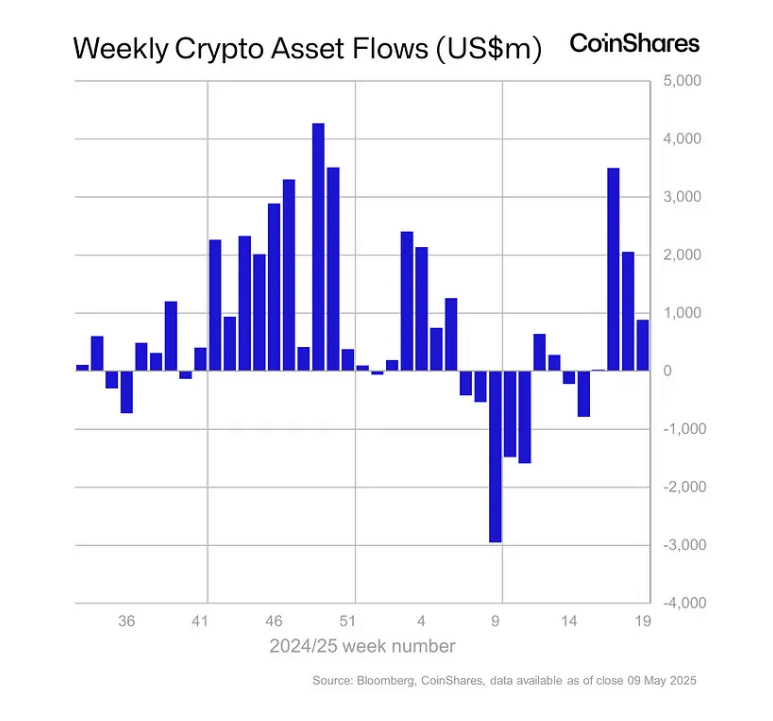

Weekly Inflows Indicate Continued Demand

According to the latest data, $882 million poured into crypto products last week. That is the fourth consecutive week of inflows. It might not rattle the broader markets, but it indicates money continues to flow in.

Managers have gathered $6.7 billion in net new cash so far this year. In plain language, that’s a steady stream of new capital flowing towards these funds.

Bitcoin Dominates The Inflows

Bitcoin funds saw $867 million of those inflows. A big chunk of that went into US-listed ETFs. Since January 2024, those Bitcoin ETFs have gathered nearly $63 billion. They just passed their all-time high of $61.6 billion set back in February. In contrast, Ethereum products only took in $1.5 million last week. That gap shows where most investors still feel safest.

Sui And Other Altcoins Catch Some AttentionSome of the smaller coins were in the limelight. Sui attracted $11.7 million in just one week, surpassing solana and Ethereum during that span. Its year-to-date figure so far stands at $84 million, narrowly over Solana’s $76 million.

XRP, for its part, posted $1.4 million of weekly inflows, taking its YTD at $258 million. XRP’s assets under management are currently at $1.35 billion.

Other altcoins showed only small moves, which tells us money is picking spots rather than spreading out.

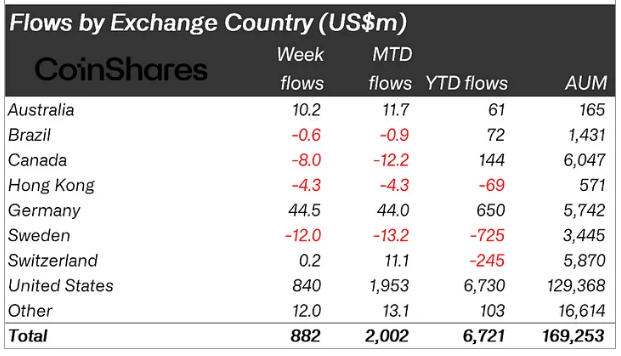

The United States dominated all regions with $840 million of last week’s total. Germany accounted for a little over $44 million and Australia $10 million. Conversely, Sweden experienced the largest outflows at $12 million.

Hong Kong lost $8 million and Canada $4.3 million. Those numbers highlight just how much the US market—led by heavy hitters such as BlackRock—is still in charge.

BlackRock’s iShares Bitcoin ETF was the best performer, bringing in over $1 billion last week. That was partially offset by $257 million in outflows from providers like Grayscale and Bitwise. Overall, it appears that one provider’s large gain can be equaled by several others’ losses.

Behind the flows are broader trends in money and policy. Global M2 money supply continues to expand, adding more cash to the system. Meanwhile, concerns about slow US growth and high inflation are pushing some investors into crypto as a hedge, or alternative store of value.

Featured image from Gemini Imagen, chart from TradingView