DoubleUp Disrupts DeFi: The High-Stakes GambleFi Protocol Turning Heads—and Portfolios

Move over, Wall Street roulette—DoubleUp’s blockchain-powered gamblefi protocol lets degens 2x or bust with algorithmic precision. Built on BNB Chain, it cuts out the casino middleman while somehow making ’degenerate yields’ sound like a viable investment thesis.

How it works: Deposit crypto, pick your odds, and let the smart contracts handle the rest. Win? Your stack doubles instantly. Lose? Well, at least it’s faster than watching your traditional 401k evaporate over 40 years.

The catch: That ’provably fair’ tagline doesn’t account for human psychology—or the fact that 95% of traders blow up their first three bags. But hey, in a market where ’number go up’ counts as fundamental analysis, maybe flipping digital coins beats staring at PE ratios.

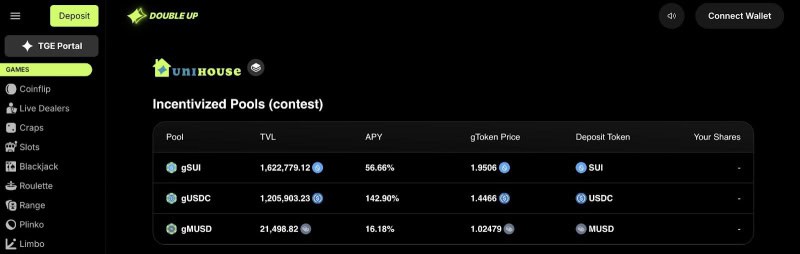

DoubleUp’s DeFi component, Unihouse, introduces a betting-linked yield mechanism that integrates with the broader platform. Unlike conventional staking or liquidity farming protocols, Unihouse allows users to deposit supported tokens and earn returns that correlate with platform betting volume and house edge outcomes. The model is structured so that platform betting activity can influence the yield distributed to token stakers, enabling a reciprocal dynamic between active bettors and passive participants. This approach also enables the use of tokens that may not otherwise offer native staking functionality within other protocols.

And now, the moment that pushed DoubleUp into the spotlight—the stealth token launch of $UP.

On, DoubleUp launched the $UP token completely unannounced, dropping it straight onto the market at a fully diluted valuation (FDV) of $40 million. No pre-hype. No upper hands. Just pure GambleFi energy. Within 24 hours of launch, $UP surged in both volume and visibility, sitting at a $53M FDV at the time of this writing. Early believers were rewarded, and a new chapter for DoubleUp officially began.

The $UP token serves multiple roles within the DoubleUp ecosystem, including facilitating lottery ticket purchases, distributing gameplay rewards, and enhancing yield mechanisms within Unihouse. Holding $UP provides users with access to Core utility features across the platform.

DoubleUp has raised $4 million in a Seed funding round at a $40 million valuation. The round was led by Karatage, with participation from Mysten Labs, Selini Capital, EBlock Capital, Comma3 Ventures, Alpha DAO, and Auros. These participants represent a range of experience across venture capital, blockchain technology, and online gaming sectors. The funding will be allocated toward infrastructure development, the launch of additional betting products, and international expansion efforts.

DoubleUp plans to expand its offerings to include sports betting, poker, and time-limited campaigns with defined prize pools. These additions are designed to broaden the platform’s appeal across various user profiles, including active bettors, strategy-focused participants, and passive token holders.

The platform operates without mandatory Know Your Customer (KYC) requirements, offering users open access to its features and reward systems. With its continued development, DoubleUp positions itself within the emerging category of GambleFi platforms that combine decentralized financial tools with blockchain-based gaming experiences.

About DoubleUp

DoubleUp is a next-generation decentralized casino redefining how users interact with crypto through high-stakes gaming and DeFi innovation. Founded by a team of seasoned engineers, DoubleUp was built with one CORE belief: crypto should be thrilling, rewarding, and community-driven.